Gianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services. Known for his rigorous approach and deep understanding of market dynamics, Gianluca specializes in derivatives and cyclical analysis, with a strong emphasis on options trading strategies and macroeconomic frameworks.

Gianluca is the founder of Cycle Quest, a project focused on applying cyclical models to financial markets, economic indicators, and more. With an international academic background and a passion for data-driven decision-making, Gianluca empowers traders and investors with expert insights, clear strategy frameworks, and cutting-edge tools.

Education

- Bachelor’s Degree in Economics from University of Brescia (Italy)

- Two Master’s Degrees in Economics and Empirical Finance from Sorbonne University (France)

References

- Founder at Cycle Quest

- Contributor at Traders Union

- Author at Tokize.com

- Author at Crypto Adventure

Experience

- Over a decade of experience trading options, with a focus on defined-risk strategies such as vertical spreads, iron condors, and diagonals

- Deep understanding of options pricing models like Black-Scholes and binomial trees, applied daily to position evaluation

- Active user of the CBOE indices as a benchmark to build and test different trading strategies with options

- Expert in managing trades using the Greeks (Delta, Theta, etc.) to dynamically adjust risk

- I regularly post live trade setups and market reads on Gianluca’s Trades via the Option Samurai blog and my personal Stocktwits profile

- Skilled in building algorithmic strategies in Python and Pine Script, with a focus on short-term price action and event-driven plays

- Creator of backtesting environments tailored to options logic using Python’s Pandas and NumPy stack

- Daily use of TradingView, Interactive Brokers, and Databento for execution, charting, and data analysis

- Developed custom automated dashboards in Plotly and Streamlit for real-time tracking of trade performance and volatility curves

- Frequently design strategies aligned with FOMC and macroeconomic indicators for directional and volatility bias

- Strong foundation in fundamental analysis, with deep dives into financial statements and earnings behavior

- Implemented statistical arbitrage and volatility modeling techniques to detect mean-reverting edges

- Experienced in handling expiration risk, assignment logic, and optimizing trade timing around options cycles

- Advocate for integrating behavioral finance principles to mitigate biases and improve trader discipline

- Regularly consult with traders on strategy design, risk control, and automation to elevate their performance across market regimes

What Happens When Options Expire in the Money? [Buyer and Seller Cases]

What happens when options expire in the money? And does it change depending on whether you’re a buyer or a seller? In this article, we look at what happens when options expire in the money for both...

What Happens to Options When a Stock Splits? [and When It Reverse Splits]

Stock splits can significantly affect options traders. What happens to options when a stock splits? How are contracts adjusted to maintain fairness? And how do reverse splits impact options...

What Happens to Options When a Company Is Acquired? Effects on Calls and Puts

As a trader, you will sometimes face particular challenges, like figuring out what happens to options when a company is acquired. This process can impact stock options (both calls and puts), at...

How to Make Money with Options in Different Market Scenarios

Making money with options is not easy (otherwise, everyone would do it), but this does not mean it’s impossible. The key lies in knowing how to make money with options in every scenario, knowing...

Is Options Trading Worth It? [Matching Strategies and Expectations]

The question "is options trading worth it?" sometimes pops up in online forums and discussions. For some, it’s a useful way to boost supplemental income with strategies like selling puts or calls....

Options Trading Basics [A Guide for New Traders]

If you've found yourself here, chances are you've come across discussions about options trading and its potential for profit—whether from someone you know or online conversations. This article...

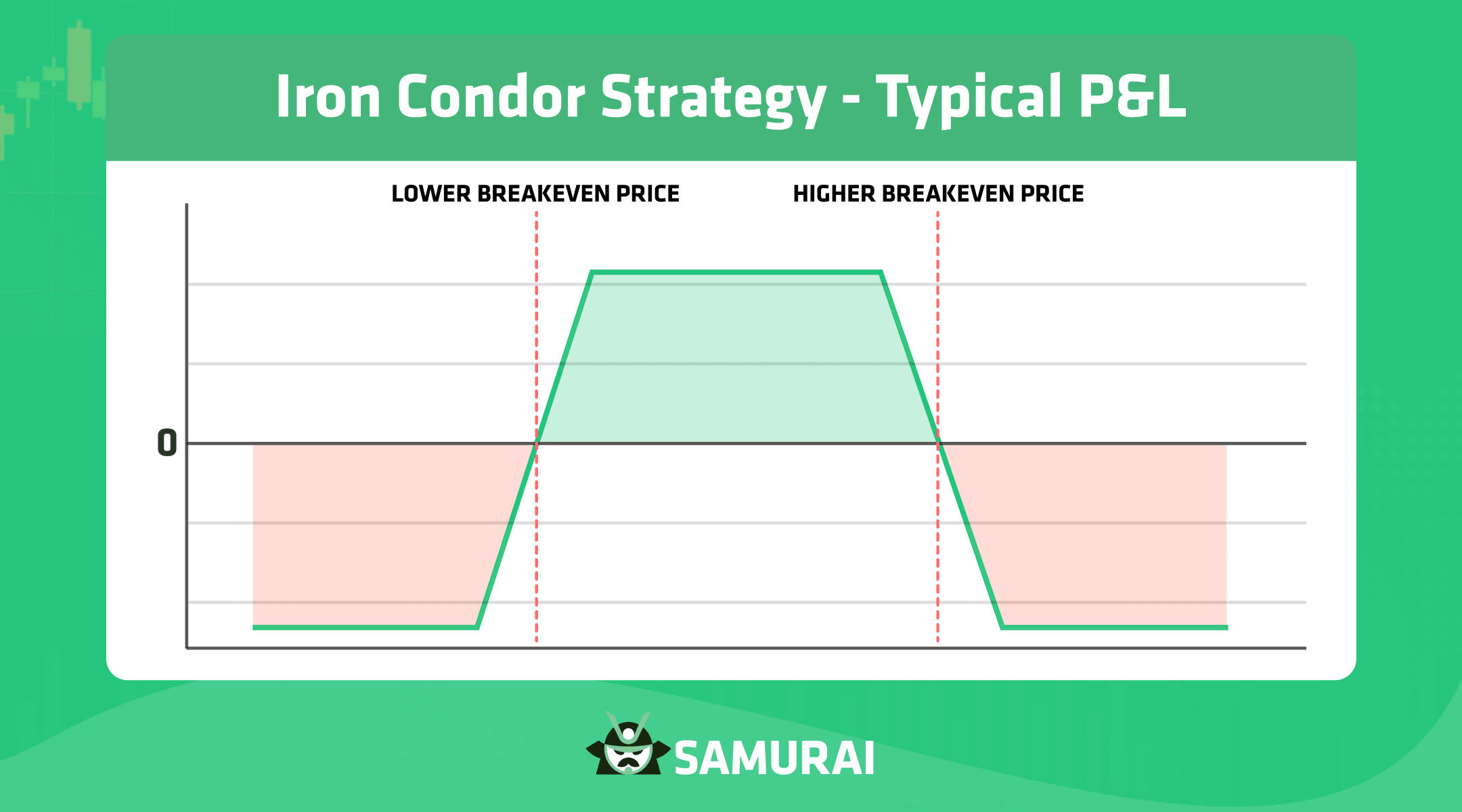

Iron Condor Strategy: Making Money in Sideways Markets [Tips and Best Practice]

You may have heard that, unlike outright stock trading, buying and selling options can make you profit from a sideways market. This is, indeed, the case with the iron condor strategy, a popular...

Stop Loss on Options - A Practical Guide

One of the most common risk management strategies in trading is using a stop loss on whatever asset you have in your portfolio. Can you put a stop loss on options? And, if so, how do you set one...

Long Call Butterfly Strategy Explained [Trader Insights]

The long call butterfly strategy is one of the many ways to employ options to benefit from a sideways market. Coming with capped losses (and, sometimes, even no losses on either the upside or the...

Is Options Trading Gambling? A Close Look at the Facts

Is options trading gambling? We will answer this to explain why it isn’t. Unlike gambling, which relies on luck, options trading requires strategy, research, and risk management. But if you...

Try our option scanner FREE for 14 days with no obligation

FIND TRADES NOW