Debit Spread vs Credit Spread - How To Choose The Right Vertical For Your Market View

Published on January 5, 2026Reviewed by Leav Graves

If you trade options long enough, you end up asking the same thing everyone else does: debit spread vs credit spread, which one should I use here? The credit vs debit spread choice changes how you profit, how fast you need the move, and whether a call debit spread vs put credit spread fits your idea. This guide keeps credit spread vs debit spread simple so you don’t overthink your next trade. It also helps you decide when a debit spread and credit spread makes more sense based on volatility and your confidence in the move.

KEY TAKEAWAYS

- The difference between debit spread and credit spread options strategies is simple: debit spreads require a net payment to open the trade, while credit spreads provide a net premium received.

- Knowing when to rely on a debit spread and credit spread structure can make your bullish or bearish ideas much easier to manage.

- While debit and credit versions can offer similar payoff shapes, when trading American options it is often safer to choose OTM spreads with credit strategies. This reduces the chance of early assignment, which can trigger unwanted margin requirements on small accounts.

What is a credit spread option strategy

The simple way traders explain debit spread vs credit spread is this: one costs you money to enter, the other pays you when you open it. A credit spread gives you a premium upfront, and you keep it if price stays on the “safe” side of your strikes.

Since you start with a credit, theta decay actually helps you. When using American options, traders generally choose to place these credit spreads OTM to reduce the chance of early assignment, especially on smaller accounts. Credit spreads include the bear call spread and the bull put spread, both popular when implied volatility is high and you want income with defined risk.

Many traders compare credit vs debit spread choices by looking at how much premium they collect and how far the breakeven sits from price. This is often where the real choice between a debit spread and credit spread appears, because each reacts very differently to movement and time decay.

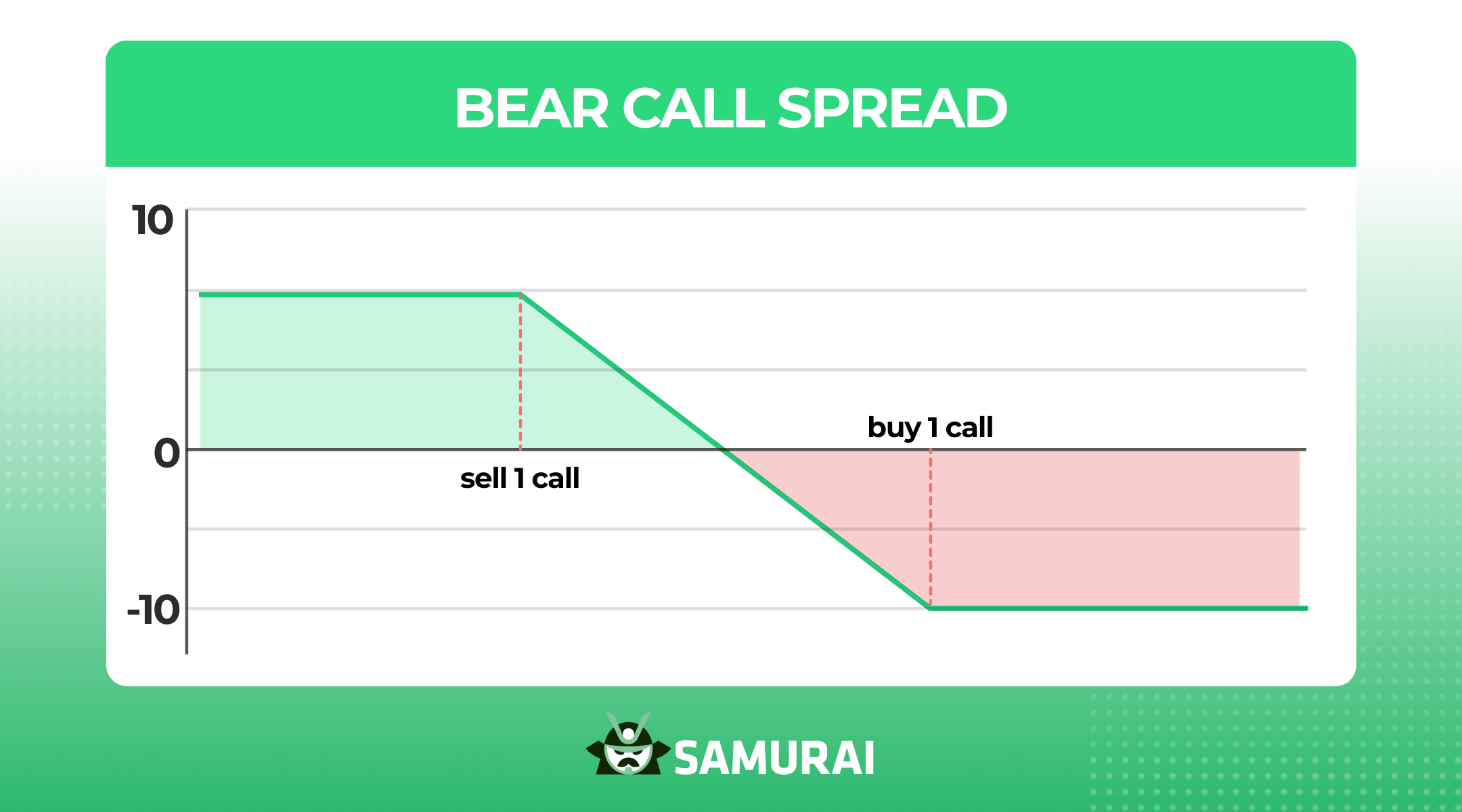

Bear Call Spread

A bear call spread is built by selling a lower strike call and buying a higher strike call. The bear call spread gives you this P&L graph:

You want the stock to stay below your short strike, so it has a clear bearish bias. With American-style calls, keeping the spread OTM also helps avoid early assignment on the short leg.

The risk stays capped because the long call protects you if price jumps. This setup works well when IV is elevated and call options are expensive. Time decay helps, because every day that passes without a big rally gives you a better chance of keeping the credit.

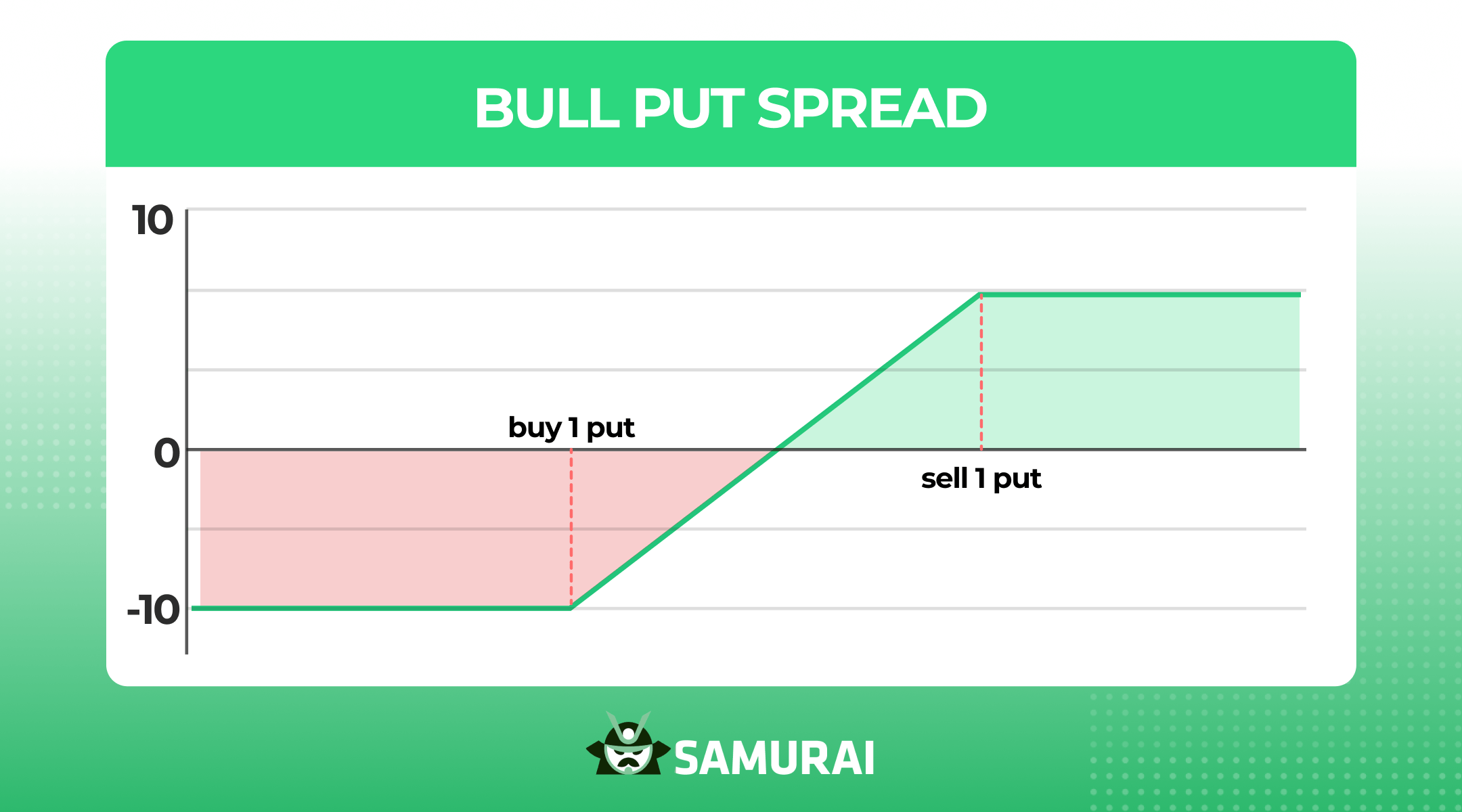

Bull Put Spread

A bull put spread means you sell a higher strike put and buy a lower strike put. With the bull put spread, you will have this P&L chart:

Once again, let us repeat: to limit assignment risk on the short put, traders often keep bull put spreads OTM, especially when trading near expiration.

You collect a credit at entry, and you want the price to stay above your short put. The bias is bullish, but you don’t need a big rally, just stability. Traders often use it to generate income while keeping downside risk defined. It fits well in high IV environments when put premiums are rich and you want a wider breakeven than you would get with a debit strategy like call debit spread vs put credit spread comparisons often show. A word of advice: we typically run both a debit spread and credit spread version of the same bullish idea to see which one gives the cleaner risk profile.

What is a debit spread option strategy

Debit spreads work the opposite way of credit spreads: you pay upfront to open them, and you want the price to move in your direction. A long call spread aims for a controlled bullish move, while a long put spread targets a controlled bearish move.

In the debit spread vs credit spread comparison, debit spreads carry a fixed max loss, a tighter breakeven, and usually work better when implied volatility is low. Many traders look at credit vs debit spread differences through three quick checks: how much they pay, how far price needs to move, and how sensitive the trade is to volatility.

A simple way to think about debit spreads:

- You pay a debit

- You want movement

- Low IV helps because options are cheaper

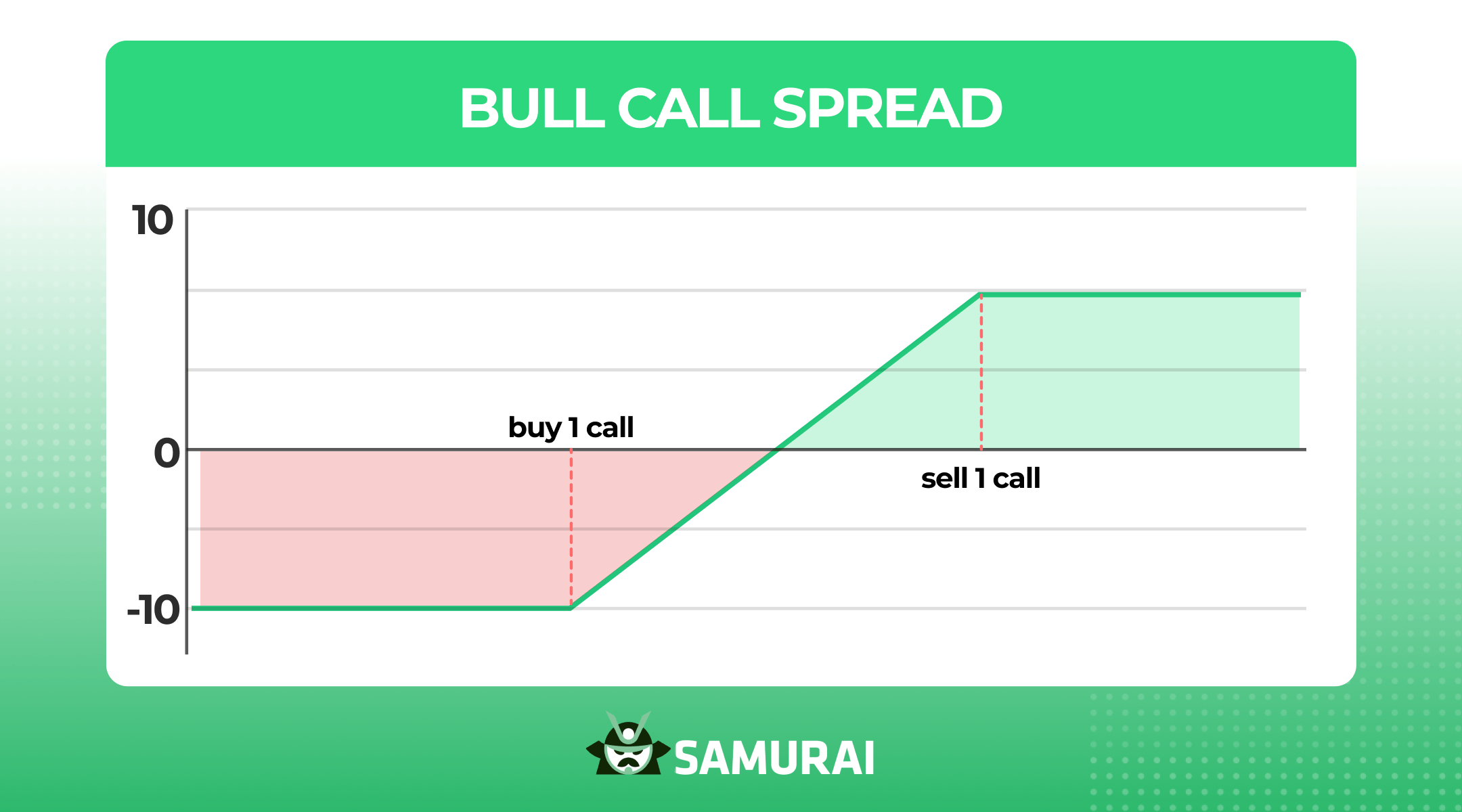

Bull Call Spread

A bull call spread is built by buying a lower strike call and selling a higher strike call. This is the typical P&L shape of a bull call spread (and you’d see the same image on our screener for options trades):

You need the stock to move higher, but you do not need a huge rally. Your max loss is the debit you paid, which makes it easier to stay disciplined when price chops around. This structure appeals to traders who want directional exposure without paying full price for a naked call. Lower implied volatility often makes this spread more attractive since call premiums shrink.

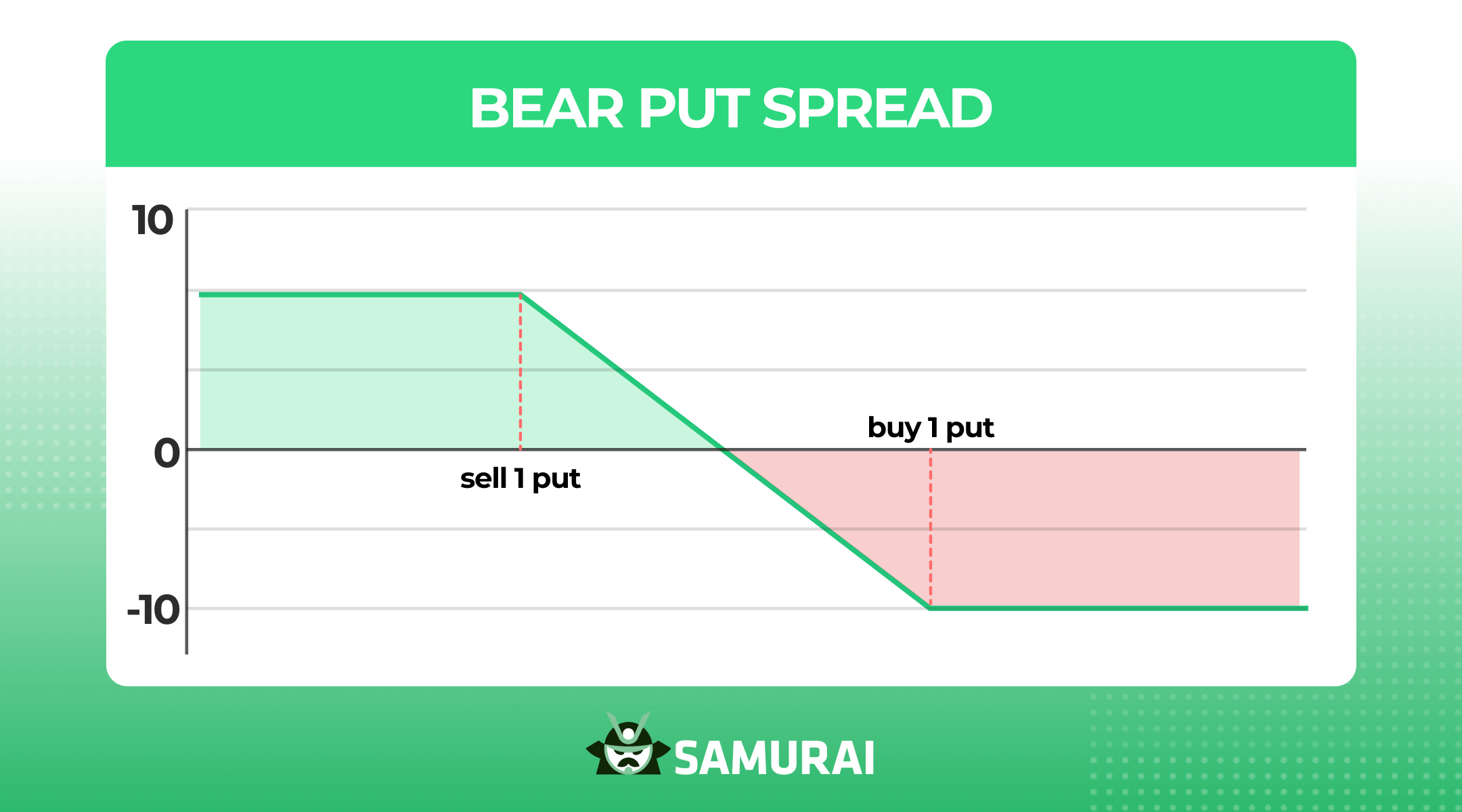

Bear Put Spread

A bear put spread means you buy a higher strike put and sell a lower strike put. The strategy comes with the following P&L chart:

It gives you bearish exposure with a defined max loss and a lower cost than buying a single put. This spread fits well in low IV environments, where puts are cheaper and the breakeven is closer. Many traders compare call debit spread vs put credit spread choices here, since both can express a view, but the debit version benefits more from clean directional movement and less from time decay.

Debit spread vs credit spread: practical comparison

Debit spread vs credit spread choices usually come down to pricing and probability. Credit spreads pay you upfront, have a wider breakeven, and often carry a higher probability of profit. Debit spreads cost money, need movement, and offer a better reward if the move actually happens. When traders compare credit vs debit spread setups, they usually check volatility and distance to strikes first.

Topic | Credit Spread | Debit Spread |

Premium | You receive | You pay |

Breakeven | Farther away | Closer |

Best IV | High | Low |

Movement needed | Small | Moderate |

In quiet markets, call debit spread vs put credit spread choices lean debit because options are cheaper. In volatile markets, credit spread vs debit spread decisions often favor credit for its wider cushion and income profile. When choosing between a debit spread and credit spread, remember that OTM credit spreads reduce assignment risk, which matters if you are trading American options with limited margin.

Seeing how each reacts to volatility swings makes it easier to match the right debit spread and credit spread to the market you are facing.

Call debit spread vs put credit spread: choosing based on market conditions

A call debit spread vs put credit spread comparison helps you choose how aggressively you want to express a bullish view. The debit version costs money but offers a better payoff if price actually pushes higher. The credit version pays you upfront, gives you a wider breakeven, and relies more on time decay. In the debit spread vs credit spread decision, volatility matters a lot: low IV tends to favor debit spreads because options are cheaper, while high IV often pushes traders toward credit spreads for the richer premium. If you want a more asymmetric way to express conviction without committing fully to a debit or credit spread, exploring risk reversal options can be useful, since they combine option buying and selling to tilt probability and payoff in one direction.

Going back to vertical spreads, here is a quick way to decide:

- Want movement and better profit potential? Go debit.

- Want a cushion and higher probability of profit? Go credit.

Most credit vs debit spread choices come down to your confidence in direction and how fast you expect the move to happen.

Examples: credit spread vs debit spread in action

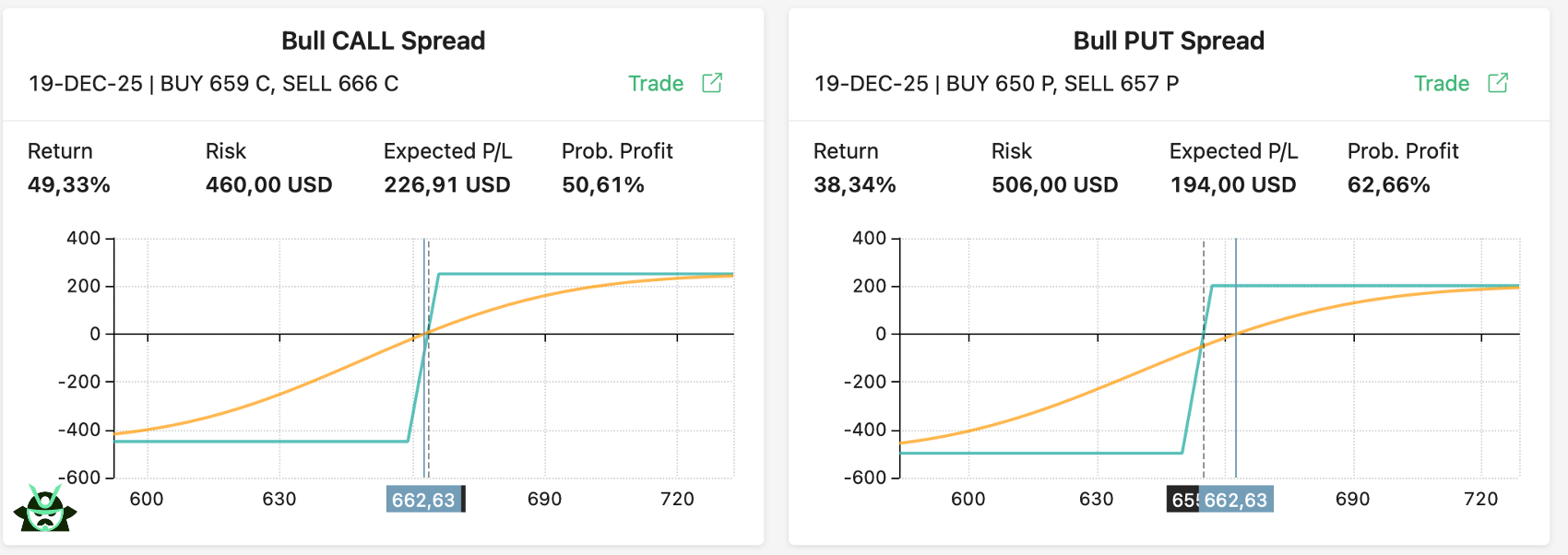

To make the debit spread vs credit spread difference concrete, it helps to look at two spreads on the same underlying. SPY is trading around 662.63, and we can build one bullish debit spread and one bullish credit spread to see how the numbers shift, like this:

The first example is a bull call spread (on the left). You buy the 659 call and sell the 666 call, paying a 460 USD debit. This is the classic debit setup: you need SPY to move higher, not just sit still. The trade offers a stronger potential return of 49.33 percent, but the probability of profit is only 50.61 percent because the payoff depends on direction. If SPY drifts sideways, you lose the debit you paid.

Now compare that with the bull put spread (on the right). Here you buy the 650 put and sell the 657 put, taking in a credit above 200 USD and accepting 506 USD of defined risk. Even though the max return is lower at 38.34 percent, the probability of profit jumps to 62,66 percent.

Keeping this spread OTM also minimizes the risk that the short put gets assigned early, which can surprise traders running small accounts. You simply need SPY to stay above your short put, not rally aggressively. Time decay works for you, not against you.

This call debit spread vs put credit spread contrast shows the heart of credit spread vs debit spread logic: movement versus cushion, higher reward versus higher probability. Both trades show how choosing between a debit spread and credit spread changes the entire payoff shape even when the outlook is the same.

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.

REVIEWER

Leav GravesCEO

Leav GravesCEOLeav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis.