Options Assignment - When It Happens and What to Expect

Published on October 13, 2025(Last updated on February 26, 2026)

Reviewed by Leav Graves

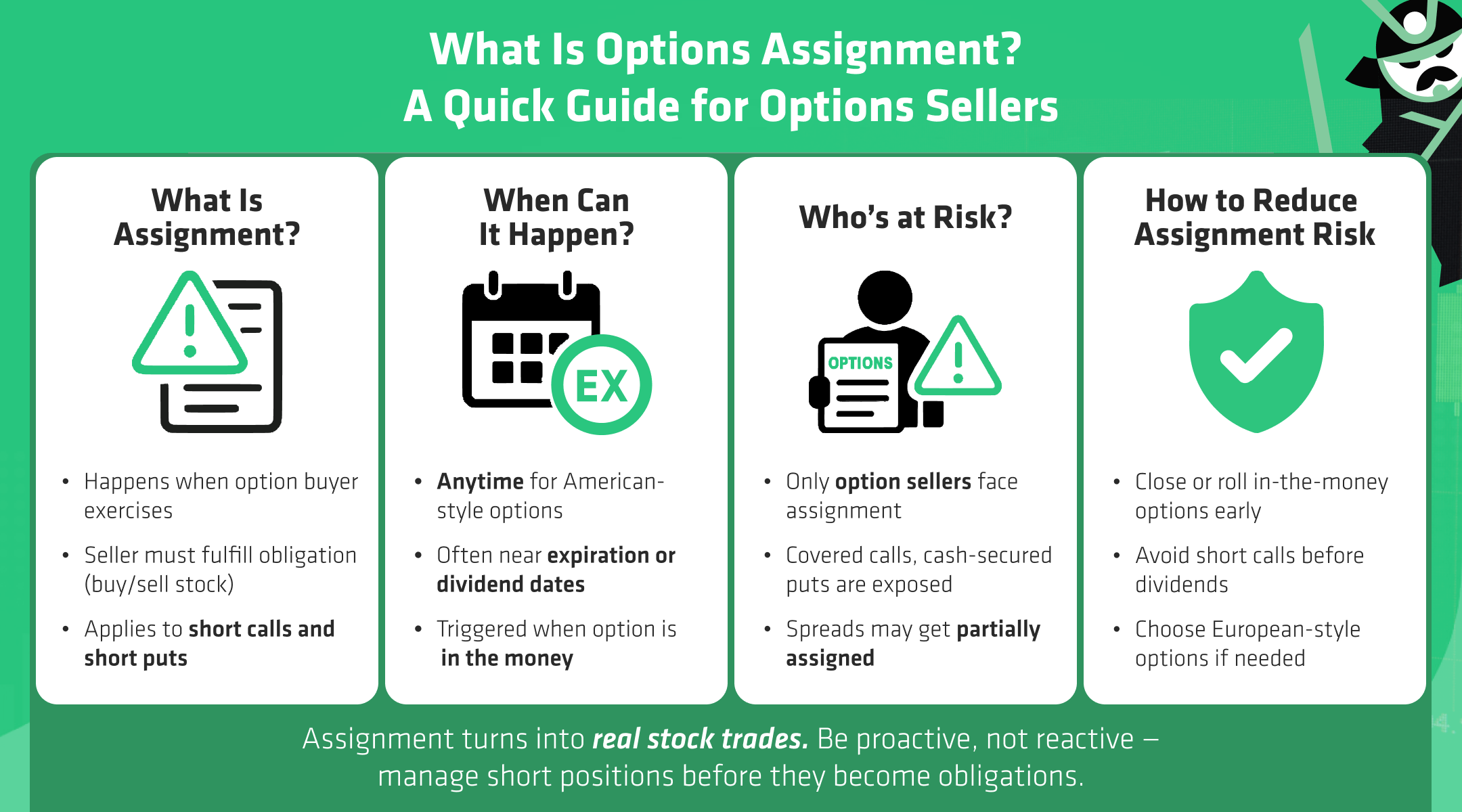

Options assignment is a key concept in options trading, especially for those who sell options who may incur into the so-called assignment risk. This article explains what options assignment is, how and when it happens, and how traders can manage the risks. Understanding this process is crucial for anyone who sells puts or calls in the market.

KEY TAKEAWAYS

- Options assignment is the risk faced by options sellers, who may be required to buy or sell the stock if the buyer exercises their option

- Options get assigned when they are in the money. With American-style options, this can happen at any time before expiration, not just on the expiration day

- You can reduce the chances of early assignment by managing your short positions carefully, especially during earnings, big price swings, or right before dividend dates

What Is Options Assignment?

Options assignment is the risk you take when you sell an option. If the buyer decides to use their right, you have to act. That means:

- If you sold a call, you may have to sell shares at the strike price

- If you sold a put, you may have to buy shares at the strike price

The buyer always has the right to choose. You, the seller, take on the obligation. That’s how options work. You get paid upfront with the premium, but in return, you’re on the hook if the option gets used.

So, when do options get assigned? With American-style options, it can happen any time before expiration. Not just at the end. If the contract is in the money, there’s a chance you’ll get assigned.

The Options Clearing Corporation (OCC) handles this behind the scenes (and keeping an eye on what does open interest mean in options for your short strikes can also give you a sense of how many contracts are outstanding and how active the market is around levels where assignment risk tends to concentrate). When an option is exercised, the OCC randomly selects a firm that holds matching short positions. Your broker then picks which customer gets assigned - either randomly or using its own method.

In short:

- Selling options comes with real obligations

- Assignment can happen suddenly, especially if the option is in the money

- Know the risks before you sell any call or put

When Do Options Get Assigned?

American-style options can trigger options assignment at any time before expiration. If you're short a call or a put and it's in the money, you can be assigned randomly, even with several days (or weeks) left. This type is the most common for stocks and ETFs.

European-style options work differently. These can only be assigned at expiration. That gives you more breathing room, especially if you're trading something like index options (e.g. SPX). You still take on risk, but at least you won’t wake up midweek assigned on a short leg.

So, when do options get assigned early? It usually happens in specific situations:

- The option is deep in the money (doesn’t have extrinsic value or leverage)

- There's a dividend coming and the call is in the money

- There’s a corporate action (like a buyout or split)

- The shares become hard to borrow

If none of those apply, assignment often happens close to expiration. But again, with American-style contracts, it’s never guaranteed to wait.

Options assignment isn’t just a deadline issue. It’s a mix of price, timing, and trader behavior. If you’re selling options, especially close to dividend dates or on fast-moving stocks, always assume early assignment is on the table. It’s rare, but it happens.

Who Is at Risk of Being Assigned?

Only traders who sell options are at risk of options assignment. If you buy an option, you have the right to exercise it, not the obligation. So if you're long a call or put, you're never the one getting assigned.

The risk sits with the seller. That’s you if you wrote a call or put. A simple way to check: ask yourself, does it make sense for the buyer to exercise the option I sold? If the answer is yes, you're at risk.

Covered call sellers and cash-secured put sellers are the most exposed. These strategies are popular because they collect premium, but they also come with the tradeoff of possible assignment.

Multi-leg strategies add more moving parts. If just one leg is assigned early, you might be stuck with an unintended position or added margin requirements. That’s when things can spiral if you’re not paying attention.

Therefore, here are a few notes to keep in mind:

- Long options can't be assigned

- Only short options face assignment risk

- Covered calls and secured puts are the most exposed

- Partial assignment in spreads can cause trouble fast

What Happens After Assignment?

When options assignment hits, the seller has to act right away. Each contract covers 100 shares. So if you sold a call, you now have to deliver 100 shares at the strike price. If you sold a put, you need to buy 100 shares at the strike price. This isn’t optional - it’s automatic.

Your broker adjusts your account to reflect this. If you were assigned on a call and already owned the shares (covered call), they’re sold. If you didn’t own them, the broker sells them short or buys them from the market, depending on margin rules.

If you’re assigned on a put, your account will be debited the full cost of the shares. If you don’t have the cash, your broker will either use margin or force a liquidation.

This is where margin comes in:

- If you have enough buying power, the shares are added

- If not, your broker may issue a margin call or auto-sell other positions

- You’re responsible for the trade, even if it wasn’t expected

Options assignment isn’t just a number in your P&L - it turns into a real position. And if your account isn’t ready, your broker will make the next move for you.

What if Assignment Breaks Your Strategy?

Options assignment can mess up a multi-leg strategy fast. If just one leg gets assigned early, like the short side of a vertical spread – you might end up with a position you didn’t plan for. Now you’re holding shares or short stock, and the other leg is still open.

This can lead to:

- Unwanted directional exposure

- Higher margin requirements

- Extra risk, especially during fast price moves

You can manage the situation by closing the remaining leg, exercising your long option, or rolling the position. But it’s better to act early, especially near expiration or if your short strike is in the money.

There are exceptions: in more advanced strategies like the wheel strategy (we’re leaving a link at the end of the text, this is a popular strategy for users relying on our screener for options trades), getting assigned is sort of part of the plan. The trader sells puts, knowing that he will face assignment from time to time, then sells covered calls on the shares received. It’s a slower, income-focused approach that uses assignment as a feature, not a problem. Some traders also use synthetic options to replicate stock exposure without holding shares directly - but any short legs in those structures still carry the same assignment risk.

If you’re new to selling puts or covered calls and want to understand how to set these trades up, check our guide on how to start trading options.

How to Reduce the Risk of Assignment

If you're selling options, you can’t eliminate options assignment risk completely, but you can reduce it by staying alert and making smart choices.

Keep an eye on short options that are close to the money. Once they move in the money, especially near expiration, you’re more likely to be assigned.

Here are a few ways to reduce your risk:

- Close or roll your short options early if they’re in the money

- Avoid selling calls near ex-dividend dates unless your position is covered

- Pick European-style options when early assignment is a dealbreaker

- Watch for stocks with high borrow fees or high implied volatility - these raise assignment odds

So, when do options get assigned? Usually when the math favors the buyer. That’s why it’s on you to manage risk before it becomes a problem. Waiting until the last day and hoping for the best isn’t a strategy - it’s a gamble.

Are Options Automatically Assigned?

Yes, if an option is in the money at expiration, most brokers will automatically assign it. You don’t need to manually exercise the contract. The clearing firm and your broker handle the process in the background.

For sellers, this means options assignment happens automatically if the contract is worth exercising. You’ll see shares bought or sold in your account the next trading day.

If the option expires out of the money, nothing happens. The contract just disappears, and the trade is over. No assignment, no shares, no action needed.

This is standard across most U.S. brokers:

- In-the-money options are usually exercised and assigned automatically

- Out-of-the-money options expire worthless

- No manual action is required at expiration

Also, as a final note, consider that understanding your breakeven price in options is just as important, especially when assignment risk is on the table.

Read More

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.

REVIEWER

Leav GravesCEO

Leav GravesCEOLeav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis.