Iron Condor with Stock Position on Dividend-Paying Stocks (Premium + Upside + Dividend)

Published on July 17, 2025(Last updated on October 13, 2025)

Table of Contents

Reviewed by Leav Graves

Table of Contents

An iron condor is typically used as a neutral income strategy, ideal when you expect a stock to stay within a range. You sell an out-of-the-money (OTM) put and call, buy protective wings further out, and aim to collect premium as time decay works in your favor.

But what if you could take this income strategy and enhance it, not just with upside exposure, but also with dividend income? By combining an iron condor with a stock position in a dividend-paying name, you can create a hybrid trade: one that still profits if the stock moves sideways, but also benefits from a rally and earns dividends along the way.

With our Custom Strategy Scanner, you can easily build and filter for this setup. Let’s walk through how it works.

KEY TAKEAWAYS

- By adding a stock position (e.g. 50 shares) to a standard iron condor, you create a hybrid strategy that earns option premium, captures upside potential, and collects dividends.

- This setup still benefits if the stock stays within a range, but now adds equity gains if the stock rallies, plus dividend income while you hold the shares.

- While the upside is enhanced, the downside risk increases due to the long stock position, though it’s partially hedged by bearish legs in the trade.

- Our Custom Strategy Scanner helps you filter for high-quality, dividend-paying stocks and set up this trade structure with your preferred share count, option strikes, and expiration.

The Classic Iron Condor

Before adding shares, let’s quickly recap what a standard iron condor looks like. In its basic form, the iron condor is a neutral, income-focused strategy. You expect the stock to stay within a certain range until expiration, and you build your position like this:

- Sell 1 out-of-the-money (OTM) put

- Buy 1 further OTM put (to protect the downside)

- Sell 1 OTM call

- Buy 1 further OTM call (to cap upside risk)

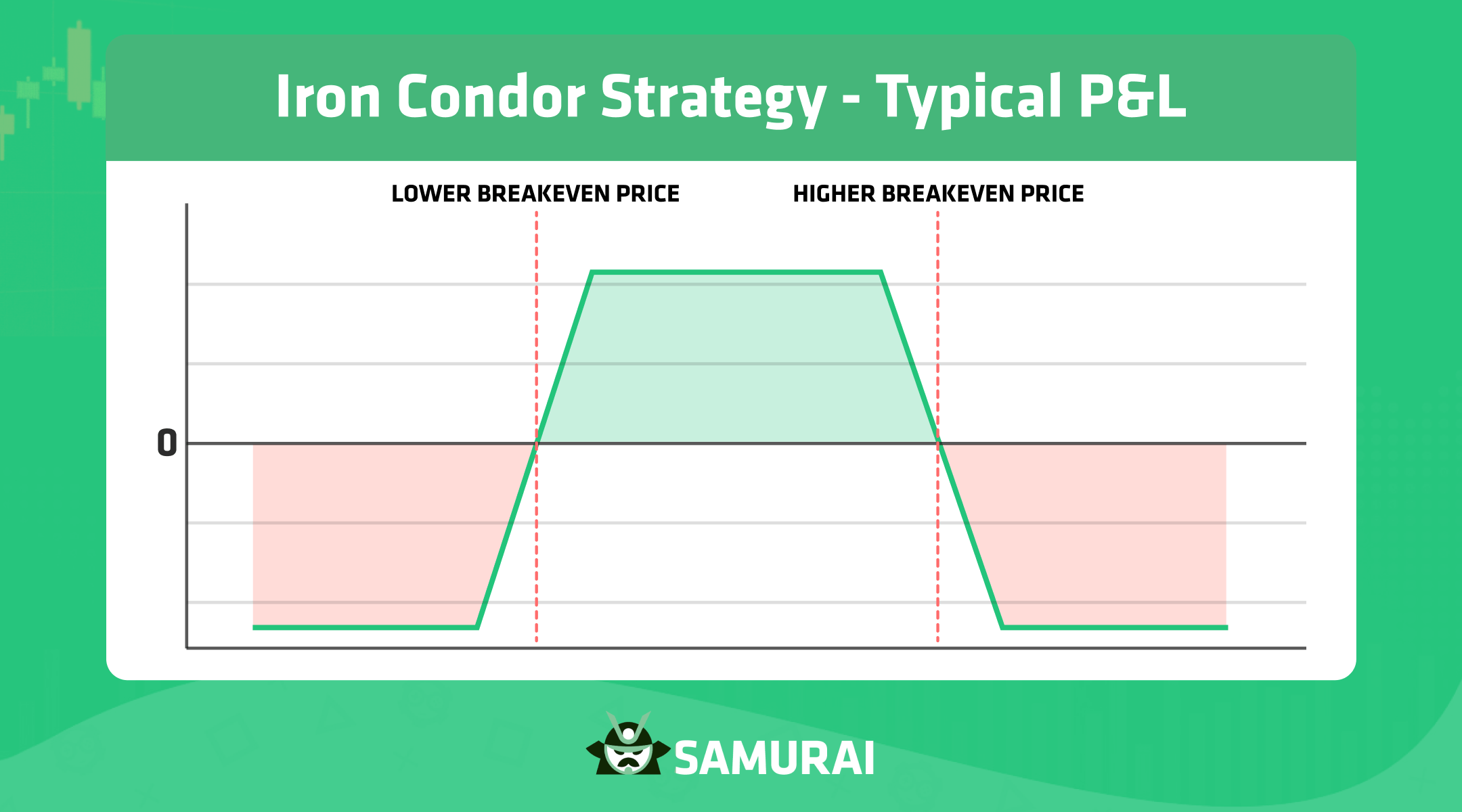

All options share the same expiration date. The result is a net credit trade, meaning you receive premium upfront. Here’s the typical payoff chart (we highlighted the profit and loss zones to make the chart easier to read):

As long as the stock stays within the inner strikes (between the short put and short call), you keep the full premium. The risk is limited on both sides, thanks to the long wings. The worst-case loss is known in advance and happens if the stock makes a big move in either direction.

This strategy is ideal when:

- Implied volatility is high (you collect more premium)

- You expect the stock to move sideways

- You want defined risk with limited capital outlay

However, the main downside of a classic iron condor is that stock prices tend to move, and they won’t remain in a range for a long time. In other words, this strategy will never benefit from a strong move (in fact, you may end up losing money in this case). That’s where you may want to consider a stock-enhanced version of the iron condor, as we tell you in the next section.

Adding Shares to an Iron Condor

Here’s what you can do:

- Own 50 shares of the underlying stock

- Sell 1 OTM put (example: 5% below current price)

- Sell 1 near-ATM call (example: just above current price)

- Buy 1 deep OTM put (protects from a major drop)

- Buy 1 further OTM call (caps your obligation if the stock explodes upward)

Your typical P&L would have this shape:

Or, even better, you could build it to make it so that there is no upside risk:

As you can see, you have a potentially unlimited loss risk on the left-hand side of the chart, which is a risk you may decide to take considering the unlimited profit gain on the other side. In the middle, you still have a profit bump that will remind you of the classic iron condor. This is basically like taking the P&L of a classic iron condor and rotate it a little bit in a counterclockwise manner.

Standard Iron Condor vs. Iron Condor with Shares

To better understand how adding shares transforms the payoff, here’s a side-by-side comparison of the classic iron condor vs. the iron condor with 50 shares:

Feature | Classic Iron Condor | Iron Condor + 50 Shares |

Max Profit | Net premium received | Net premium + upside from 50 shares |

Max Loss | Defined by width of wings minus premium | Unlimited on downside due to equity risk (partially softened by long put) |

Upside Potential | Capped by short call | Unlimited above call strike due to stock |

Downside Protection | Capped by long put | Partial: 50 shares exposed, long put helps |

Ideal Market Condition | Sideways, range-bound | Sideways or, even better, with a strong bullish breakout |

Volatility View | High IV preferred | High IV preferred |

This makes it clear: if you're slightly bullish but still want to collect premium, the hybrid version gives you a better outcome if the stock moves up. You give up some protection on the downside but get rewarded with real upside potential - something a plain iron condor can’t offer. You could like this strategy in case you own shares on a company (meaning you are bullish on it) but expect it to potentially remain trapped in a gap for a while before moving up.

