Category: Tutorials

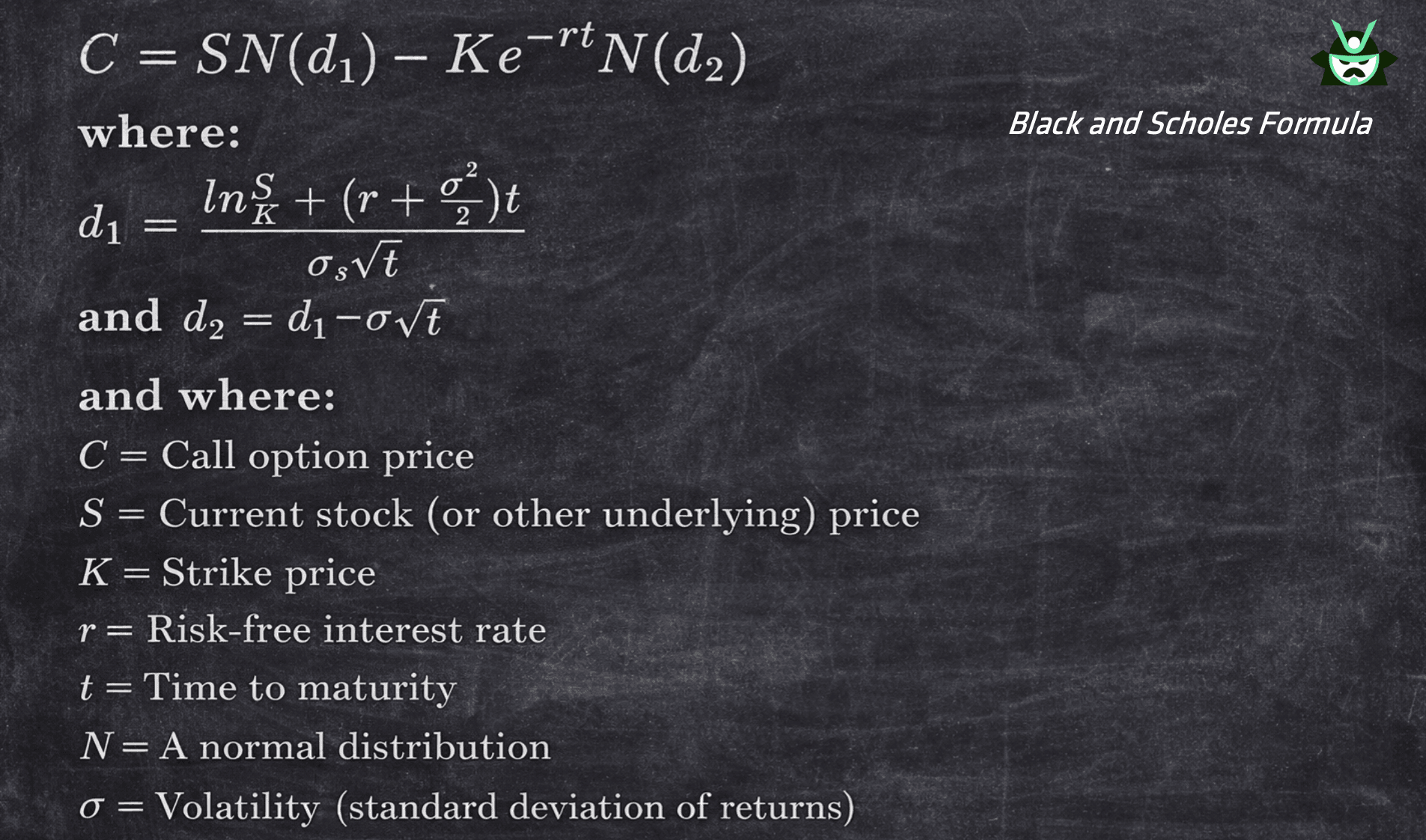

Black and Scholes Option Pricing Model - The Benchmark Behind Option Prices

A clear explanation of the Black and Scholes option pricing model, covering the formula, inputs, method, put pricing, and real-world limitations.

