Category: Expected Value

![Put-spread[1]](/_next/image/?url=%2Fapi%2Fmedia%2Ffile%2FPut-spread1.png&w=3840&q=90)

What is Expected Value and 3 ways to use it

In the realm of trading strategies, Expected Value (EV) is a statistical measure that seeks to predict the potential profitability of a particular strategy, given certain market conditions. By...

Calculating Options Expected Value using Monte Carlo Analysis

Expected Value (EV) is a statistical measure designed to help understand the value of a variable over time under uncertain conditions. This article will describe how you can apply it to options...

Optimal Iron Condor Strategy and how to find it in Option Samurai

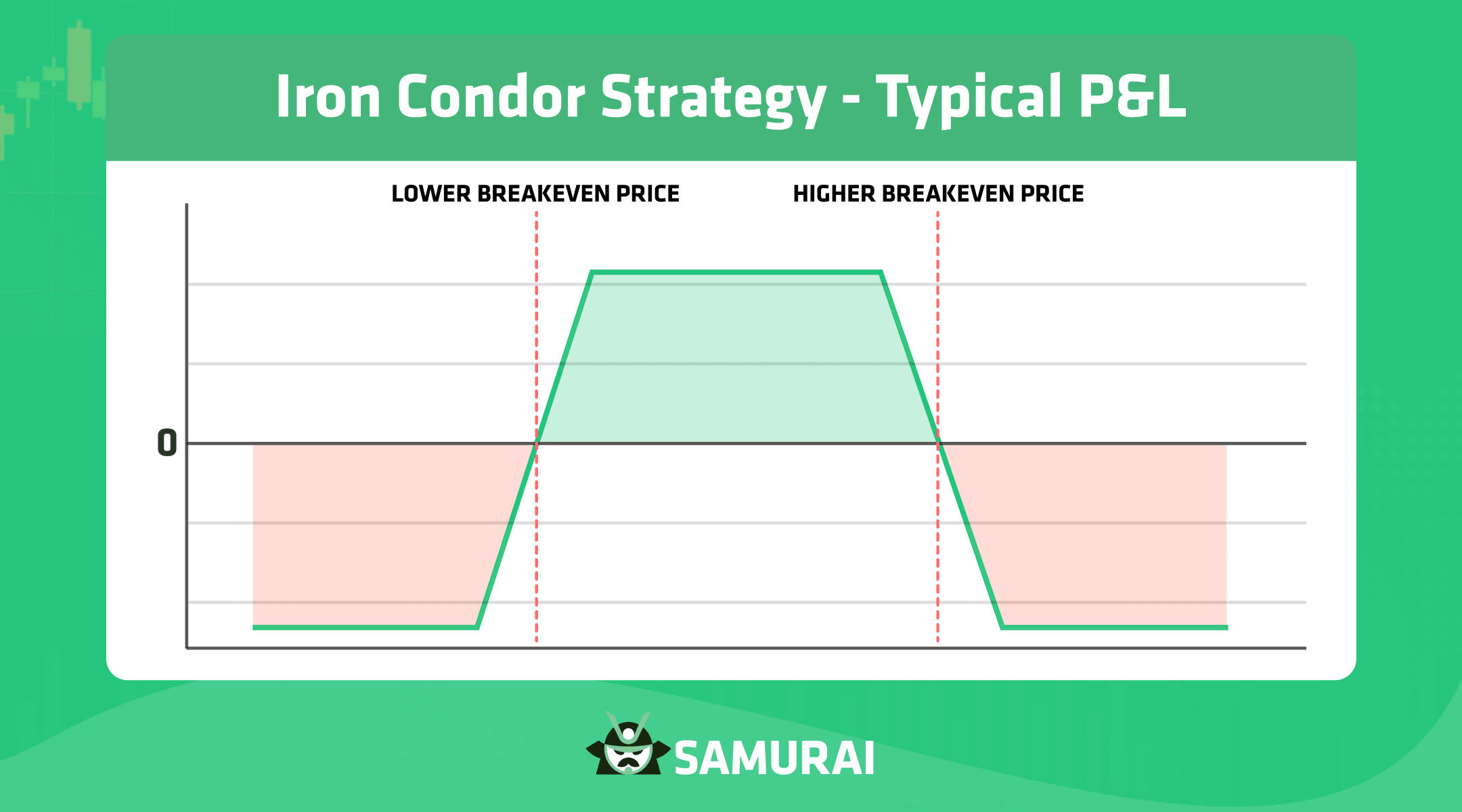

Today we will discuss one of the most popular strategies in options trading: iron condor. The Strategy became very popular due to the limited risk profile while maximizing the time value derived...

Creating an optimum vertical spread

Update: This article describes what vertical spreads are, considerations on how to build optimal spreads, data points to take into considerations, how to find your comfort zone, and more. Feel free...