Category: Tutorials

Using the Stock Valuation Excel Template - Step-by-Step guide

With the addition of the Excel integration to the Samurai platform, we can now create advanced tools in Excel and increase our edge while trading. For example, we have shown in our Blog and Video...

Trading Options on Over-Extended Stocks - Webinar Recording 💻

During the Synergy Traders #39 event, we presented how you could profit from trading over-extended stocks with options. We showed example trades, backtests and showed how you could use Samurai to...

Stock Valuation Model (+Automatic excel import of stock data)

What is Stock Valuation?

Stock valuation is the process of estimating the intrinsic value of a stock.

The stock valuation model is a simple model that helps you determine a company's intrinsic...

How to Import Options Data to Excel and Google Sheets (Including Templates)

Most traders have spreadsheets they enter data in. This helps them analyze data and improve their workflow. However, importing data to the spreadsheet is a chore, and it wastes time. This problem...

Excel template: Good covered calls trades on Dividend Aristocrats

We've recently launched our new Excel and Google Sheet integration with Option Samurai. It allows you to import options data directly from our options scanner to Excel and Google Sheets. This...

Tip: Use Scans as Part of Your Investment Process

This article will be a short technical how-to article to help you create scans for your investing process. We use it personally to quickly access our scans in our daily routines, save time, and...

Lowering Cost Basis with Options (With a trade example)

In this post, I wish to talk about lowering the cost basis of a position. I will do that by showing a trade that didn't go so well but still showed a profit because I managed to lower my cost...

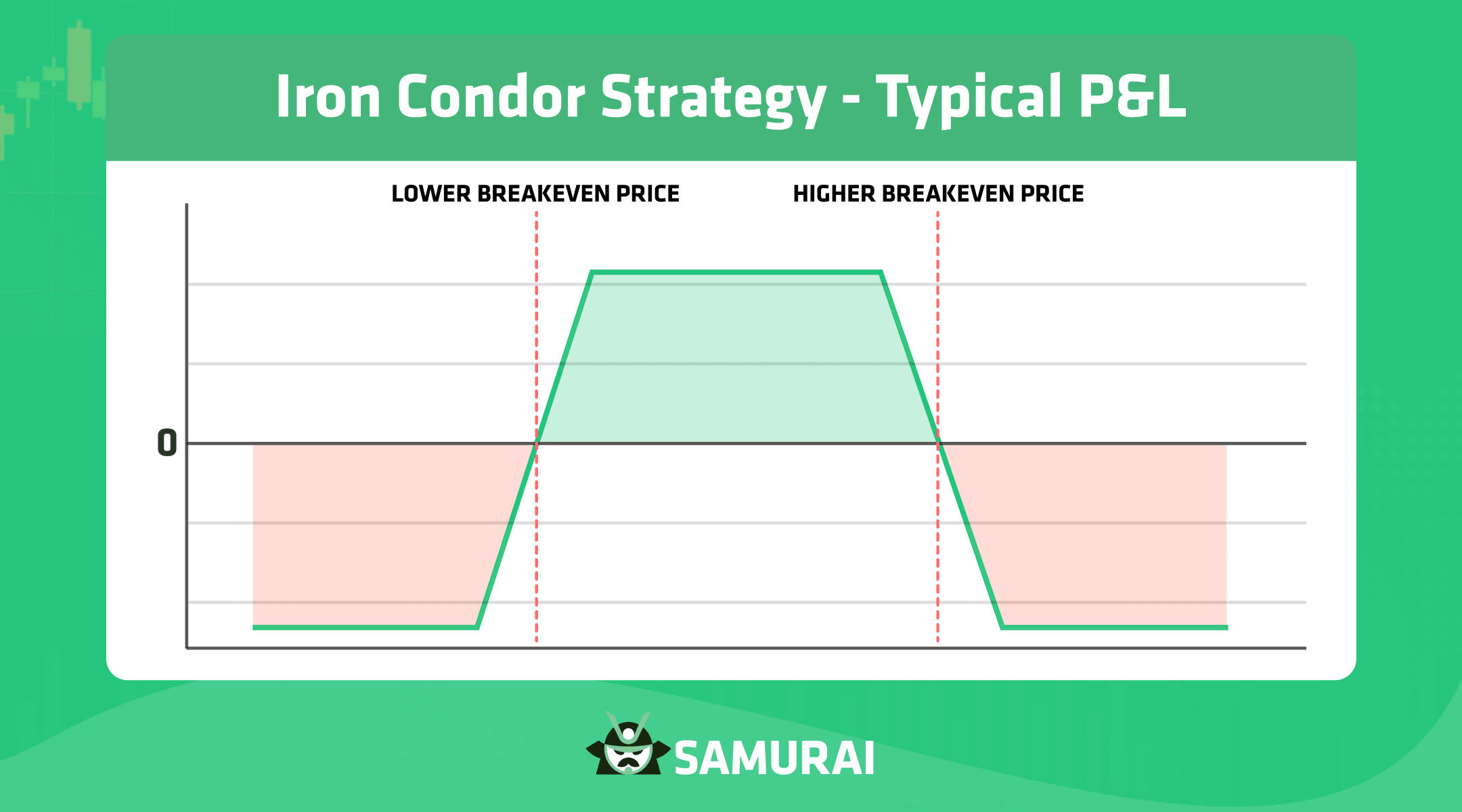

Optimal Iron Condor Strategy and how to find it in Option Samurai

Today we will discuss one of the most popular strategies in options trading: iron condor. The Strategy became very popular due to the limited risk profile while maximizing the time value derived...

![multisorting[1]](/_next/image/?url=%2Fapi%2Fmedia%2Ffile%2Fmultisorting1.gif&w=3840&q=90)

Multi-column sorting

[We have improved the usage of this feature based on your feedback. Here is the updated article: Here]

We've just launched the Multi-column sorting feature that allows you to sort results by two...

Creating an optimum vertical spread

Update: This article describes what vertical spreads are, considerations on how to build optimal spreads, data points to take into considerations, how to find your comfort zone, and more. Feel free...