Disclaimer: The trades discussed in this blog reflect the author’s personal strategies and decisions. These are not financial advice and should not be considered recommendations to buy, sell, or hold any financial instruments. The author is not a licensed financial advisor. Options trading carries significant risk, and readers should perform their own research or consult a qualified financial advisor before making any investment decisions. Past performance does not guarantee future results.

Today I opened a defined-risk, directional trade on Capital One Financial (COF) using a long call butterfly. This strategy is ideal when I have a moderately bullish outlook and want to express that view with low capital outlay and limited downside. With COF trading near $220.40, I’m targeting a move toward the $225 strike over the next several months, while keeping my max loss strictly limited.

The long call butterfly lets me benefit from a move toward the middle strike (where profit is maximize) while protecting against larger moves in either direction. It’s a more cautious way to express directional conviction without chasing the stock or exposing too much capital.

The Trade

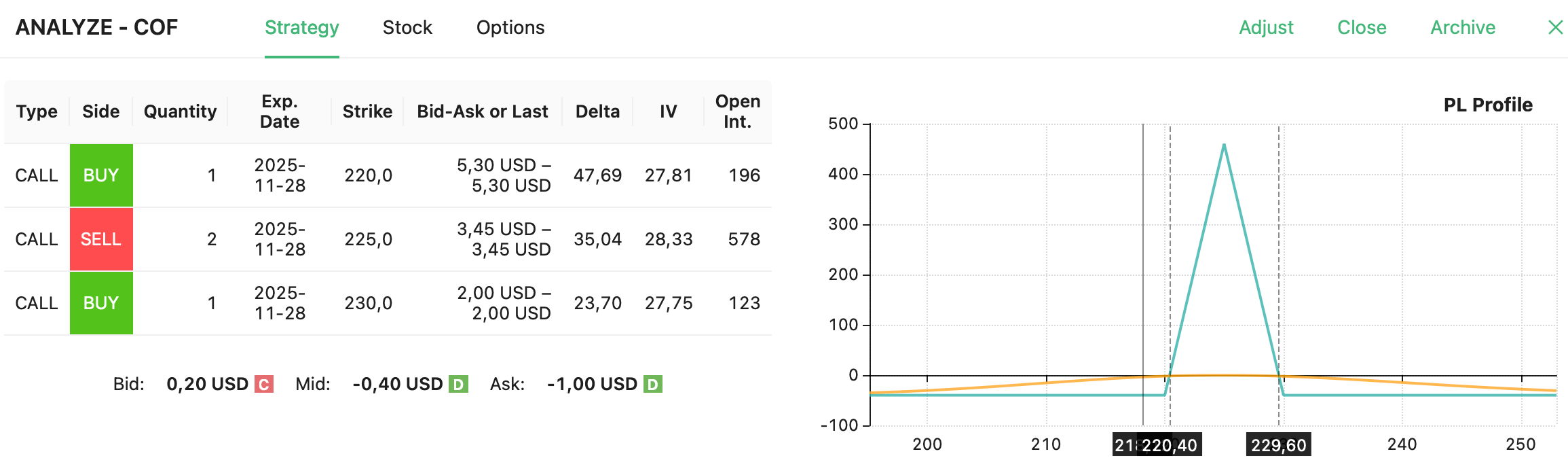

All contracts are in the November 28, 2025 expiration:

- Buy 1× 220 Call

- Sell 2× 225 Calls

- Buy 1× 230 Call

This setup cost $0.20 per share, or $20 total per spread. The risk is capped at the initial debit, and the max reward is achieved if COF closes right at $225 at expiration, making this an attractive risk/reward profile with a 5:1 payoff potential.

Here’s the P&L snapshot:

Why COF?

Capital One (COF) continues to impress on multiple fronts. The recently completed Discover Financial acquisition is a game-changer, positioning the company as a dominant player in the credit card space and expanding its scale across digital banking. The deal is expected to be 15%+ accretive to EPS by 2027, and synergies are already underway.

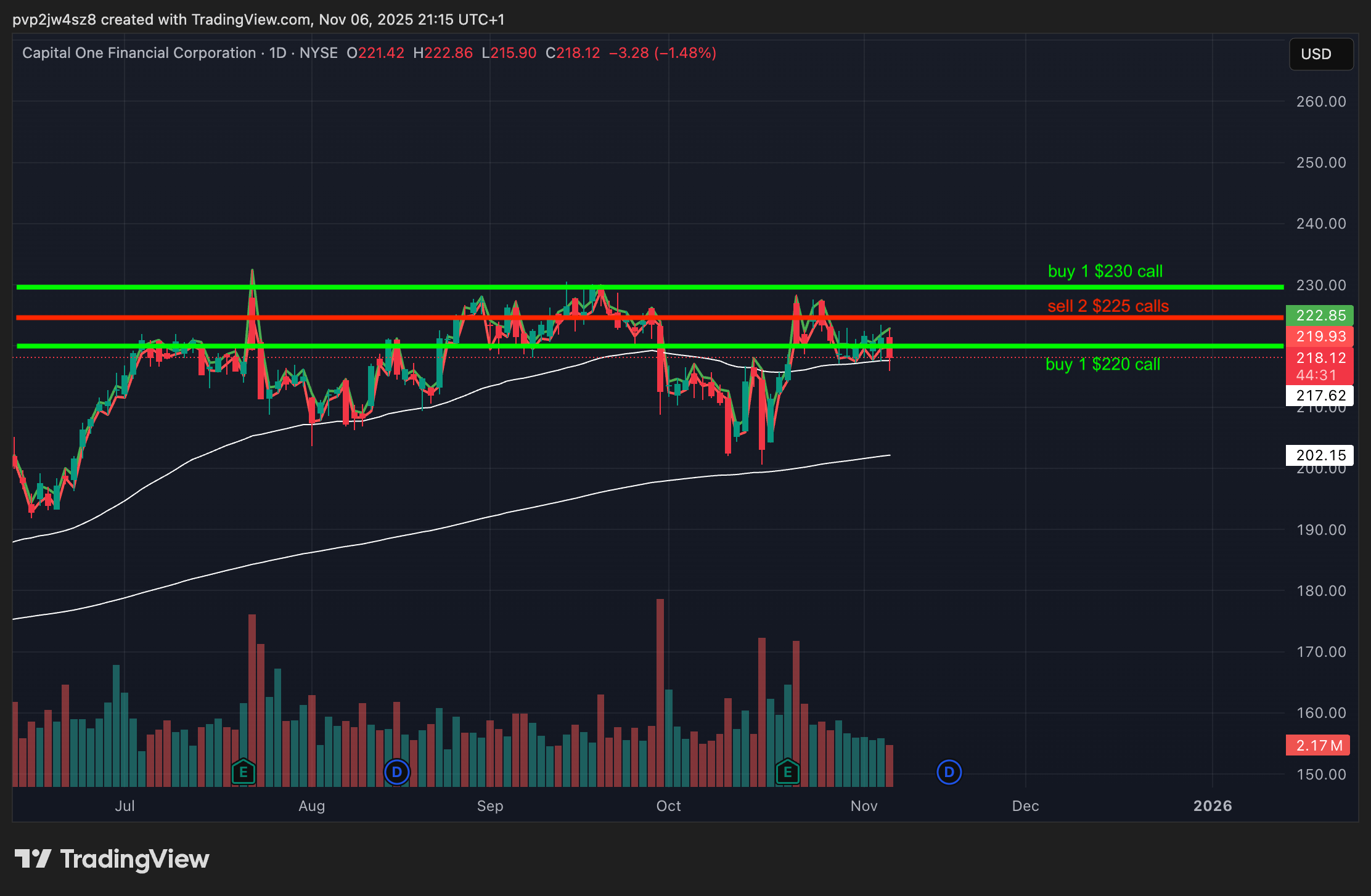

And by the way, this is the price chart:

I've also been reading about the recent earnings (Q3 2025), which were strong, with EPS of $5.95, blowing past expectations by over 40%. Revenue rose 23% sequentially, driven by a surge in net interest income and a significant expansion in net interest margin to 8.36%. The loan book continues to grow, and the company maintains a healthy deposit base.

Despite macroeconomic headwinds, COF’s strong liquidity position, solid capital ratios (CET1 at 14.4%), and robust cash holdings ($55.3B) make it well-positioned to navigate volatility. Shareholder returns are also ramping up - $1B in buybacks last quarter, with a fresh $16B repurchase authorization announced.

This trade is clear for me: COF is fundamentally strong, technically poised, and has a reasonable chance of drifting into the $225 area over the coming months (in fact, I may roll the position or just open new similarly bullish strategies on the ticker). I've also added this butterfly to my public trade log, as usual.

Update - Trade Closed

I closed the trade at a $77.50 profit, which is almost a 200% return. I actually expected to close it earlier but the temporary decline in the markets created this opportunity:

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.