We have summed up this strategy in the following infographic:

An Iron Condor with Shares Example on a Dividend-Paying Stock

Let’s walk through a real hybrid trade on ABBV, a dividend-paying stock with a yield above 3%. This example combines an iron condor with 50 shares of stock to create a position that benefits from both sideways movement and a potential rally, while also earning dividend income.

Here’s the structure:

- Buy 50 shares of ABBV at $185.62

- Sell 1 put at the $175 strike

- Buy 1 put at the $160 strike

- Sell 1 call at the $190 strike

- Buy 1 call at the $200 strike

Your P&L has this particular shape:

As you can see, the position brings in net credit and has a bullish directional bias, but remains profitable within a wide range. Between roughly $176 and $200, the trade acts like a classic sideways setup (it will likely remind you of a butterfly), collecting premium and benefiting from time decay.

If ABBV rallies past $200, your 50 shares continue to rise in value. Practically speaking, you now have an iron condor with uncapped profit and uncapped losses (uncapped losses are the price to pay to have an uncapped profit, in this case). Notice that risk starts below $176 and is partially cushioned by the long put at $160. The stock position introduces exposure, but the options structure helps soften major drops.

This strategy works well when you’re holding a dividend-paying stock with long-term upside potential, but expect it to trade sideways in the short term. You collect premium, keep the dividend, and retain upside, all in one defined setup. In our ABBV example, you’ll collect premium from the iron condor plus approximately $82 in dividends (50 shares × estimated $1.64 dividend per share, with payout expected in a couple of weeks). If the options premium collected is a little above $500 like in our example, that’s an additional ~5.4% return on capital in just a few weeks, before even factoring in any upside from the stock. You collect premium, keep the dividend, and retain upside, all in one defined setup.

Why Would You Trade an Iron Condor with Shares on a Dividend-Paying Stock?

This hybrid strategy isn’t just about collecting premium, it’s about stacking multiple income sources while keeping a bullish bias. Here’s what makes it attractive:

- Premium from the Iron Condor: You collect upfront credit from selling the put and call spreads. If the stock stays within range, you keep the entire premium.

- Dividends from the Stock: By holding 50 shares of a dividend-paying stock, you earn regular cash payouts, a nice-to-have addition to an options income strategy.

- Upside from the Equity: If the stock rallies, your shares gain value beyond the short call’s cap, adding another layer of potential return.

In short, you get three ways to win: premium, dividends, and capital appreciation, all while keeping your risk structured and partially hedged. Does this mean you’ll definitely make money out of it? Absolutely not, but this is an edge you can add to your portfolio.

How to Build It in the Custom Scanner

Here’s how to scan for this setup using our Custom Strategy Scanner:

- Start a New Scan

- Select “Custom” as strategy type

- Add 1 stock leg (50 shares)

- Add the following option legs:

- 1 short put (OTM)

- 1 short call (near ATM)

- 1 long put (deep OTM)

- 1 long call (further OTM)

- Use filters like:

- Stock Score (Fundamental, Growth, Technical): set all above 7

- Option Volume: above 5,000 contracts

- Probability of Profit: above 70%

- Dividend yield: above 0%, 3%, 5%, etc.

- … and more!

Alternatively, you can also refer to the predefined scan we prepared for this strategy. You can use it directly or duplicate it and edit it according to your taste.

Read More

- Our article on the iron condor strategy (Iron Condor Strategy: Making Money in Sideways Markets [Tips and Best Practice])

- Our predefined scan on this iron condor + shares strategy (Iron Condor with Stock Position on Dividend-Paying Companies)

- Our guide on the custom scan feature (Custom Options Strategy Screener)

- Try this strategy on our screener for the options market

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.

REVIEWER

Leav GravesCEO

Leav GravesCEOLeav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis.