Leav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis. His passion for finance began in third grade, and he's been immersed in the markets ever since, turning a lifelong curiosity into a full-time career. Before founding Option Samurai, Leav worked as an options trader and portfolio manager, specializing in both fixed income and equity strategies.

He brings deep expertise in options trading, risk-defined strategies, and portfolio construction, with a strong focus on volatility, automation, and decision-making frameworks. Over the years, he has developed proprietary trading tools, including a dividend capture engine, an options-enhanced portfolio tracker, and an AI-based trade assistant. Leav’s insights have been featured in Benzinga, The Street, Yahoo Finance, and Finance Magnates, and he was named runner-up in the Benzinga Fintech Awards. His mission with Option Samurai is to equip retail investors with institutional-grade tools to help them make smarter, more confident trades.

Education

- Bachelor’s Degree in Economics from Tel Aviv University

- Portfolio manager license from the Israel Securities Authority

References

- Interview on Benzinga (again)

- Contribute to US News.

- Interview on Fox Business.

- Author at the Option Samurai blog

- Mentioned on Business Insider

- Featured on Finance Magnet

- Interview on Yahoo Finance

Experience

- Started actively trading ~2005 and have been actively trading since. Increased his expertise and moved into the professional space, only to return to the retail space with Option Samurai.

- Founder and CEO of Option Samurai, a platform designed to help retail investors make better options trades.

- Former Chief Analyst and Portfolio Manager at Dividend Investments, where he managed fixed-income portfolios for clients, focusing on cash-flow optimization and tax efficiency

- Advocate for democratizing options education and bridging the knowledge gap between retail and institutional traders.

- Options trading expert with deep experience building and executing strategies based on technical analysis, volatility patterns, quantitative models, fundamental metrics, and options open interest data.

- Such as cash-secured put, covered calls, dividend capture, collars, etc.

- Built quantitative trading systems for trading stocks, bonds, and options.

- Wrote hundreds of educational articles about options in the Option Samurai blog and emails.

- Developed a proprietary dividend-capture model combining options overlays and ex-date logic.

- Experienced in building trading algorithms that use call and put options and advanced strategies using Python and Excel-based tools.

- Built Go/No-Go models for fundamental analysis using financial reports, focused on Israeli and U.S. equities.

- Designed and tested volatility-based reversion strategies and earnings plays for short-duration options to capitalize on volatility crush, time decay, movement, etc., using iron condors, vertical spreads, and other options strategies.

March 2021 Version is out!

We are thrilled to announce the launch of our new version for March 2021. In this version, we've added two new strategies, new predefined scans, deployed bug fixes, and more.

Main improvements...

Tip: Use Scans as Part of Your Investment Process

This article will be a short technical how-to article to help you create scans for your investing process. We use it personally to quickly access our scans in our daily routines, save time, and...

February 2021 Version is live!

We are very happy to announce the launch of our new version for February 2021. In this version, we've added a new strategy, improved our stock analysis model, added predefined scans, improved...

Lowering Cost Basis with Options (With a trade example)

In this post, I wish to talk about lowering the cost basis of a position. I will do that by showing a trade that didn't go so well but still showed a profit because I managed to lower my cost...

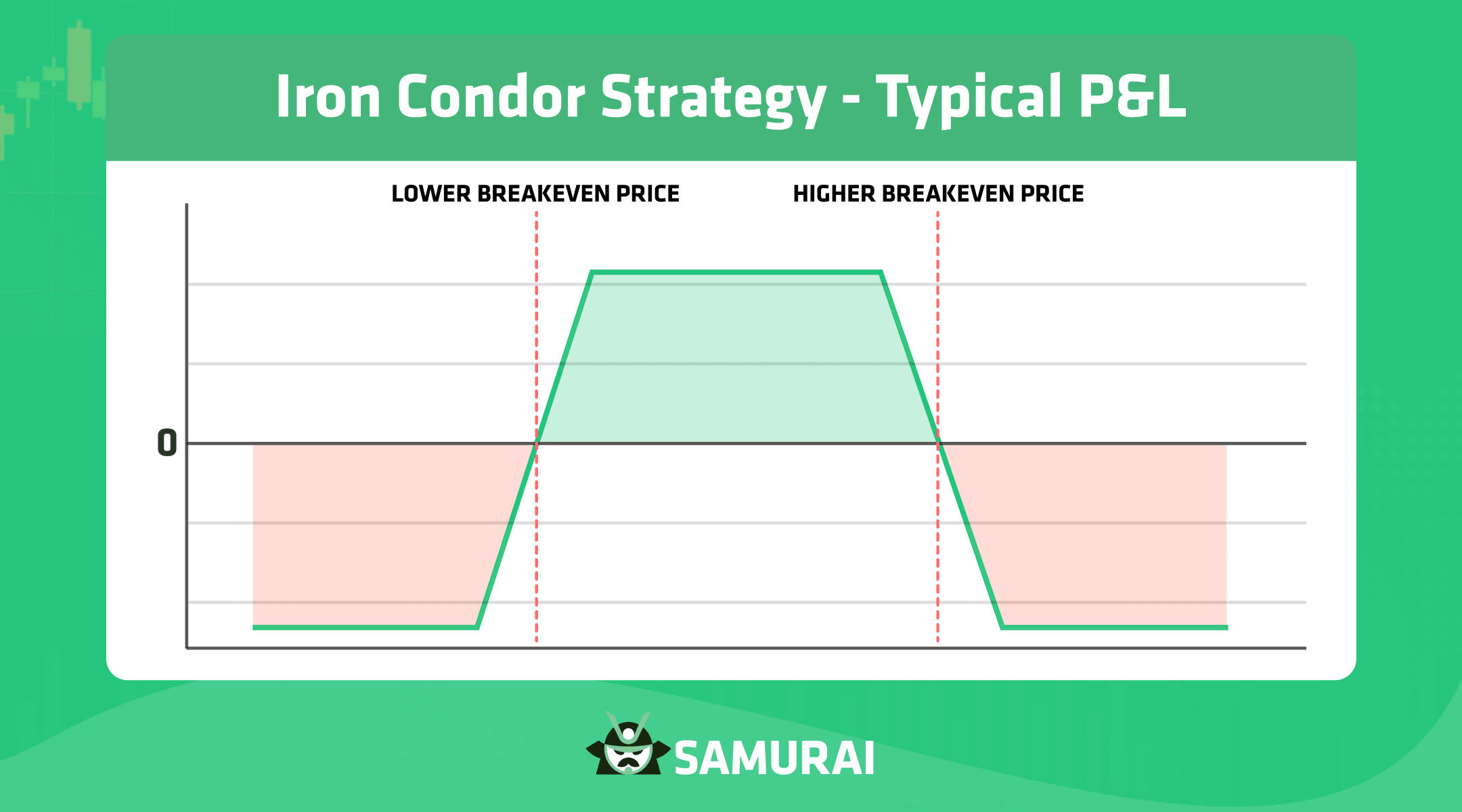

Optimal Iron Condor Strategy and how to find it in Option Samurai

Today we will discuss one of the most popular strategies in options trading: iron condor. The Strategy became very popular due to the limited risk profile while maximizing the time value derived...

![Long-Call-Calendar[1]](/_next/image/?url=%2Fapi%2Fmedia%2Ffile%2FLong-Call-Calendar1.gif&w=3840&q=90)

Janurary 2021 Version is out!

Happy new year! We are so glad to announce the first version release of 2021. In this version, we've added many new features, including many features you've been requesting for:

Calendar...

![multisorting[1]](/_next/image/?url=%2Fapi%2Fmedia%2Ffile%2Fmultisorting1.gif&w=3840&q=90)

Multi-column sorting

[We have improved the usage of this feature based on your feedback. Here is the updated article: Here]

We've just launched the Multi-column sorting feature that allows you to sort results by two...

Creating an optimum vertical spread

Update: This article describes what vertical spreads are, considerations on how to build optimal spreads, data points to take into considerations, how to find your comfort zone, and more. Feel free...

![New-Analyse-Chart[1]](/_next/image/?url=%2Fapi%2Fmedia%2Ffile%2FNew-Analyse-Chart1.gif&w=3840&q=90)

December 2020 Version is out!

We're thrilled to announce that the December version is now online for everyone to use. We have continued to improve the features we released in the past versions and laid the groundwork for new...

![New-Scan[1]](/_next/image/?url=%2Fapi%2Fmedia%2Ffile%2FNew-Scan1.gif&w=3840&q=90)

November 2020 Version launch!

We are so happy to announce the new version we launched this month. This version is the result of listening to your feedback and will allow us to provide even more relevant features in the coming...

Try our option scanner FREE for 14 days with no obligation

FIND TRADES NOW