Covered Calls on Dividend Stocks - Monthly Income from Quality Companies

Published on October 20, 2025(Last updated on February 20, 2026)

Reviewed by Leav Graves

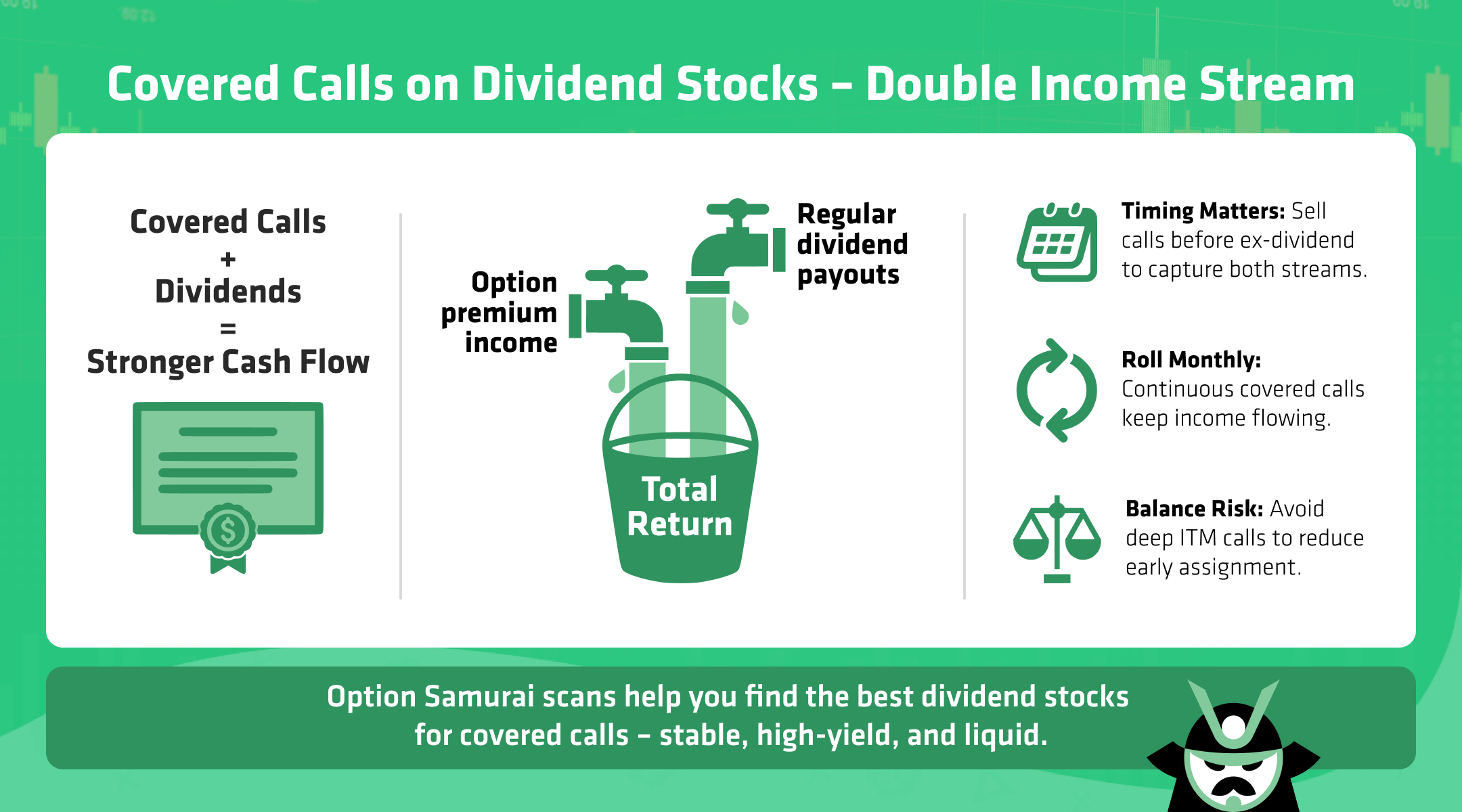

Covered calls on dividend stocks can turn steady dividend income into a stronger cash flow stream. But how do you find the best dividend stocks for covered calls, and when should you sell for a covered call dividend? This guide explains the setups, timing, and key risks.

KEY TAKEAWAYS

- Covered calls on dividend stocks are a popular strategy to generate monthly income while also receiving regular dividend payouts.

- The best dividend stocks for covered calls are stable companies with high yields and low volatility, ideal for consistent income strategies.

- A well-timed covered call dividend strategy can even boost total return if the call is sold before the ex-dividend date, capturing both option premium and dividend.

Why Pair Covered Calls with Dividend Stocks?

Covered calls on dividend stocks are a practical way to earn monthly income while keeping the steady payouts from dividends. The idea is simple: you own the shares, then sell a call option that gives someone else the right to buy them at a set price before a certain date. In return, you collect an upfront premium.

When combined with dividend stocks, the benefits stack. Dividends provide a predictable stream of cash, and the call premium adds a second source of income. This combination can help offset small declines in the stock’s price, making the position more resilient in sideways markets.

This approach works best when the stock is not expected to move sharply. The best dividend stocks for covered calls tend to be stable companies with low volatility and strong fundamentals.

Why traders use this pairing:

- Two income streams: dividend + premium

- Reduced downside impact in modest pullbacks

- Works well in range-bound or slightly bullish conditions

A well-timed covered call dividend setup can also be part of more advanced strategies, like dividend capture or even the wheel. The key is selecting quality stocks and matching option expirations to your market outlook.

The Power of Covered Call Dividend Timing

Selling covered calls on dividend stocks before the ex-dividend date can let you collect both the dividend and the option premium. For this to work, the option expiration must be after the ex-dividend date, so you still own the shares when the dividend is paid. Keep in mind that if the call is in the money and the dividend is larger than the option’s remaining extrinsic value, early assignment is likely, meaning your shares could be called away before you collect the dividend.

The main risk is early assignment. If your call is deep in the money, the buyer may exercise before the ex-dividend date to capture the dividend themselves. This can wipe out the covered call dividend advantage.

The dividend capture - covered calls scan is built for this timing. It focuses on quality stocks where the ex-dividend date is before expiration, helping traders line up both income streams.

Therefore, here are some key points to remember on covered call dividend timing:

- Ex-dividend must come before option expiration

- Avoid deep ITM calls to reduce early assignment risk

- Best dividend stocks for covered calls have stable prices and reliable payouts

Using Continuous Covered Calls for Ongoing Yield

Rolling covered calls on dividend stocks each month can turn a single trade into a steady income engine. The approach is simple: when the short call expires, you sell a new one on the same stock, keeping the shares to continue earning the dividend. This creates a consistent cycle of collecting option premiums and dividends.

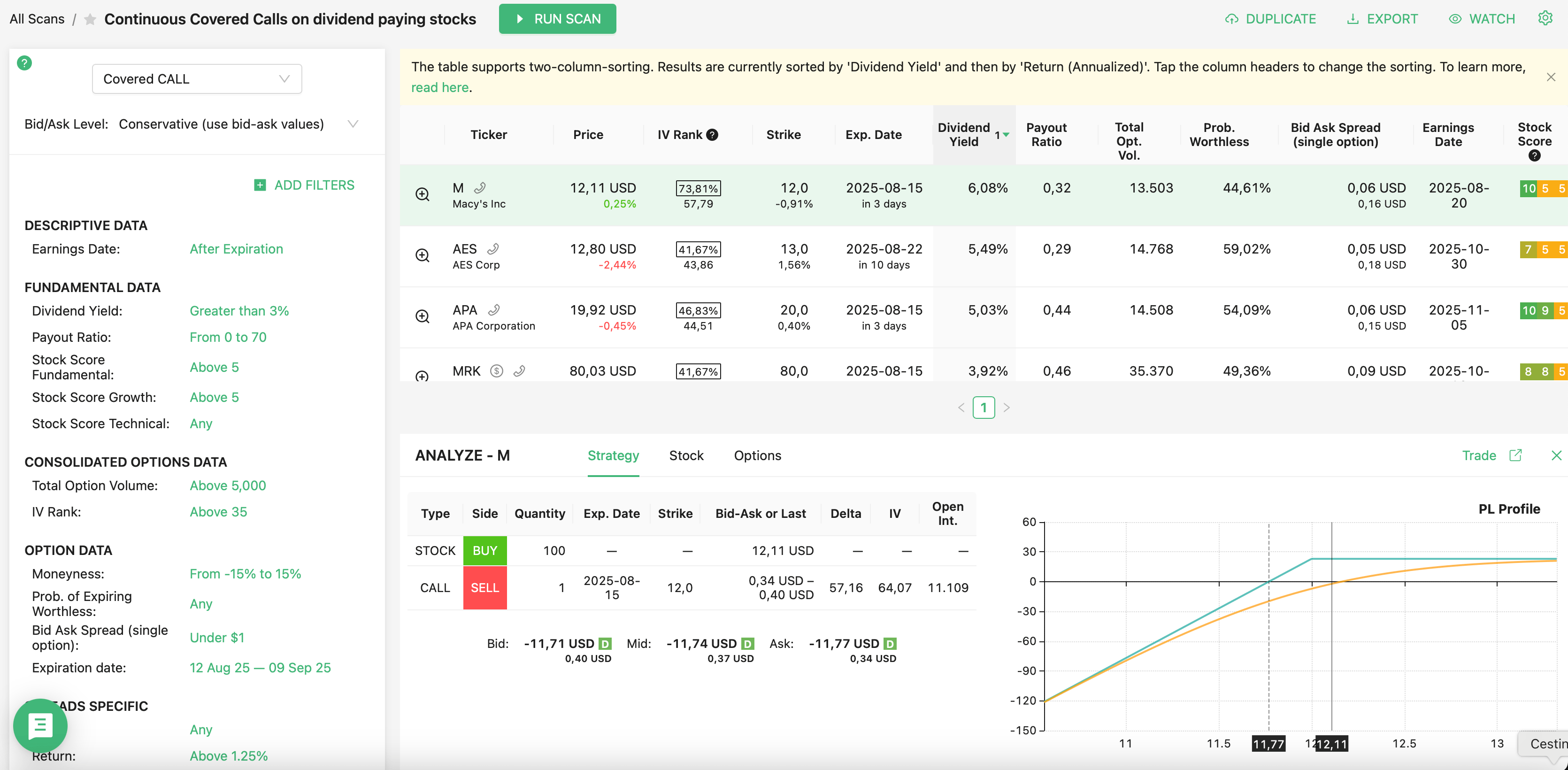

Our Continuous Covered Calls on dividend paying stocks scan is built for this. It finds companies with:

- Stable dividend yields over 3%

- Covered call income greater than 1% per month

- Price stability that supports repeated option selling

The output of the scan on our screener for the options market will look like this:

By combining these traits, the scan targets stocks that can produce reliable income without excessive price swings. The best dividend stocks for covered calls tend to be large, well-established companies with liquid options markets, making rolling positions easier.

A continuous approach can be appealing for income-focused investors who want regular cash flow. Over time, the covered call dividend and the monthly premium can add up to a meaningful annual yield, even if the stock price stays flat. The key is sticking to quality names, avoiding high-volatility setups, and letting the strategy run month after month. Many long-term investors also use this approach in retirement accounts. If you’re wondering whether that’s possible, our guide on selling covered calls in an IRA explains how it works, the restrictions, and the potential benefits for tax-advantaged income.

If you like this strategy, you may also enjoy our “Dividend capture - Covered calls (quality companies, no earning, Ex-div before expiration)” predefined scan. We’ll leave you a few of links to these scans at the bottom of the article.

Find the Best Dividend Stocks for Covered Calls

The best dividend stocks for covered calls share a few traits that make the strategy smoother and more consistent. Price stability helps reduce the chance of large swings that can work against you. Liquid options mean tighter bid-ask spreads and easier trade execution. A dividend yield over 3% adds meaningful income, and strong fundamentals reduce the risk of holding the stock long term.

Well-known names like KO, PFE, XOM, and T often meet these conditions, but there are many others. Our scans can filter the market for stocks with these characteristics, saving hours of manual searching. If you want to limit results to well-established payers, you can use the “Include Symbols” field and choose the “S&P 500 dividend aristocrats” universe.

Here is a quick checklist you may want to keep in mind when looking for the best dividend stocks for covered calls:

- Stable price action

- Options with high liquidity

- Dividend yield of 3% or more

- Strong balance sheet and consistent earnings

Using these filters, you can narrow down the list to stocks that are more likely to deliver steady covered call dividend income without excessive volatility. The goal is to create a portfolio of covered calls on dividend stocks that can produce predictable monthly and quarterly returns. Covered calls on dividend stocks work especially well when markets are calm. You can explore more setups like this in our guide on options strategies for sideways markets, where we explain how to generate income when prices move within a range.

Covered Calls as Part of the Wheel Strategy

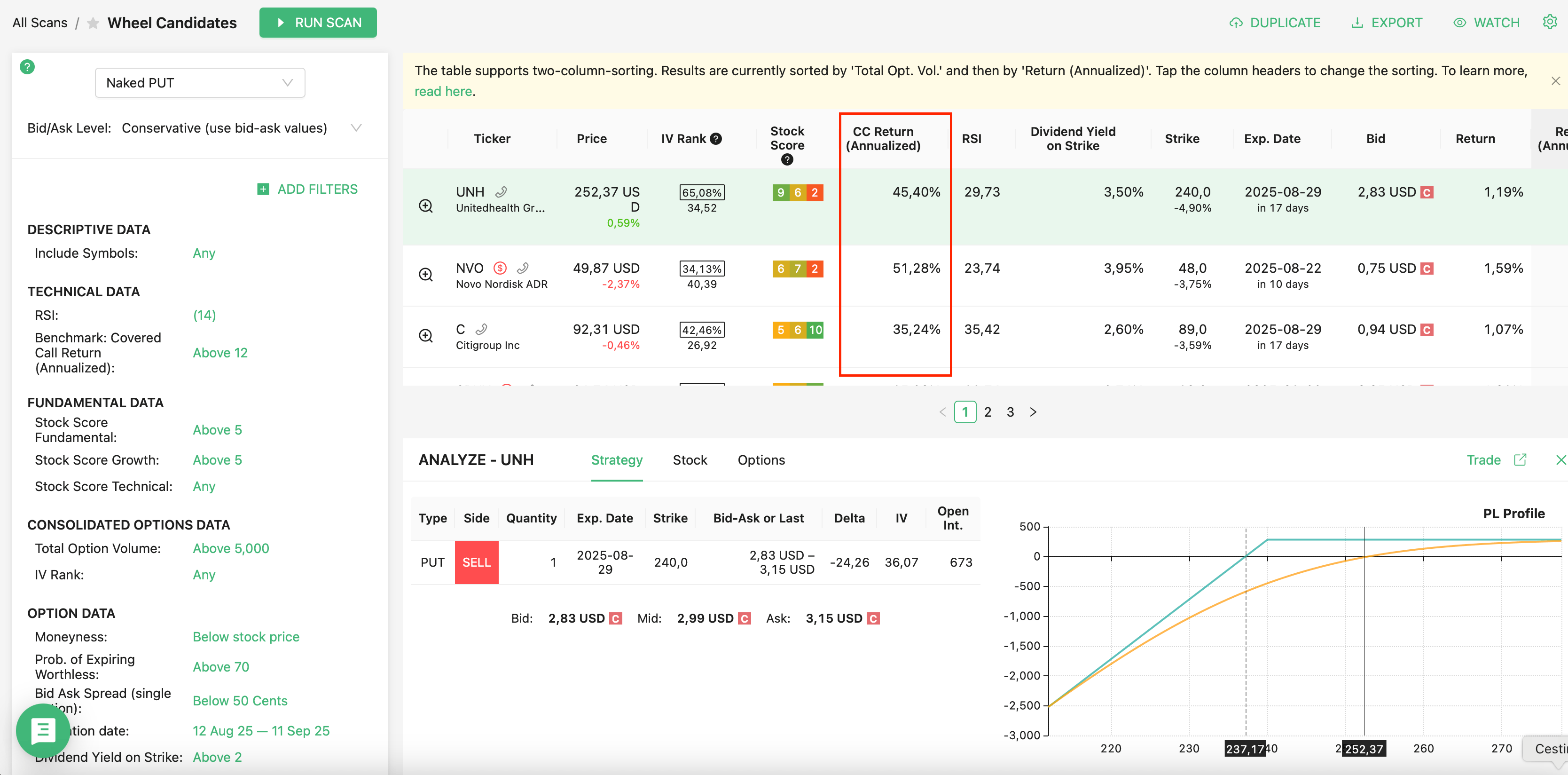

Another popular way in which traders use covered calls on dividend-paying stock is the wheel strategy. With the wheel strategy, you start by selling a put on a stock you would be happy to own. If the option expires worthless, you keep the premium and repeat. If assigned, you get the shares and move to the next step: selling a covered call.

The Wheel Candidates scan (once again, you’ll find a link at the bottom of the article) makes this process easier by factoring in both the covered call dividend potential and the annualized return from the put leg. It looks for high-probability puts with annualized returns over 15% and covered call returns above 12% on quality dividend stocks. The output of this scan will normally look like this:

Notice that the scan also has the covered call annualized return, which is a nice reference to have before opening the wheel strategy (you can never know if you will get assigned on your naked put, so it’s better to have an idea of what you may get from your covered call strategy if you get to it).

Some traders prefer using the best dividend stocks for covered calls in the wheel because the holding phase generates extra income. This means your income stack looks like this:

- Put premium when selling the initial put

- Dividend income while holding shares

- Call premium from the covered call sale

By combining all three, the wheel can produce a steady flow of cash while still leaving room for capital gains if the stock is called away at a higher price.

Risks and Considerations

Early assignment is one of the main risks with covered calls on dividend stocks. If the call is deep in the money before the ex-dividend date, the buyer might exercise early to capture the dividend. This takes away your shares and the chance to collect the covered call dividend. Choosing strikes above the current price and avoiding deep ITM positions near the ex-dividend date can help.

Even the best dividend stocks for covered calls can cut or suspend their dividends. A reduction in payout lowers your overall return and can signal weakening fundamentals. Regularly review company earnings, payout ratios, and cash flow trends to avoid holding stocks with an unstable dividend history.

The combined income from the dividend and premium provides only limited downside protection. A sharp price drop can erase several months of income quickly. Rolling calls too aggressively, especially over earnings announcements, can also increase risk, as large price swings may force you into less favorable positions.

Managing these risks means being selective with your stock choices, paying attention to timing, and knowing when to let a position expire rather than forcing a roll. Tax treatment is another factor worth considering: understanding how are covered calls taxed can influence decisions around strike selection, early assignment, and whether to hold through the ex-dividend date.

All of this will help you keep covered calls on dividend stocks a steady, income-focused strategy.

Read More

- Predefined scan: Continuous Covered Calls on dividend paying stocks

- Predefined scan: Dividend capture - Covered calls (quality companies, no earning, Ex-div before expiration)

- Predefined scan: Wheel Candidates

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.

REVIEWER

Leav GravesCEO

Leav GravesCEOLeav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis.