Table of Contents

- Key Takeaways

- What is short term options trading

- Why traders use short dated options

- Risks of short term options

- Popular short term options strategies

- Technical analysis in short term options trading

- Managing risk in short term options

- Short term options vs long term options

- Tips for beginners in short term options

Reviewed by Leav Graves

Table of Contents

- Key Takeaways

- What is short term options trading

- Why traders use short dated options

- Risks of short term options

- Popular short term options strategies

- Technical analysis in short term options trading

- Managing risk in short term options

- Short term options vs long term options

- Tips for beginners in short term options

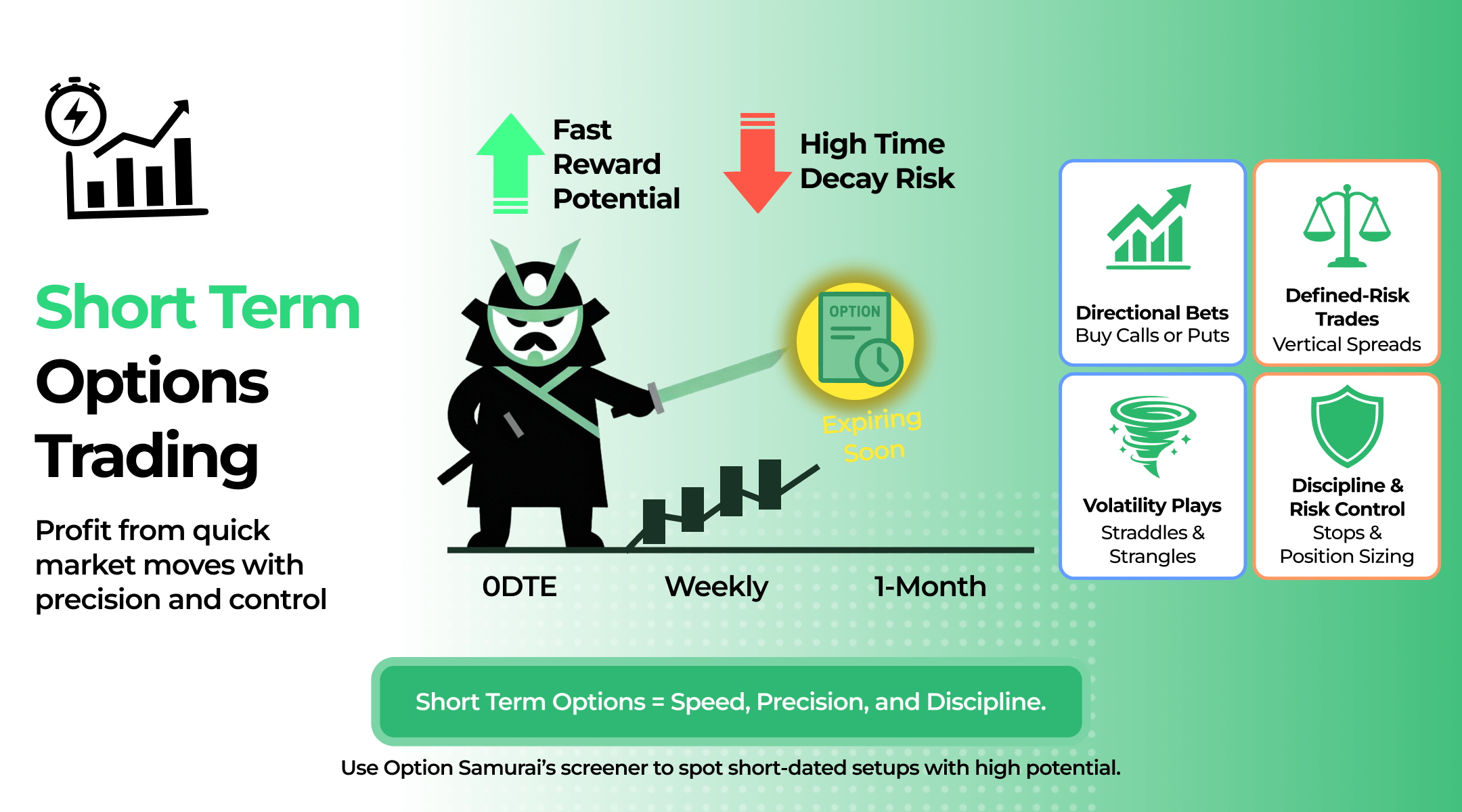

Short term options trading focuses on taking advantage of quick market moves using contracts that expire in days or weeks. Many traders use short dated options to react to earnings, news, or strong price swings. This article explains how short term options strategies work, why timing matters, and how traders manage risk.

KEY TAKEAWAYS

- Short term options trading is a way to profit from quick market moves, using contracts that expire in days or weeks

- Traders use short dated options to target earnings announcements, news events, or fast price swings

- Short term options strategies require discipline, technical analysis, and strict risk management

What is short term options trading

Short term options trading focuses on quick market reactions using contracts that last from a few hours to a few weeks. Unlike longer-term positions that depend on company fundamentals or macro trends, traders here care only about short-lived price moves and volatility bursts. Most short term options are short dated options such as 0DTE (zero days to expiration), weekly, or monthly contracts with very little time value left. Because of that, price changes happen fast, and timing is everything. The goal is not to “invest” but to trade momentum, news, or technical setups before the option expires.

Common timeframes include:

- 0DTE options that expire the same day

- Weekly options expiring within 5-7 days

- Short term options up to one month

Short term options strategies focus on precision and speed, not patience. Small mistakes can cost profits quickly, but good timing can generate outsized gains in a short window.

Why traders use short dated options

Traders use short dated options because they offer strong leverage with a small upfront cost. A small move in the stock price can translate into a large percentage return, making short term options trading attractive for those who want quick exposure without committing much capital. These contracts are often used to target events that can cause sharp price swings, like earnings reports, Fed rate announcements, or company news.

Short term options are also appealing because they let traders express short-term views without holding long positions for weeks or months. Both retail and institutional traders use them to fine-tune exposure or hedge existing positions.

Typical reasons traders choose short term options strategies include:

- High potential reward compared to the premium paid

- Flexibility to trade specific events or short market trends

- Limited capital at risk when managed properly

- Opportunity to scale in and out quickly based on momentum

Risks of short term options

Short term options trading carries higher risks than it seems at first glance. The main issue is time decay: with short dated options, the contract loses value quickly as expiration approaches. Even if the stock moves slightly in your favor, theta can erase most of the profit if timing is off.

Another challenge is the narrow margin for error. Prices must move fast and far enough to overcome both the premium paid and time decay. Traders often feel pressure to act quickly, which can lead to emotional trades or overtrading.

Here’s a quick summary of common risks:

Risk Type | Description |

Time Decay (Theta) | Option value drops fast as expiration nears. This is a risk if your are an option buyer (and an opportunity, if you are an options seller) |

Volatility Collapse | Implied volatility can fall right after an event, cutting prices (again, this is bad if you bought options, but good if you sold them) |

Limited Reaction Time | Fast moves leave little room to adjust |

Emotional Stress | Pressure to act can lead to poor decisions |

Using an advanced screener for options trades can help you handle the risks mentioned above. But remember: no trade is without risk.

Popular short term options strategies

Some of the most used short term options strategies aim to profit from fast price moves or short bursts in volatility. The simplest method is buying calls or puts to take a clear directional bet. If you expect a stock to move up quickly, a call offers leveraged upside; if you expect a drop, a put gives downside exposure.

For traders who want to reduce risk and cost, vertical spreads are a common approach. A bull call spread or bear put spread limits both loss and gain but requires less capital than buying single options outright.

Volatility-based plays like straddles and strangles work well when large moves are expected, such as before earnings. These involve buying both a call and a put to profit from movement in either direction.

In high implied volatility environments, selling short dated options can be profitable, but it demands discipline and strong risk control.

Common short term options trading setups include:

- Directional: buying calls or puts

- Defined-risk: vertical spreads

- Volatility: straddles or strangles

- Income-based: short premium trades in high IV conditions

Short term options trading works best when strategies are chosen based on volatility levels, timing, and clear exit plans.

Technical analysis in short term options trading

Technical analysis is the backbone of most short term options trading setups. Traders rely on indicators like moving averages, RSI, and MACD to identify entry and exit points. A rising 20-day moving average or a bullish MACD crossover can confirm momentum, while an RSI above 70 often signals overbought conditions.

Price action matters even more for short dated options, since trades develop fast. Watching support and resistance levels helps identify where momentum might stall or break. Many traders focus on intraday and daily charts to align timing with the short life of their contracts.

Tool | Purpose | Typical Use |

Moving Averages | Identify trend direction | Confirm trend before entry |

RSI | Measure momentum | Spot overbought/oversold zones |

MACD | Detect shifts in momentum | Time entries or exits |

Support/Resistance | Gauge key price zones | Plan stop losses and targets |

In short term options strategies, combining indicators with volume and price confirmation helps improve timing and reduce false signals.

Managing risk in short term options

Managing risk is what keeps short term options trading sustainable. This is where disciplined options portfolio management becomes essential, since frequent short-dated trades can quickly skew overall exposure if position sizing and aggregate risk are not tracked carefully.

Because short dated options move fast, a clear plan is needed before entering any position. The first step is position sizing: never risk more than a small percentage of your account on one trade, no matter how confident you feel. Stop losses and profit targets should be placed as soon as the trade is opened, not after the market moves.

It’s also smart to avoid holding options overnight unless that’s part of your short term options strategies. Sudden news or after-hours moves can quickly change prices and wipe out gains.

Practical rules for better risk control:

- Limit trade risk to 1-3% of total capital

- Set both a stop loss and a profit target before entry

- Avoid trading around high-impact news unless planned

- Review each trade to track mistakes and improve timing

Small, consistent discipline keeps traders active long term.

Short term options vs long term options

Short term options trading and long term options serve different goals. Short dated options are cheaper and react quickly to price changes, but they also decay faster and leave little time to recover from mistakes. Longer term contracts cost more upfront but hold value longer and give traders more flexibility to adjust or roll positions.

In simple terms, short term options fit traders who enjoy fast decisions and can monitor the market closely, while longer term options work better for those who prefer slower setups with higher probability of profit.

Type | Pros | Cons | Best For |

Short Term Options | Low cost, fast return potential | High time decay, quick losses | Active traders |

Long Term Options | More time, smoother moves | Higher cost, slower returns | Patient investors |

While short term options strategies can be exciting, we’re generally fans of longer term trading for its flexibility and lower stress.

Tips for beginners in short term options

One final word on short term options trading: try to start small when learning how to do it. Focus on defined-risk trades like debit spreads to control losses and avoid emotional decisions. Keep a trading journal to track what works and what doesn’t. Also, use liquid tickers with tight spreads such as SPY, QQQ, AAPL, and TSLA for better fills and consistency.

AUTHOR

Gianluca LonginottiFinance Writer - Traders Education

Gianluca LonginottiFinance Writer - Traders EducationGianluca Longinotti is an experienced trader, advisor, and financial analyst with over a decade of professional experience in the banking sector, trading, and investment services.

REVIEWER

Leav GravesCEO

Leav GravesCEOLeav Graves is the founder and CEO of Option Samurai and a licensed investment professional with over 19 years of trading experience, including working professionally through the 2008 financial crisis.