Option Samurai Blog

Learn. Trade. Profit.

Call Option Payoff Diagram - A Visual Guide to Call Option Risk

Learn how a call option payoff diagram works, how profits and losses are calculated, and how long and short call positions behave at expiration.

Trade Idea - Naked Put on AMZN

Amazon (AMZN) looks at the beginning of a (potentially) positive cycle, and IV is not low (IV rank above 60%), so I sold a put expiring in a month

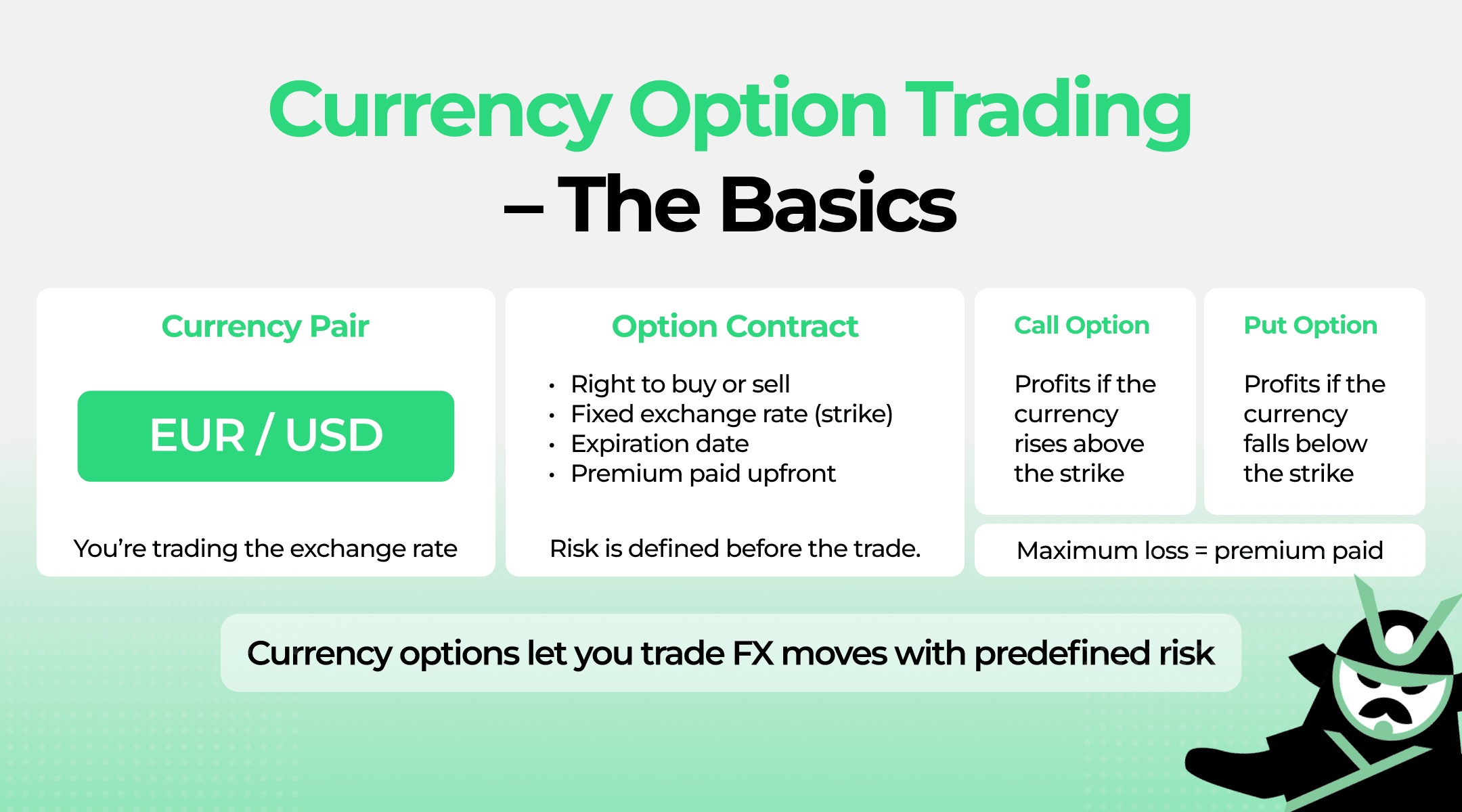

Currency Option Trading - How FX Options Work and When to Use Them

Learn how currency option trading works, including foreign exchange options, US currency options, and more.

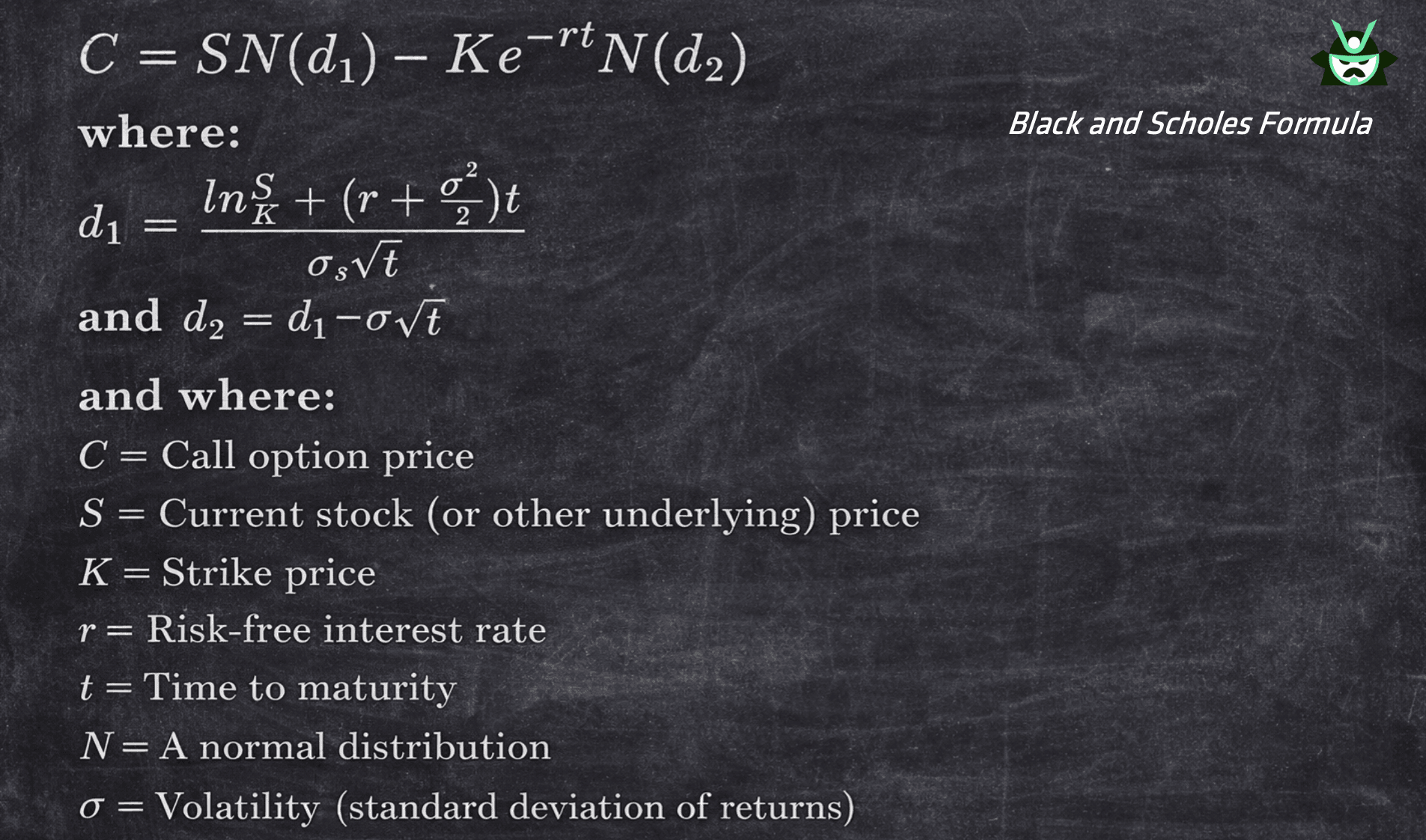

Black and Scholes Option Pricing Model - The Benchmark Behind Option Prices

A clear explanation of the Black and Scholes option pricing model, covering the formula, inputs, method, put pricing, and real-world limitations.

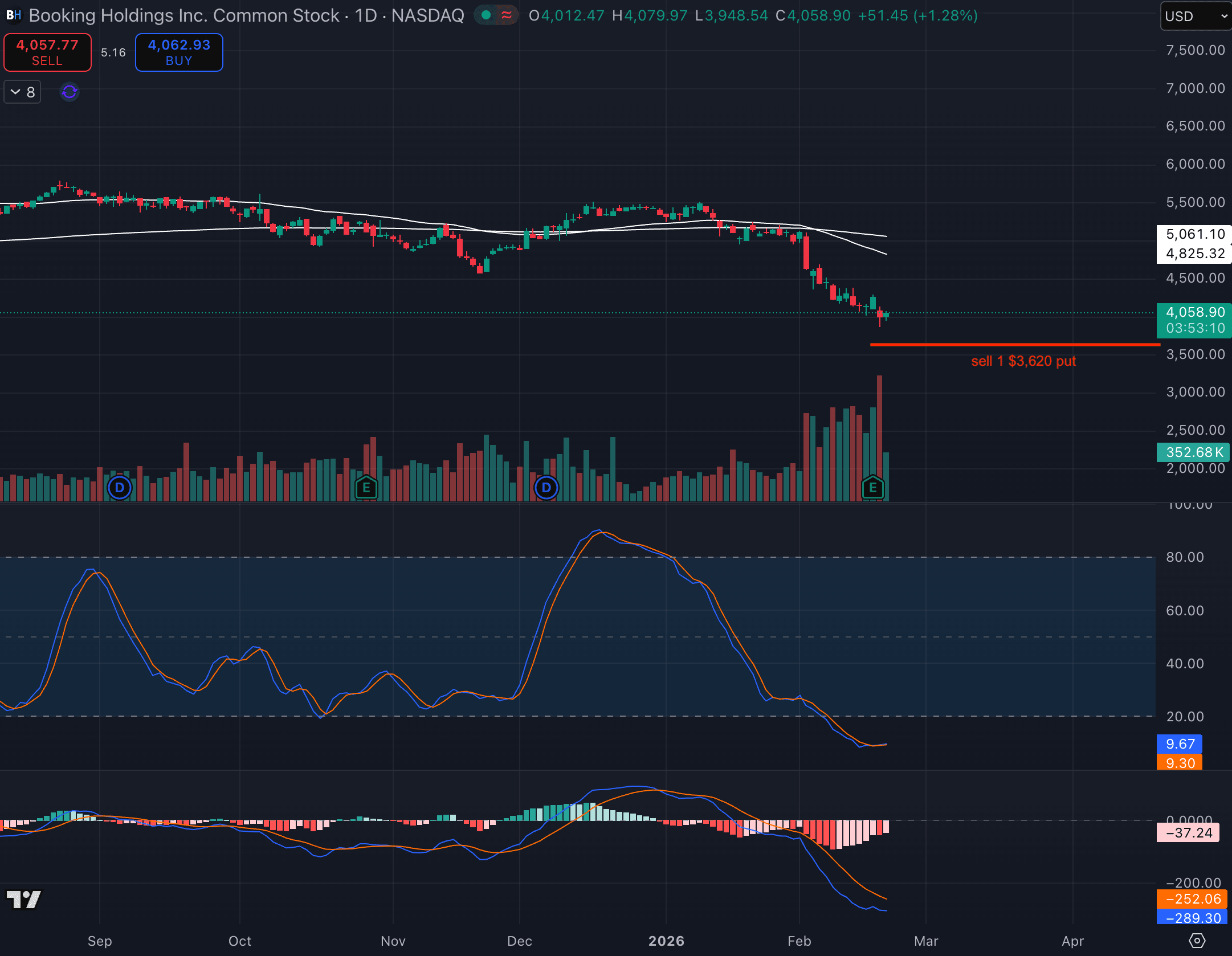

Trade Idea - Naked Put on BKNG

I opened a short put position on BKNG today. The stock is widely oversold so I'm ok with either getting assigned shares (and do a wheel with a covered call) or rolling this down and further in time a few times. But since BKNG is quite expensive, I'll probably aim for rolling.

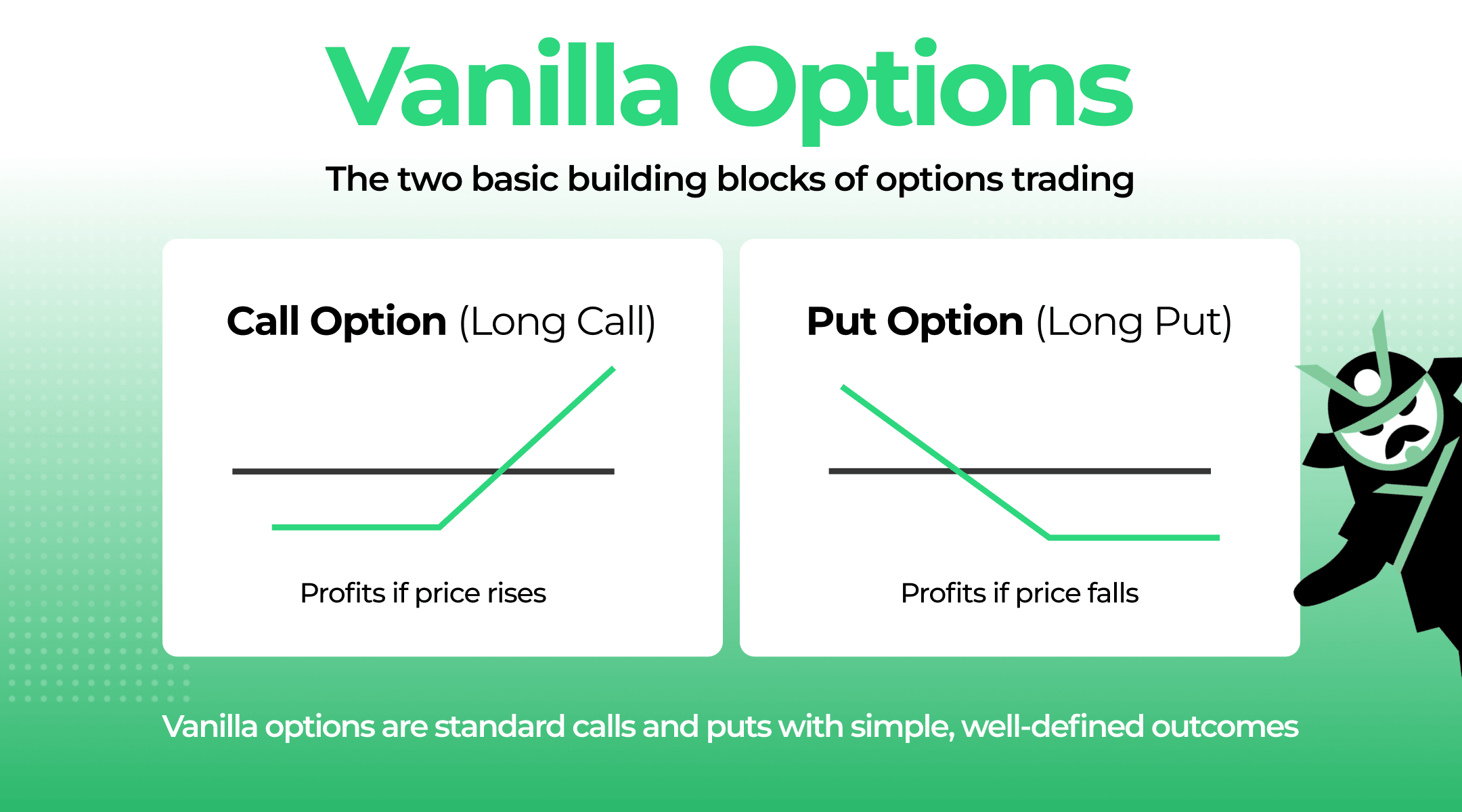

Vanilla Options - The Foundation of Options Trading Strategies

A clear guide to vanilla options, the standard call and put options traded in markets, and how they differ from exotic options.

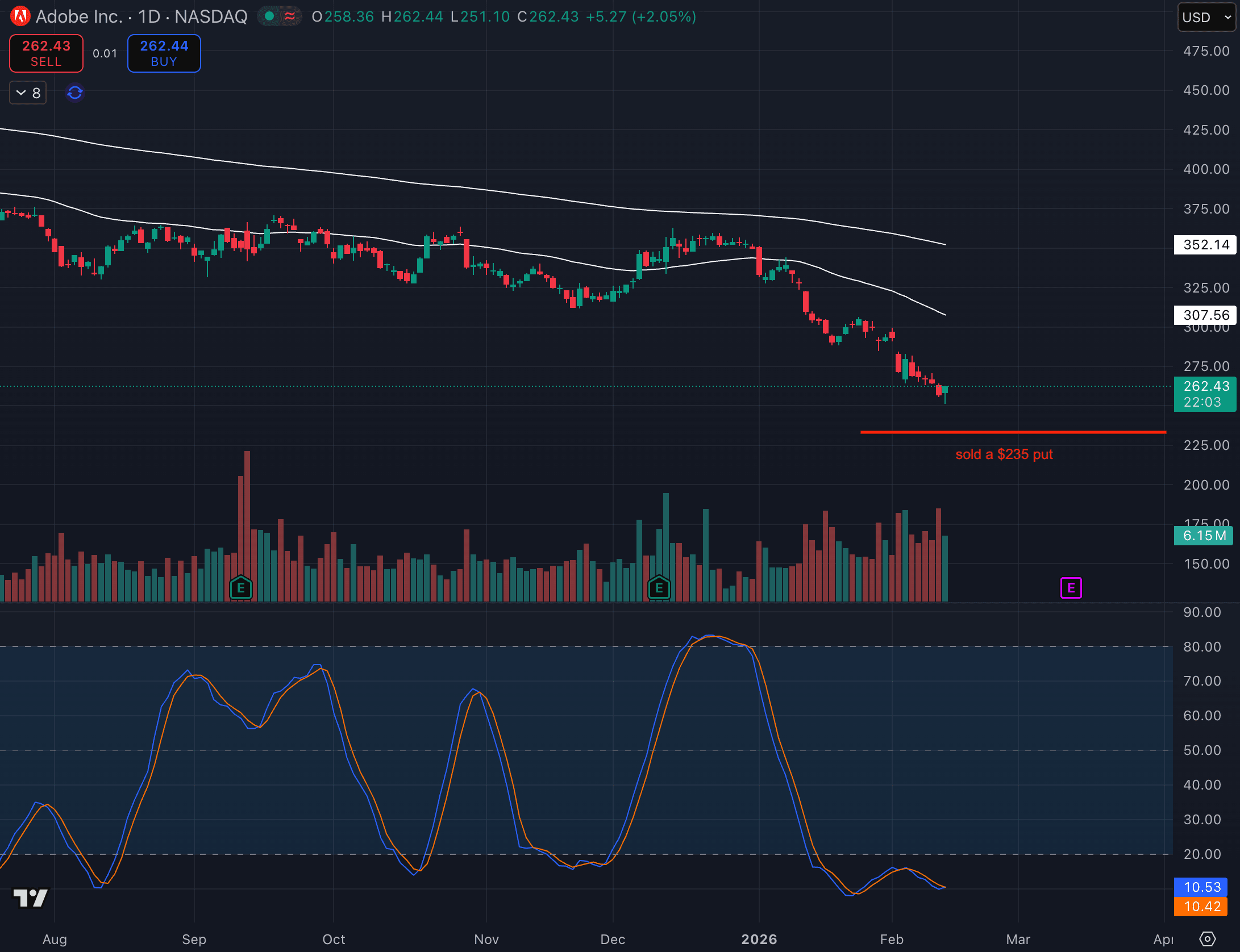

Trade Idea - Naked Put on ADBE

I opened a short put position on ADBE today. The stock is widly oversold so I'm ok with either getting assigned shares (and do a wheel with a covered call) or rolling this.

In the Money vs Out of the Money: What’s the Difference?

Confused by strike prices? We break down in the money vs out of the money options using simple logic and real-world examples.

Trade Idea - Long Call on AAPL

Today I bought a call on AAPL. IV was low, and price action was looking good.

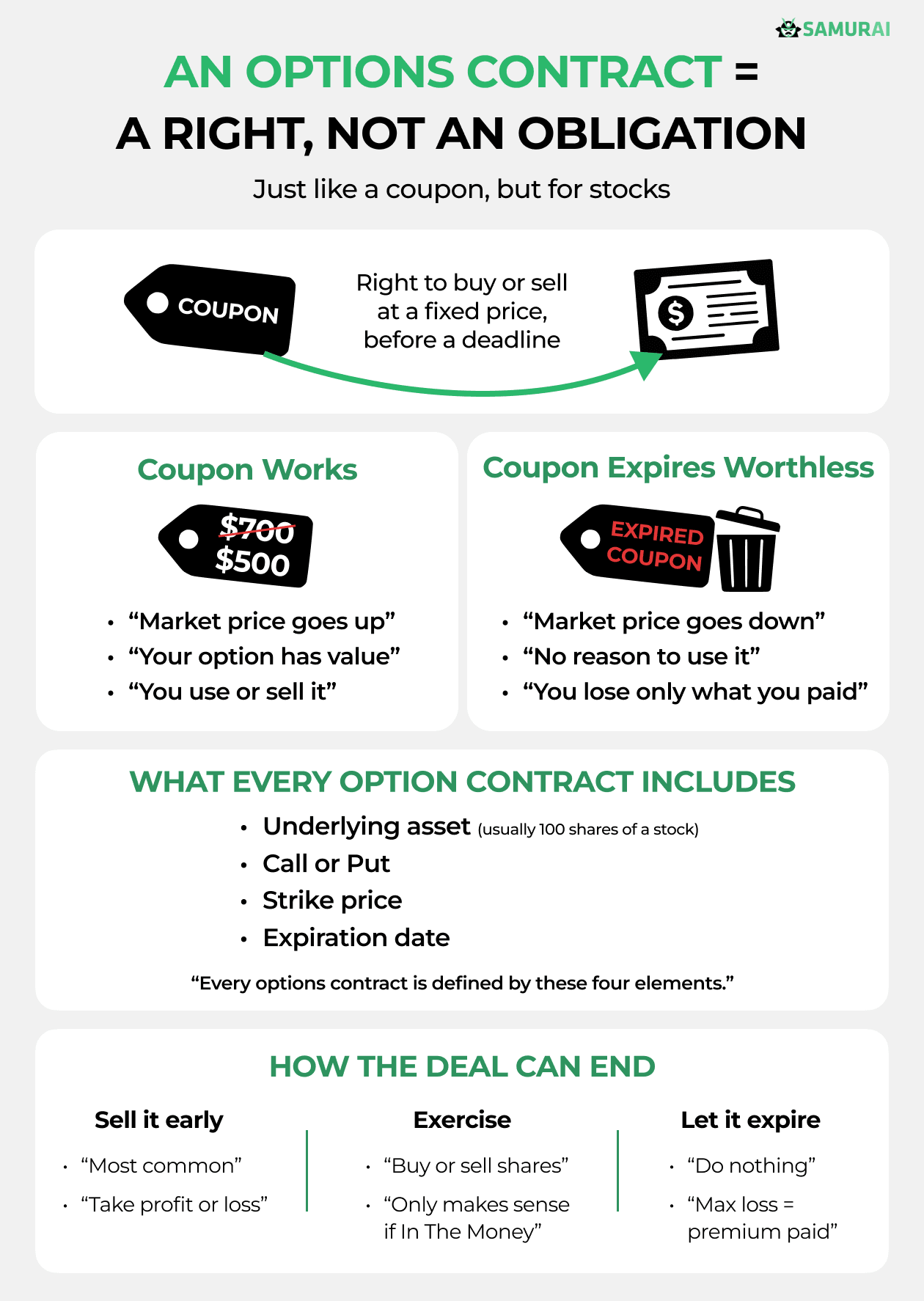

Options Contract - Understanding What an Option Is

We break down the definition, provide a clear option contract example, and explain how these agreements work.