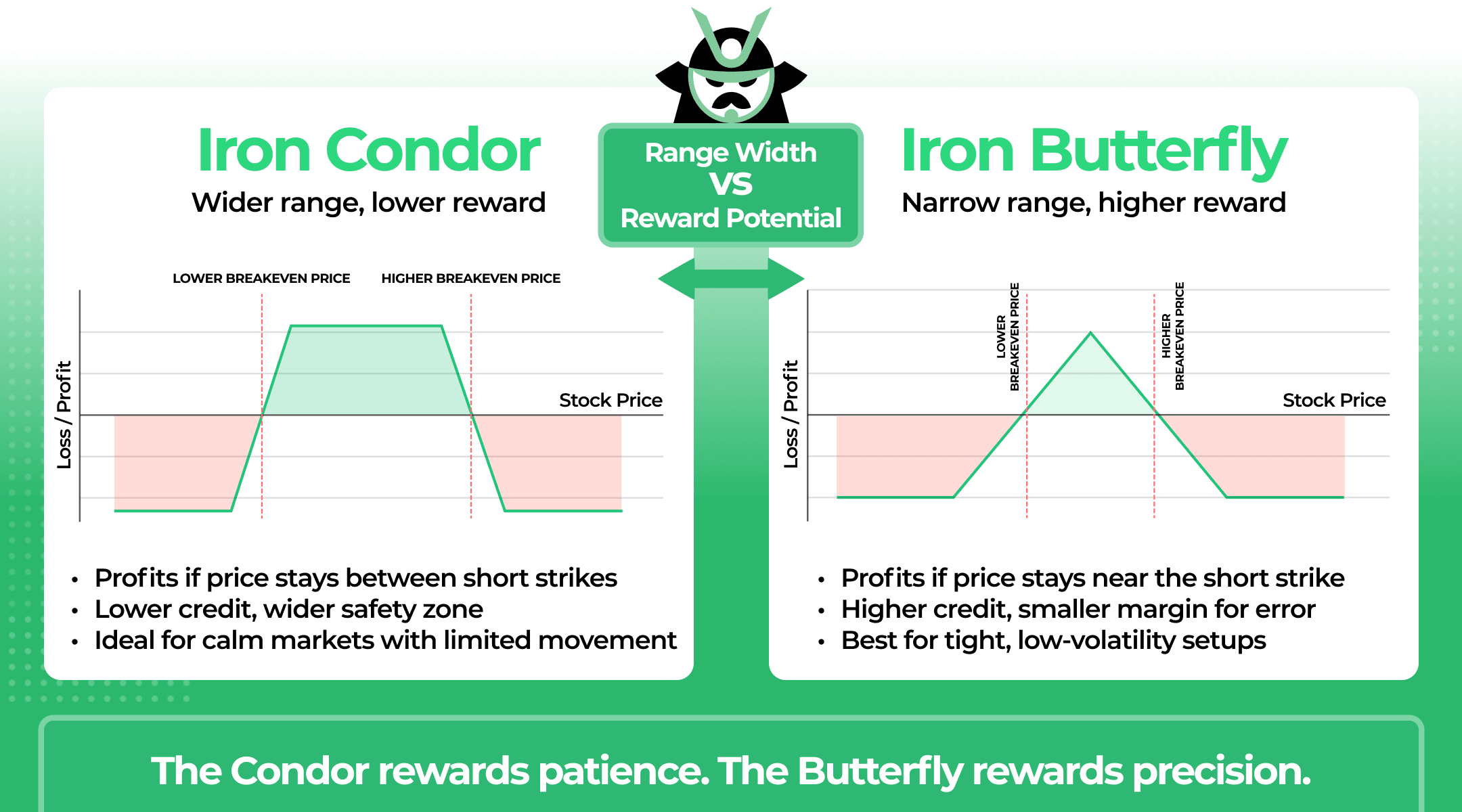

Iron Condor vs Iron Butterfly Strategies - Two Different Ways to Trade a Sideways Market

Understand the difference between the iron condor vs iron butterfly strategies. These setups are 2 popular ways to trade a sideways market.

Options Portfolio Management: How to Build and Balance Positions

Master options portfolio management with strategies, risk controls, and practical examples. Learn how to diversify, size positions, and more.

Debit Spread vs Credit Spread - How To Choose The Right Vertical For Your Market View

A clear guide to debit spread vs credit spread strategies, how they work, when to use them, and how volatility and pricing shape your choice between the two.

Risk Reversal in Options - How to Trade Direction With Minimal Upfront Cost

Understand risk reversal options, how they provide low cost directional exposure, and how to trade them in bullish or bearish markets.

No Loss Option Strategies - How True Zero Risk Trades Really Work

Learn how no loss option strategies actually work using put call parity, synthetic pricing, and true zero risk structures like collars, box spreads, and butterflies.

Low Cost Options Trading Explained - Strategies for Small Accounts

Low cost options trading explained with clear strategies for small accounts, from cheap option trades to spreads and the poor man’s covered call.

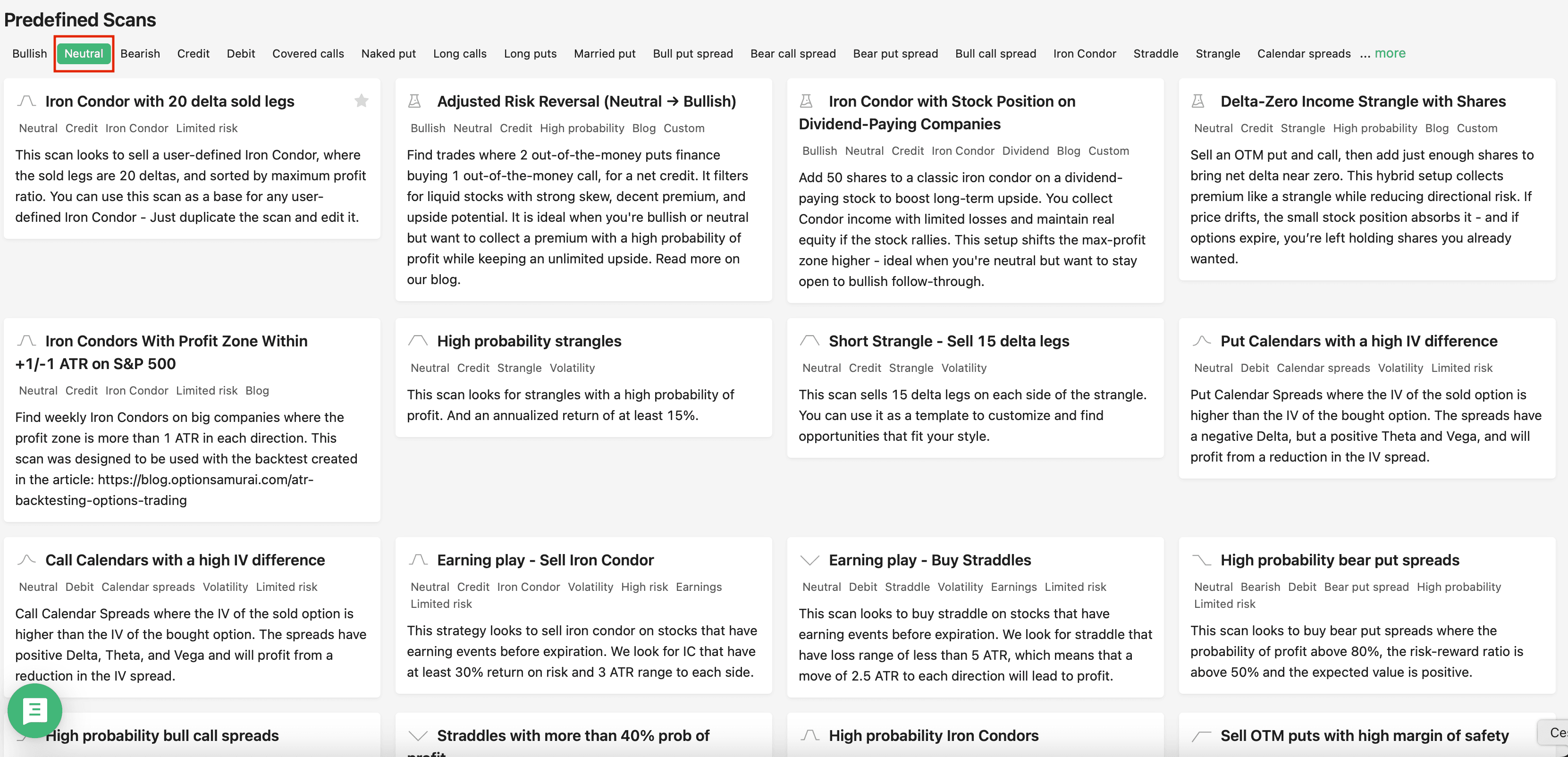

Options Strategy for a Sideways Market - How to Profit When Prices Don’t Move

Discover the best options strategies for a sideways market. Learn how to profit from low volatility phases.

Covered Calls on Dividend Stocks - Monthly Income from Quality Companies

How do you find the best dividend stocks for covered calls, and when should you sell for a covered call dividend?

High Probability Options Strategies with Low Risk and Strong Edge

Discover high probability options strategies like put selling, iron condors, and ratio spreads. Low risk, high edge trades with defined probabilities.