Reviewed by Leav Graves

The short strangle is a common strategy for collecting premium in neutral markets. It involves selling an out-of-the-money call and an out-of-the-money put, with the expectation that the stock will stay between the two strikes. What’s less common, but fully supported by our Custom Strategy Scanner, is combining that same short strangle with a small number of shares to keep the overall position close to delta-neutral.

The result is a structure that generates steady theta income without taking a strong directional stance, while also leaving you with some equity exposure once the options expire. This article walks through how the setup works, how it compares to a standard strangle, and how to build and scan for it using custom share quantities, a feature that allows for position types not typically found on traditional platforms.

KEY TAKEAWAYS

- Adding a small number of shares (e.g., 20–40) to a short strangle can bring the overall position close to delta-neutral, with a slight bullish bias

- The delta-zero short strangle allows you to collect theta like a traditional short strangle, while reducing exposure to gradual price drift

- Any combination between a short strangle and shares can be constructed and filtered using our Custom Strategy Scanner.

What Is a Short Strangle?

A short strangle is a neutral options strategy that involves selling:

- 1 out-of-the-money (OTM) put

- 1 out-of-the-money call

Your typical P&L will have this shape:

You are receiving premium from both options, and, as you see from the chart above, your goal is for the stock to stay between the strikes until expiration. If it does, both options expire worthless, and you keep the full credit.

The main con of this strategy is that your risk is unlimited if the stock moves sharply in either direction. But what if you were slightly bullish for the long term of a stock and wanted to earn income from a relatively calm period in the market? The section below tells you how you can achieve this.

What Is a Delta-Zero Income Strangle with Shares?

Here’s the modified setup:

- Sell 1 OTM put

- Sell 1 OTM call

- Buy a few shares (e.g., 20) of the underlying stock

You can combine the 2 options you sold with the shares you bought to create a delta-neutral trade. Here is the P&L you can expect to see in this case:

The short options give you a premium, while the small share position offsets directional drift. As you can see from the P&L above, you still need the underlying stock to remain between two breakeven points, but you can now make more money if the price moves closer to the upper bound.

Why Not Just Sell a Strangle?

Let’s compare the traditional short strangle with our stock-based delta-zero version:

Classic Strangle | Delta-Zero with Shares | |

Theta income | Yes | Yes |

Directional exposure | High | Lower on the upper side, higher on the lower side |

Delta drift risk | Unmanaged | Neutralized with stock once you open the position. Delta may change, so you may want to adjust your share leg |

Shares owned at expiry | Only in case of assignment | You will definitely own shares once your options expire |

Both strategies generate premium, but only one gives you some control over delta, and potentially leaves you with shares you want to own anyway.

When Does It Work Best?

We believe that this setup is most effective when:

- There are 25 to 45 days to expiration

- High IV Rank, which means elevated premium

- You target a probability of profit around 65–75%

It’s also a great way to slowly build a position in a stock while generating income, especially if you want to buy the shares over time anyway. But keep in mind: risk is still unlimited if the stock gaps far beyond the strikes. Monitor your position closely, especially around earnings or major events.

An Example of Delta-Zero Income Strangle with Shares

Let’s look at a practical example using TSLA:

- Buy 20 shares at $322.05

- Sell 1 call at the $280 strike, expiring July 11, 2025

- Sell 1 put at the $345 strike, also expiring July 11, 2025

At the time of setup, the call has a delta of +82.81, the put has a delta of -63.59, and the 20 shares contribute approximately +20 delta (since we’re using “1” delta per share), bringing the total net delta close to zero.

This creates a payoff structure where:

- The short call caps upside but is partially offset by the stock

- The short put brings in premium and is softened by the overhedge created by not holding 100 shares

- The stock provides exposure to upside moves between the strikes, creating a skewed but mostly neutral risk profile

Here’s the full risk/reward profile at expiration:

As you can see, the strategy has limited upside, defined downside, and a neutral tilt, with a slight bullish bias from the stock. You collect premium from both options and maintain some equity exposure, even if the stock remains range-bound. Your maximum return is above $2,000 if TSLA closes at $345 on the day the options expire (which is roughly a 5% return).

Tradeoffs and Customization

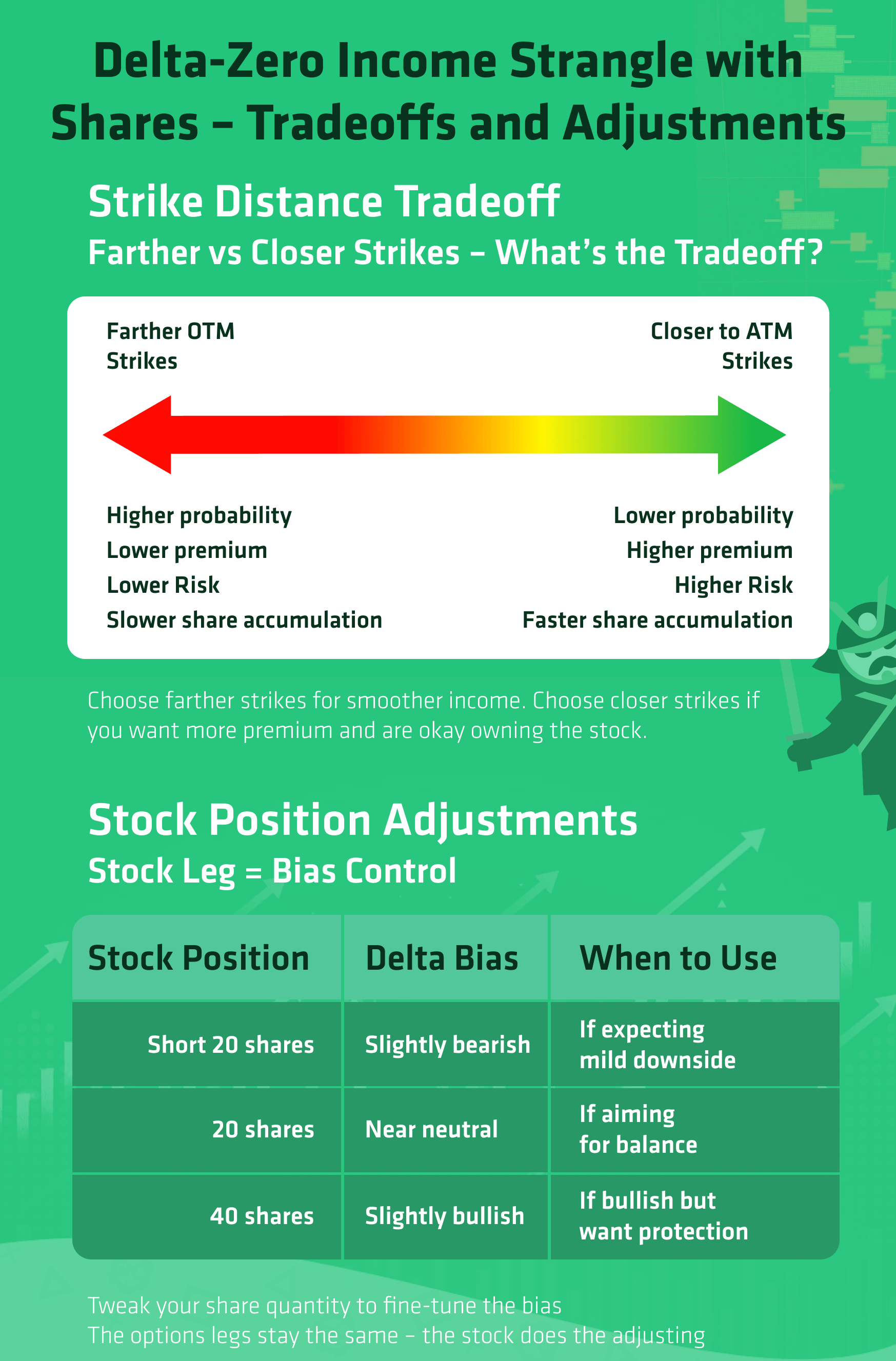

One of the biggest strengths of the delta-zero income strangle with shares is its flexibility, but that also means every version of the strategy comes with tradeoffs. The infographic below summarizes the main tradeoffs and customizations for this strategy:

Farther OTM Options = Higher Probability, Lower Reward

If you choose strikes that are further out of the money:

- You’ll collect less premium

- But your probability of profit will be higher

This tradeoff is common in options trading: a more conservative setup brings lower returns but smoother outcomes. It’s a good choice if your goal is to slowly accumulate shares or collect theta with minimal risk.

Of course, the opposite is true as well. If you bring the strikes closer to the stock price:

- You’ll earn more premium upfront

- But you’ll be increasing your risk of assignment

This may make sense in higher IV environments or when you're happy to take ownership of the stock.

Stock Position = Bias Control

Adjusting the number of shares changes the directional tilt of the trade:

- 20 shares keeps the position near delta-neutral

- 40 shares introduces a more bullish bias

- Short 20 shares (if allowed by your account) creates a mildly bearish tilt

In other words, the stock leg lets you express your bias without changing the core structure. If you're bullish, add more shares. If you’re bearish, consider reducing the stock leg, or even using short shares to flip the risk profile. That flexibility gives you tools to tailor the trade based on your view, rather than relying only on the options legs.

How to Build It With Our Custom Scanner

This is a strategy you won’t find on other platforms, but it’s easy to build with our Custom Strategy Scanner:

- Start a New Scan

- Select Custom as the strategy type

- Add a stock leg, and set the quantity to 20–40 shares

- Add a put leg (Sell OTM)

- Add a call leg (Sell OTM)

- You can filter by:

- IV Rank ≥ 30

- DTE between 25 and 45

- Minimum premium or credit

- Probability of profit ≥ 65%

- … and more!

As an alternative, you can refer to the predefined scan we created for this specific strategy (linked at the bottom of this text). You can also duplicate it and edit it according to your own taste.

Read More

Our blog article on the short strangle strategy (Short Strangle: A Strategy for Stable Markets [Theory, Example, and Things to Know])

Our predefined scan on the delta-zero income with shares (Delta-Zero Income Strangle with Shares)

Our guide on the custom scan feature (Custom Options Strategy Screener)

Try this strategy on our options screener

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.

REVIEWER

Leav GravesCEO

Leav GravesCEOLeav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis.