Gianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services. Known for his rigorous approach and deep understanding of market dynamics, Gianluca specializes in derivatives and cyclical analysis, with a strong emphasis on options trading strategies and macroeconomic frameworks.

Gianluca is the founder of Cycle Quest, a project focused on applying cyclical models to financial markets, economic indicators, and more. With an international academic background and a passion for data-driven decision-making, Gianluca empowers traders and investors with expert insights, clear strategy frameworks, and cutting-edge tools.

Education

- Bachelor’s Degree in Economics from University of Brescia (Italy)

- Two Master’s Degrees in Economics and Empirical Finance from Sorbonne University (France)

References

- Founder at Cycle Quest

- Contributor at Traders Union

- Author at Tokize.com

- Author at Crypto Adventure

Experience

- Over a decade of experience trading options, with a focus on defined-risk strategies such as vertical spreads, iron condors, and diagonals

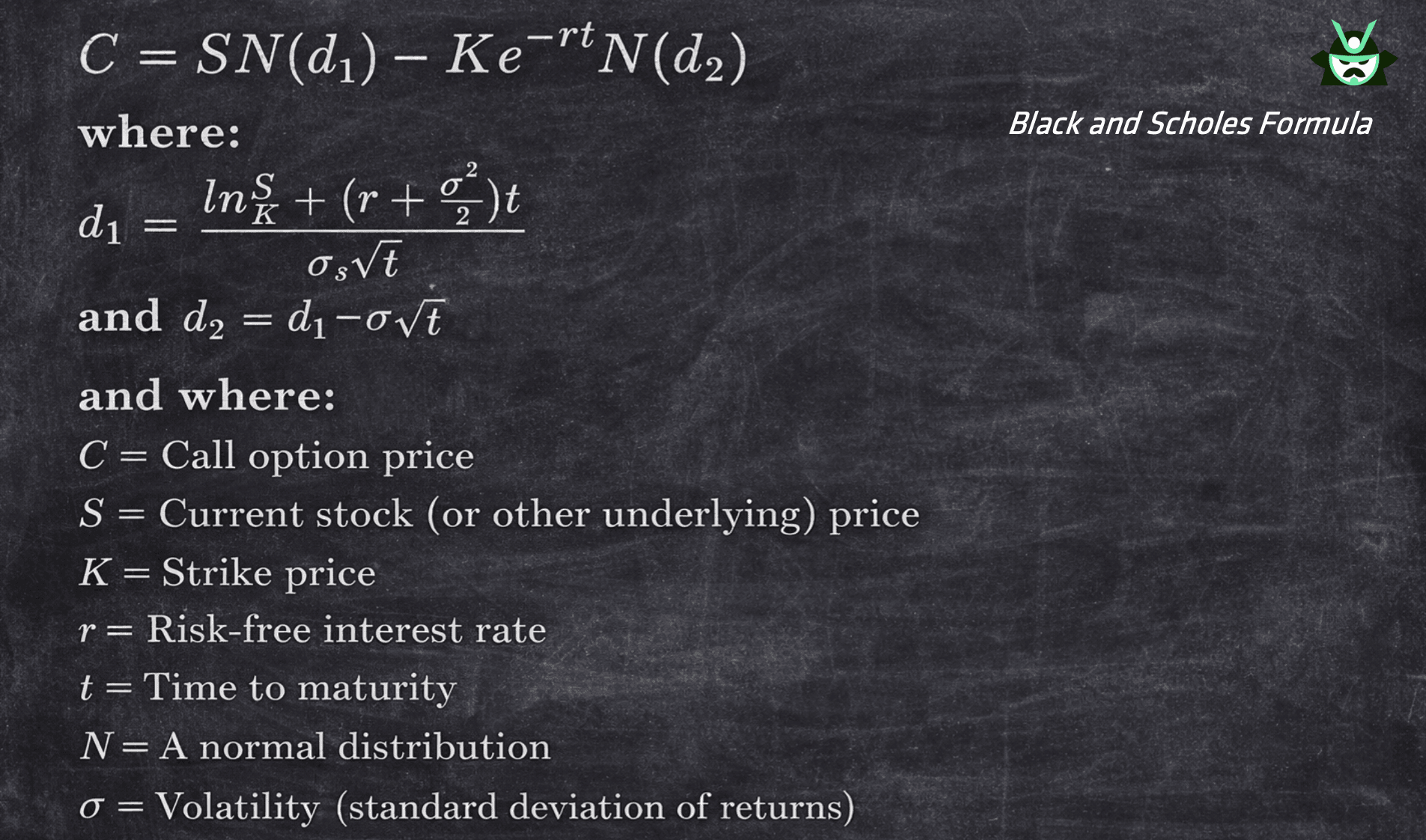

- Deep understanding of options pricing models like Black-Scholes and binomial trees, applied daily to position evaluation

- Active user of the CBOE indices as a benchmark to build and test different trading strategies with options

- Expert in managing trades using the Greeks (Delta, Theta, etc.) to dynamically adjust risk

- I regularly post live trade setups and market reads on Gianluca’s Trades via the Option Samurai blog and my personal Stocktwits profile

- Skilled in building algorithmic strategies in Python and Pine Script, with a focus on short-term price action and event-driven plays

- Creator of backtesting environments tailored to options logic using Python’s Pandas and NumPy stack

- Daily use of TradingView, Interactive Brokers, and Databento for execution, charting, and data analysis

- Developed custom automated dashboards in Plotly and Streamlit for real-time tracking of trade performance and volatility curves

- Frequently design strategies aligned with FOMC and macroeconomic indicators for directional and volatility bias

- Strong foundation in fundamental analysis, with deep dives into financial statements and earnings behavior

- Implemented statistical arbitrage and volatility modeling techniques to detect mean-reverting edges

- Experienced in handling expiration risk, assignment logic, and optimizing trade timing around options cycles

- Advocate for integrating behavioral finance principles to mitigate biases and improve trader discipline

- Regularly consult with traders on strategy design, risk control, and automation to elevate their performance across market regimes

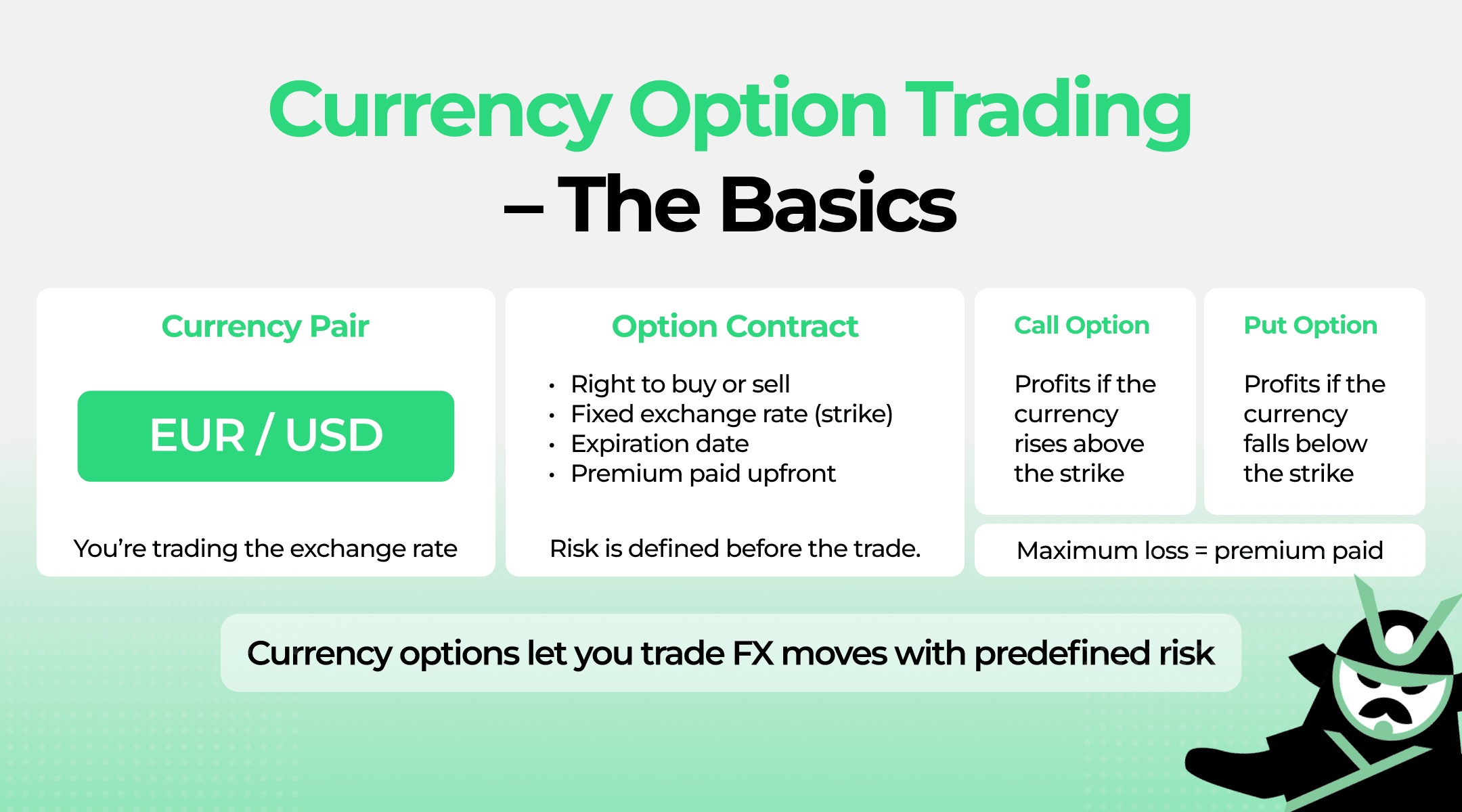

Currency Option Trading - How FX Options Work and When to Use Them

Learn how currency option trading works, including foreign exchange options, US currency options, and more.

Black and Scholes Option Pricing Model - The Benchmark Behind Option Prices

A clear explanation of the Black and Scholes option pricing model, covering the formula, inputs, method, put pricing, and real-world limitations.

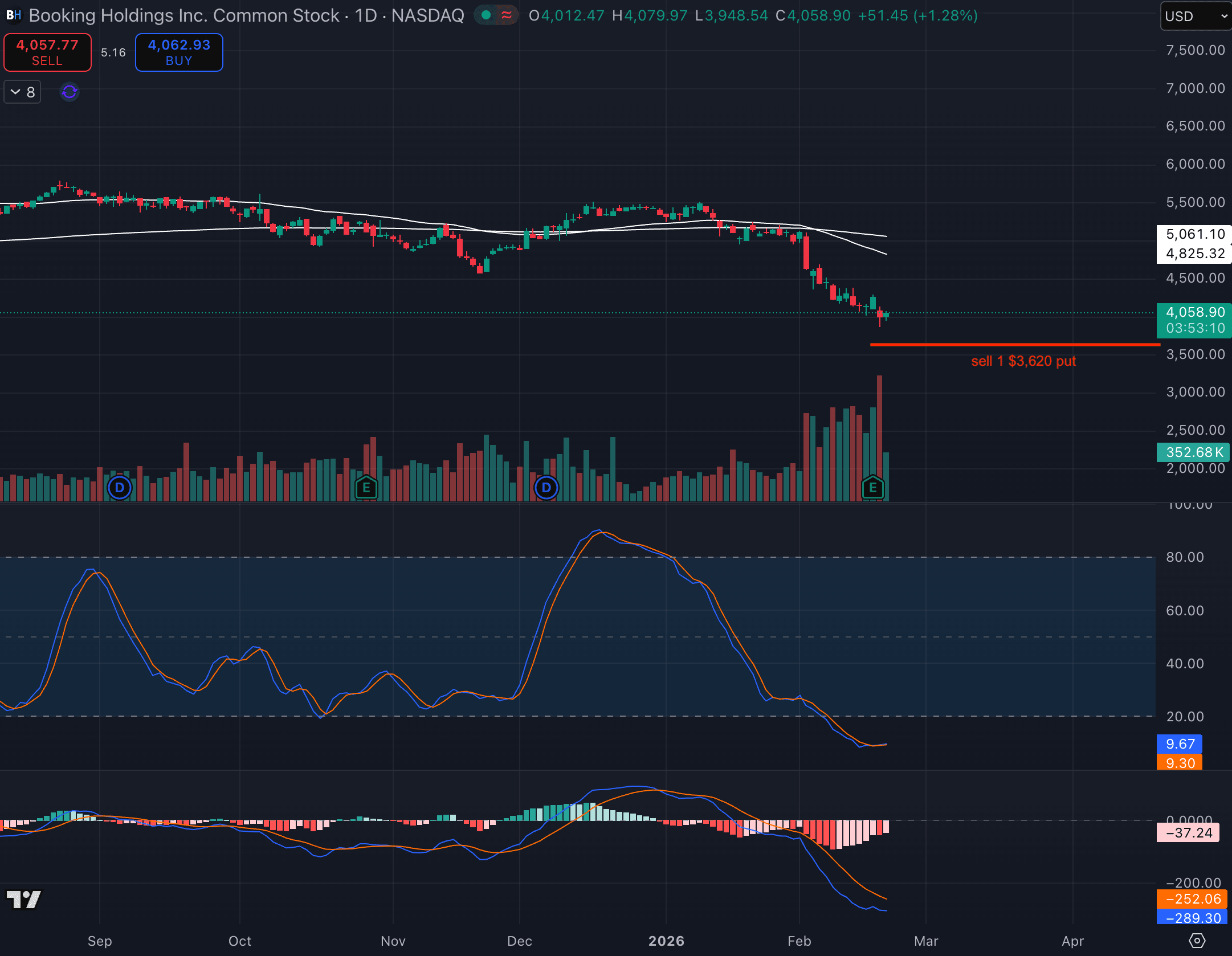

Trade Idea - Naked Put on BKNG

I opened a short put position on BKNG today. The stock is widely oversold so I'm ok with either getting assigned shares (and do a wheel with a covered call) or rolling this down and further in time a few times. But since BKNG is quite expensive, I'll probably aim for rolling.

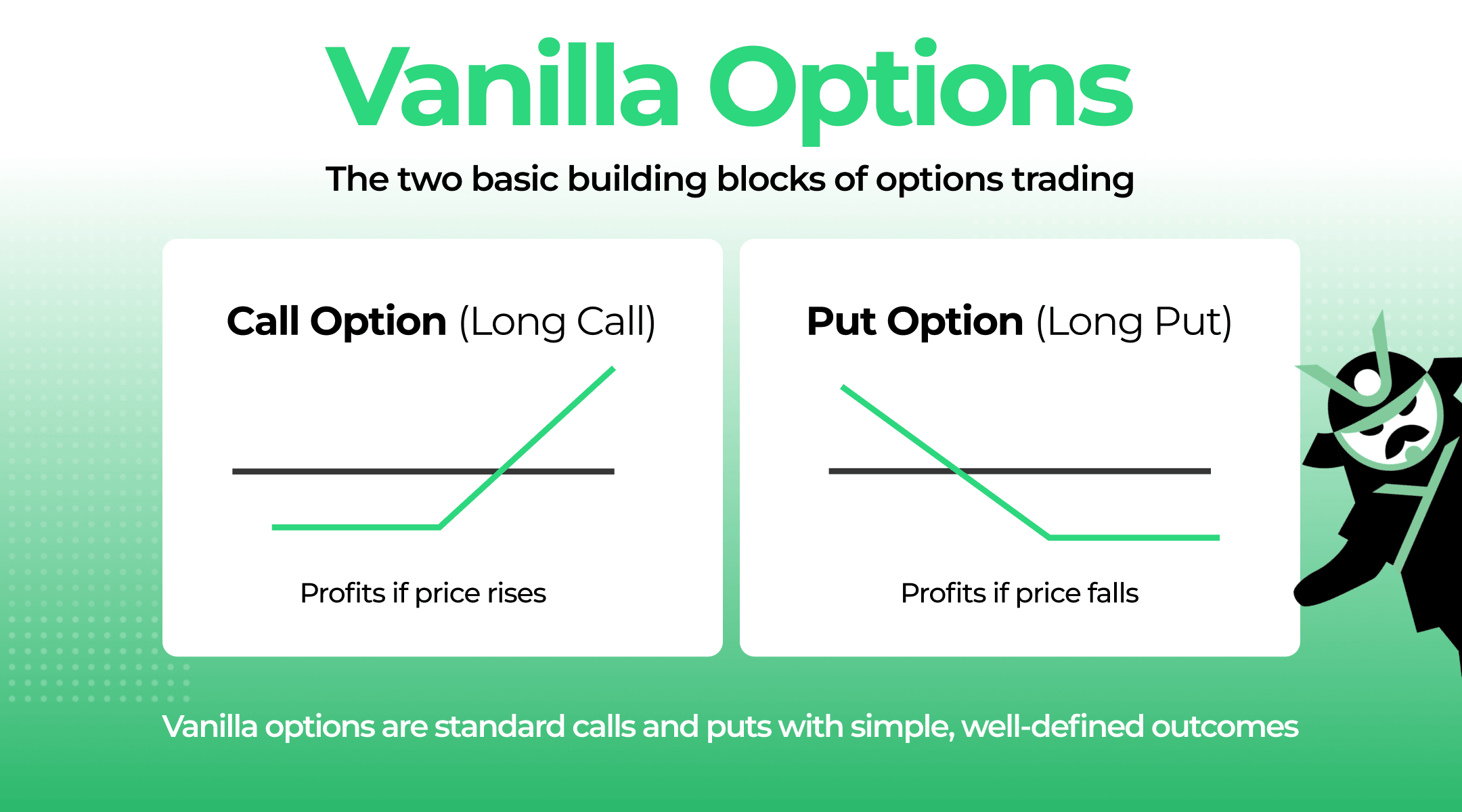

Vanilla Options - The Foundation of Options Trading Strategies

A clear guide to vanilla options, the standard call and put options traded in markets, and how they differ from exotic options.

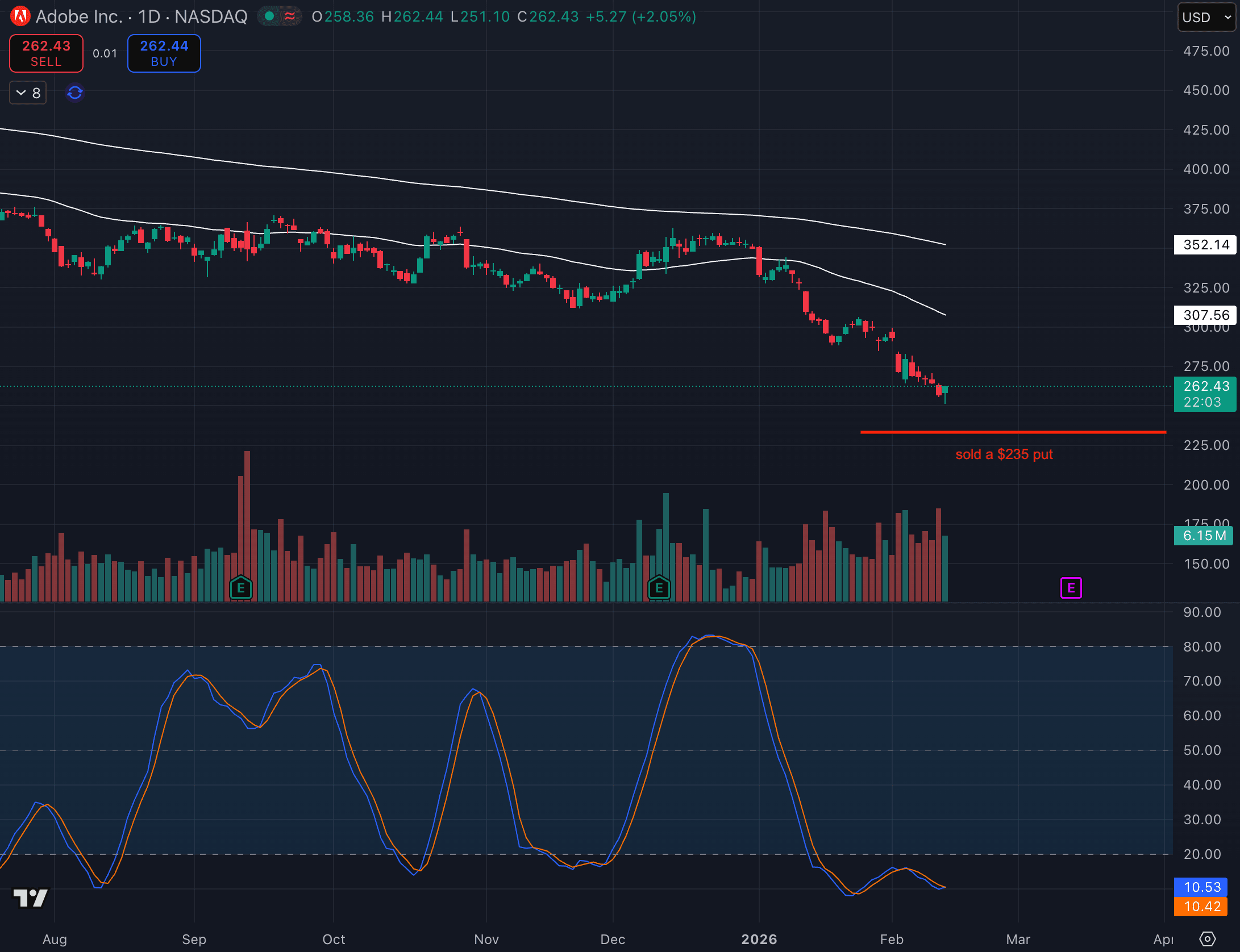

Trade Idea - Naked Put on ADBE

I opened a short put position on ADBE today. The stock is widly oversold so I'm ok with either getting assigned shares (and do a wheel with a covered call) or rolling this.

In the Money vs Out of the Money: What’s the Difference?

Confused by strike prices? We break down in the money vs out of the money options using simple logic and real-world examples.

Trade Idea - Long Call on AAPL

Today I bought a call on AAPL. IV was low, and price action was looking good.

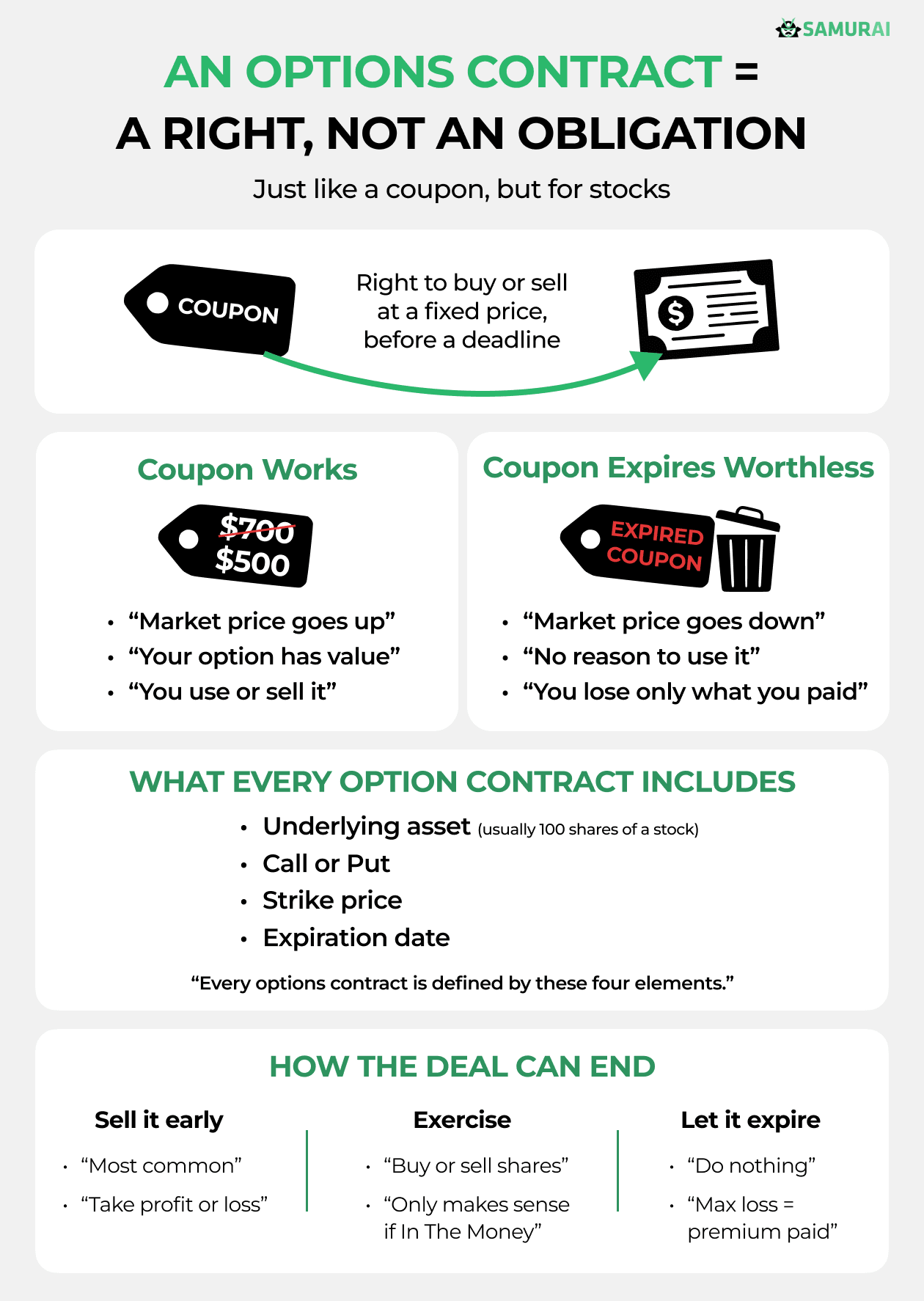

Options Contract - Understanding What an Option Is

We break down the definition, provide a clear option contract example, and explain how these agreements work.

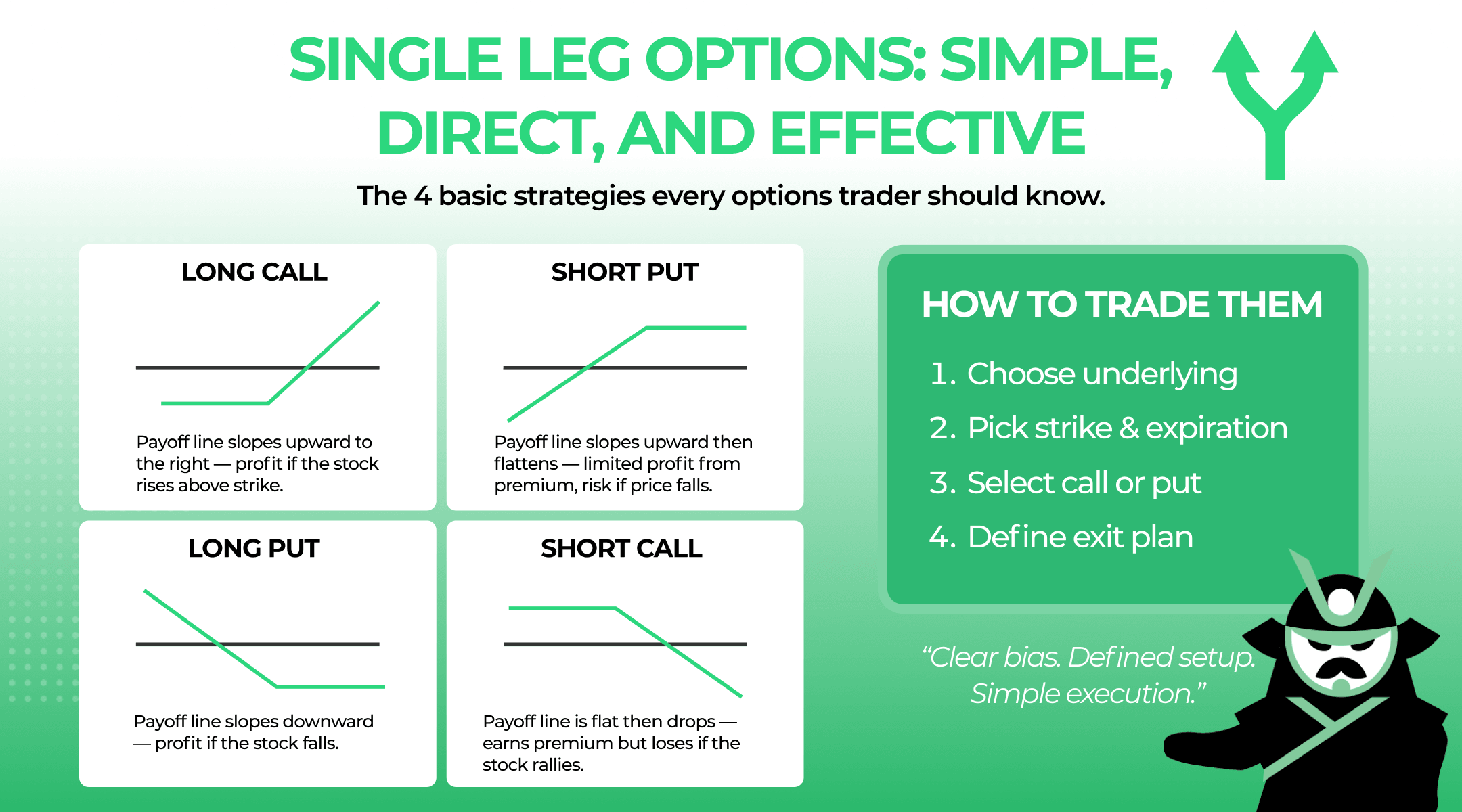

Single Leg Options Trading - The 4 Core Options Strategies to Know

The basics of single leg options explained: learn what they are, how they work, the four core strategies, and when to trade them.

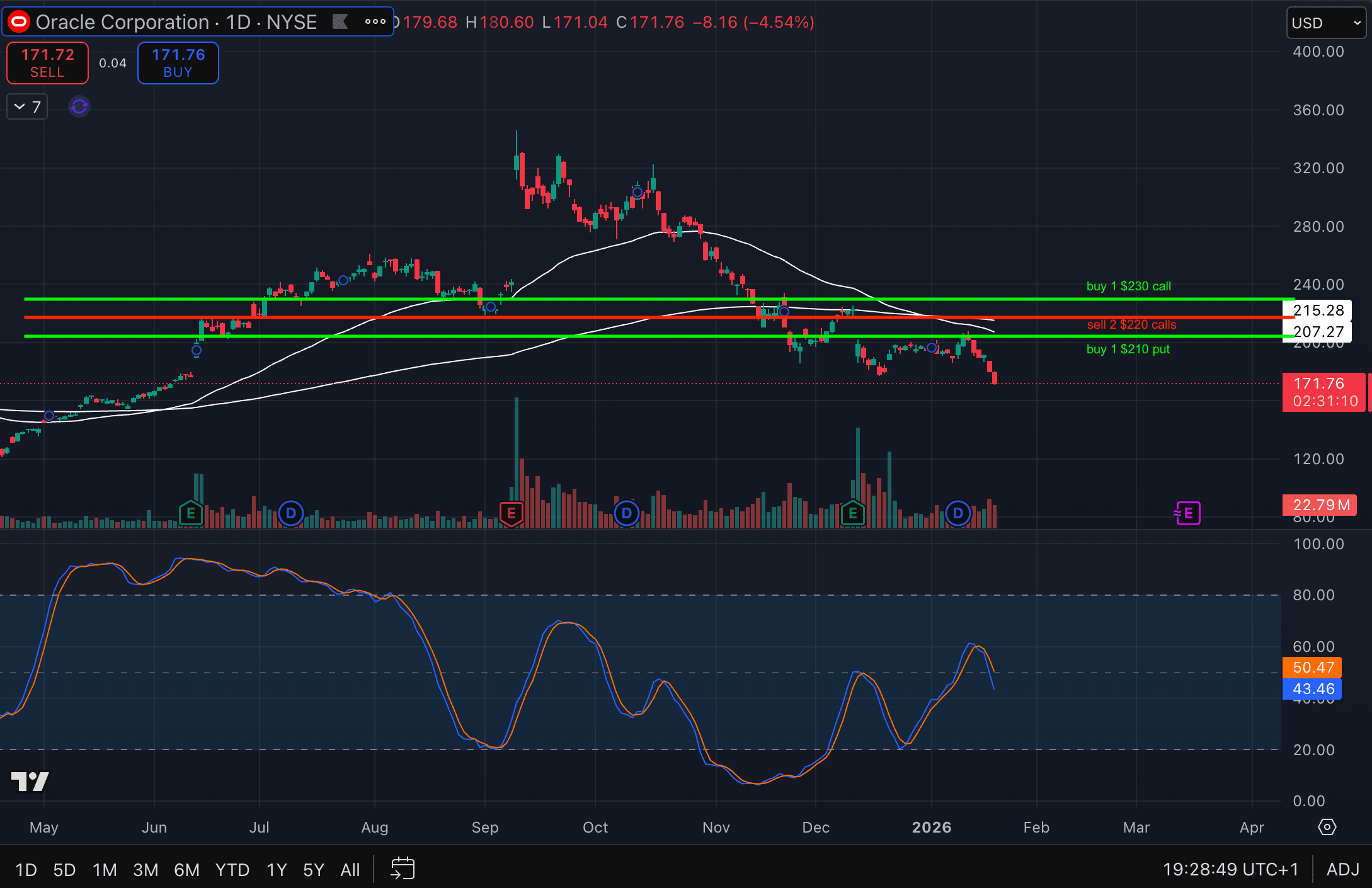

Trade Idea - Riskless Butterfly on ORCL

Today I opened a zero-loss butterfly on Oracle (ORCL). Structurally, this is a bullish butterfly with a defined outcome: it cannot lose money at expiration.

Try our option scanner FREE for 14 days with no obligation

FIND TRADES NOW