Option Samurai Blog

Learn. Trade. Profit.

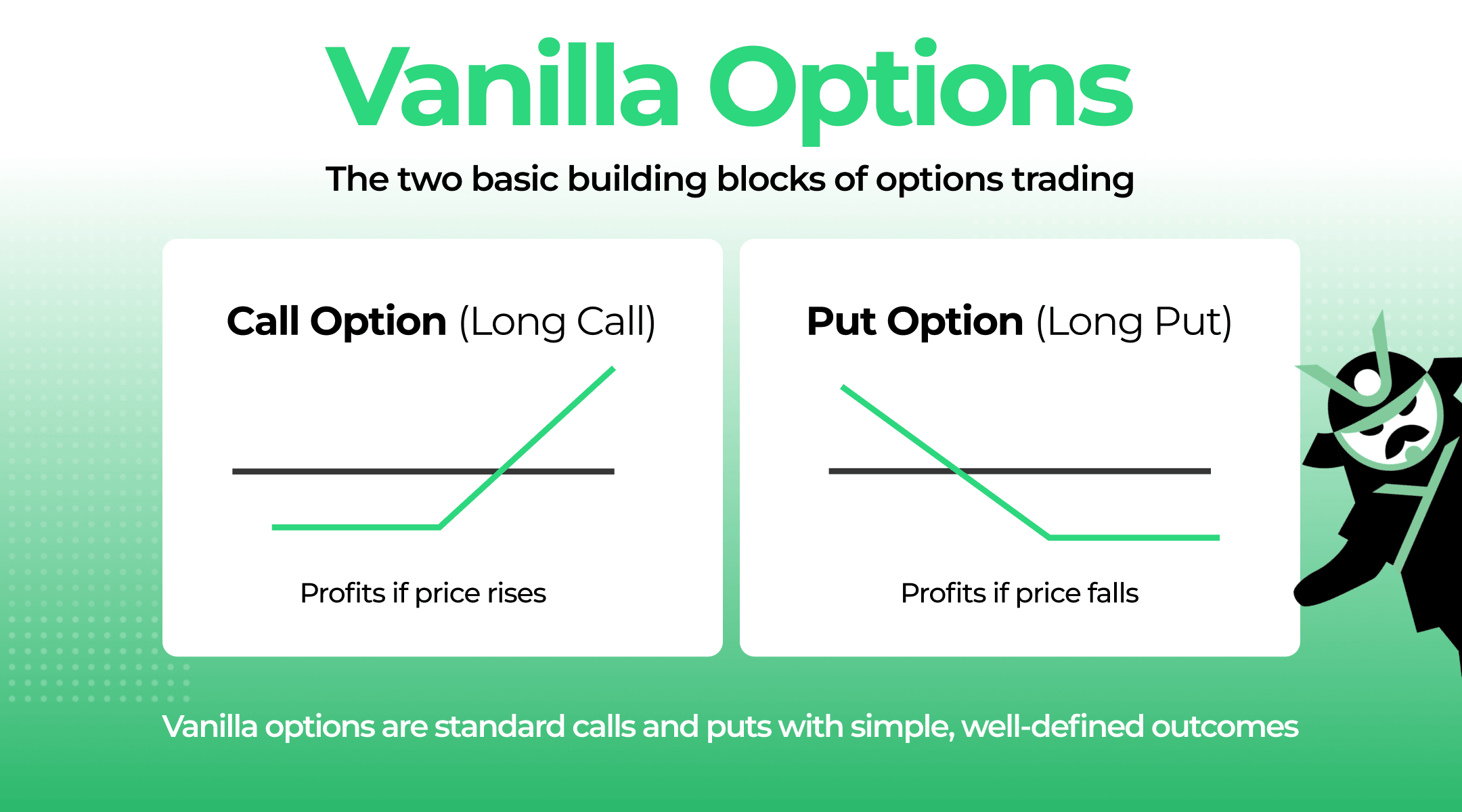

Vanilla Options - The Foundation of Options Trading Strategies

A clear guide to vanilla options, the standard call and put options traded in markets, and how they differ from exotic options.

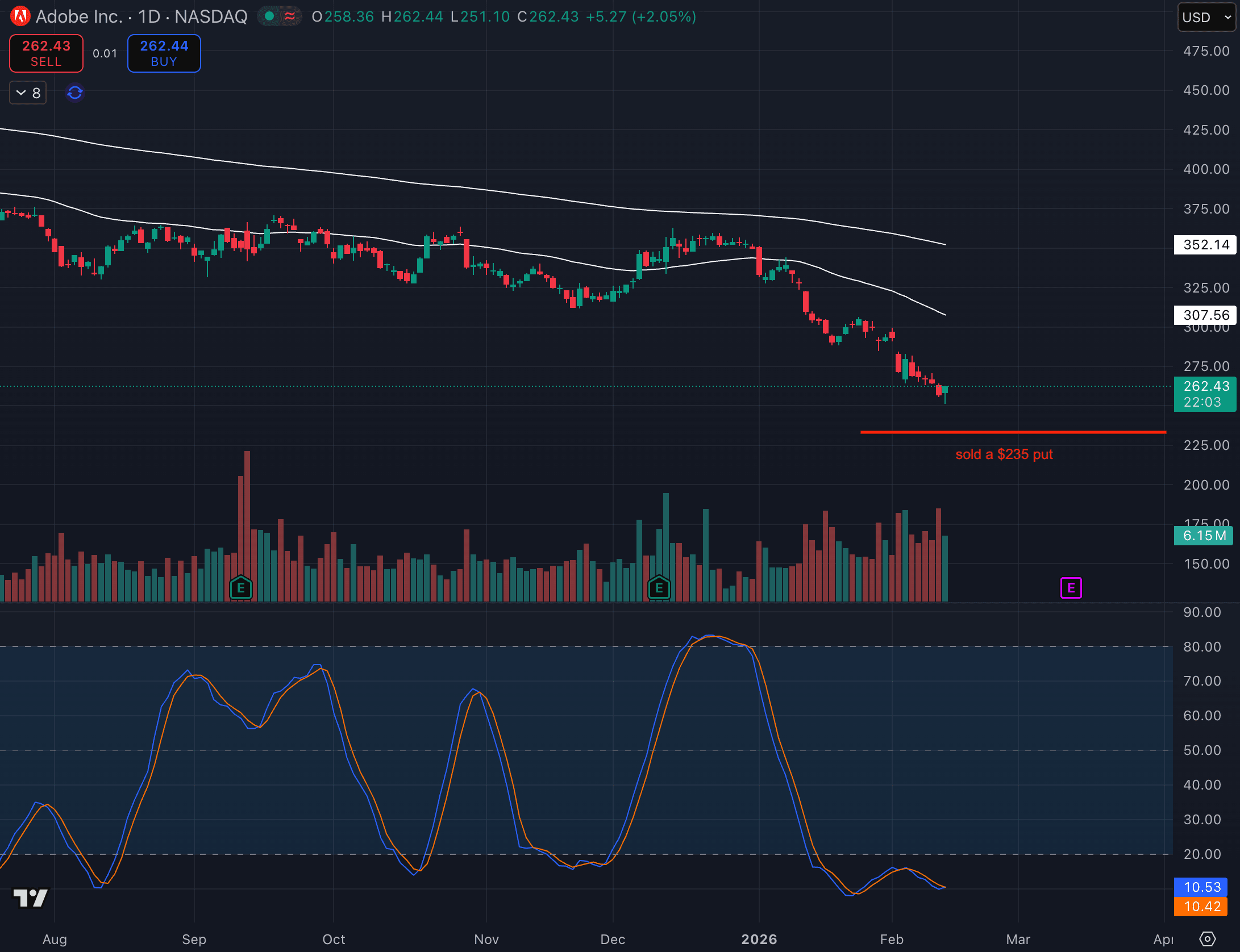

Trade Idea - Naked Put on ADBE

I opened a short put position on ADBE today. The stock is widly oversold so I'm ok with either getting assigned shares (and do a wheel with a covered call) or rolling this.

In the Money vs Out of the Money: What’s the Difference?

Confused by strike prices? We break down in the money vs out of the money options using simple logic and real-world examples.

Trade Idea - Long Call on AAPL

Today I bought a call on AAPL. IV was low, and price action was looking good.

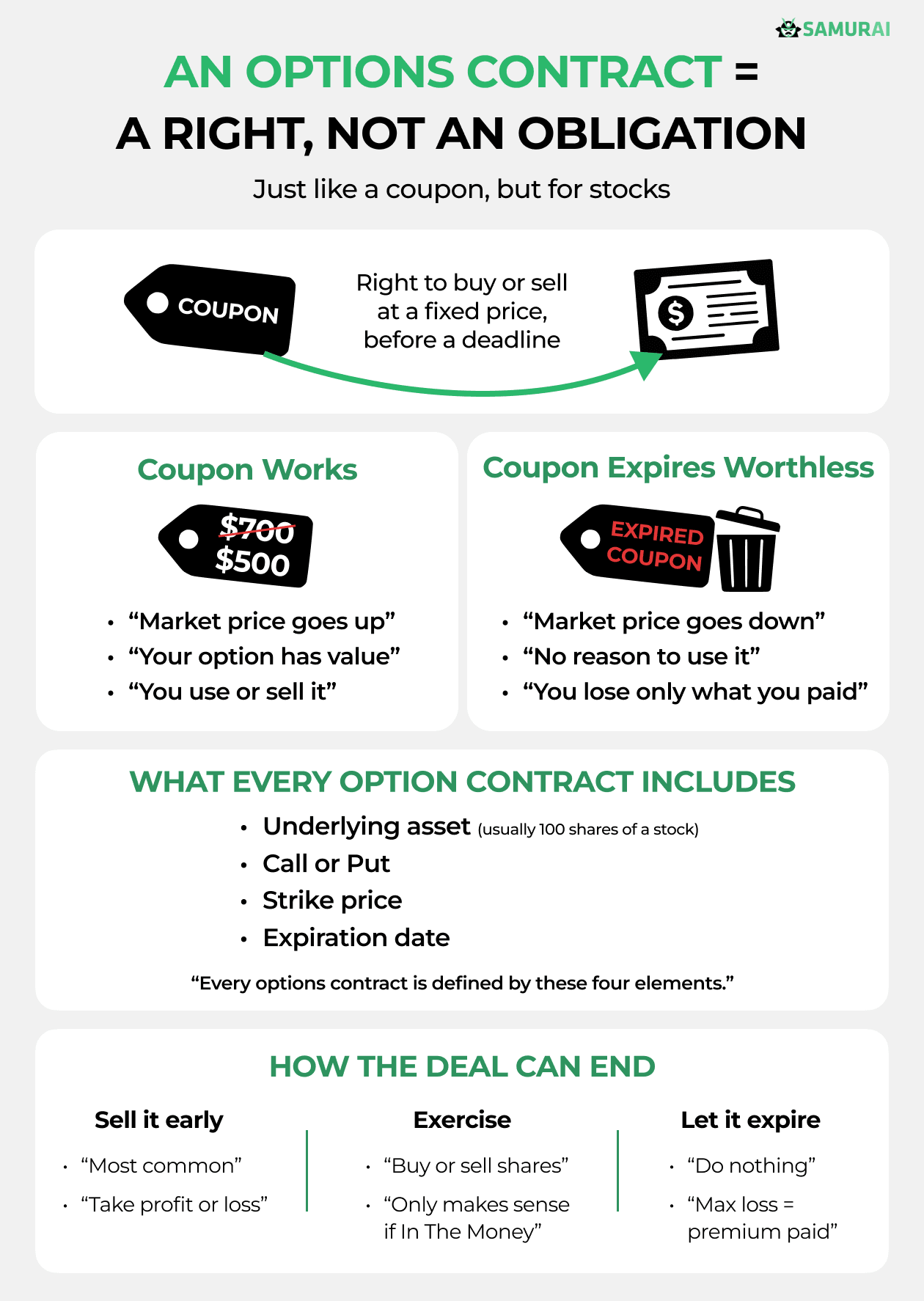

Options Contract - Understanding What an Option Is

We break down the definition, provide a clear option contract example, and explain how these agreements work.

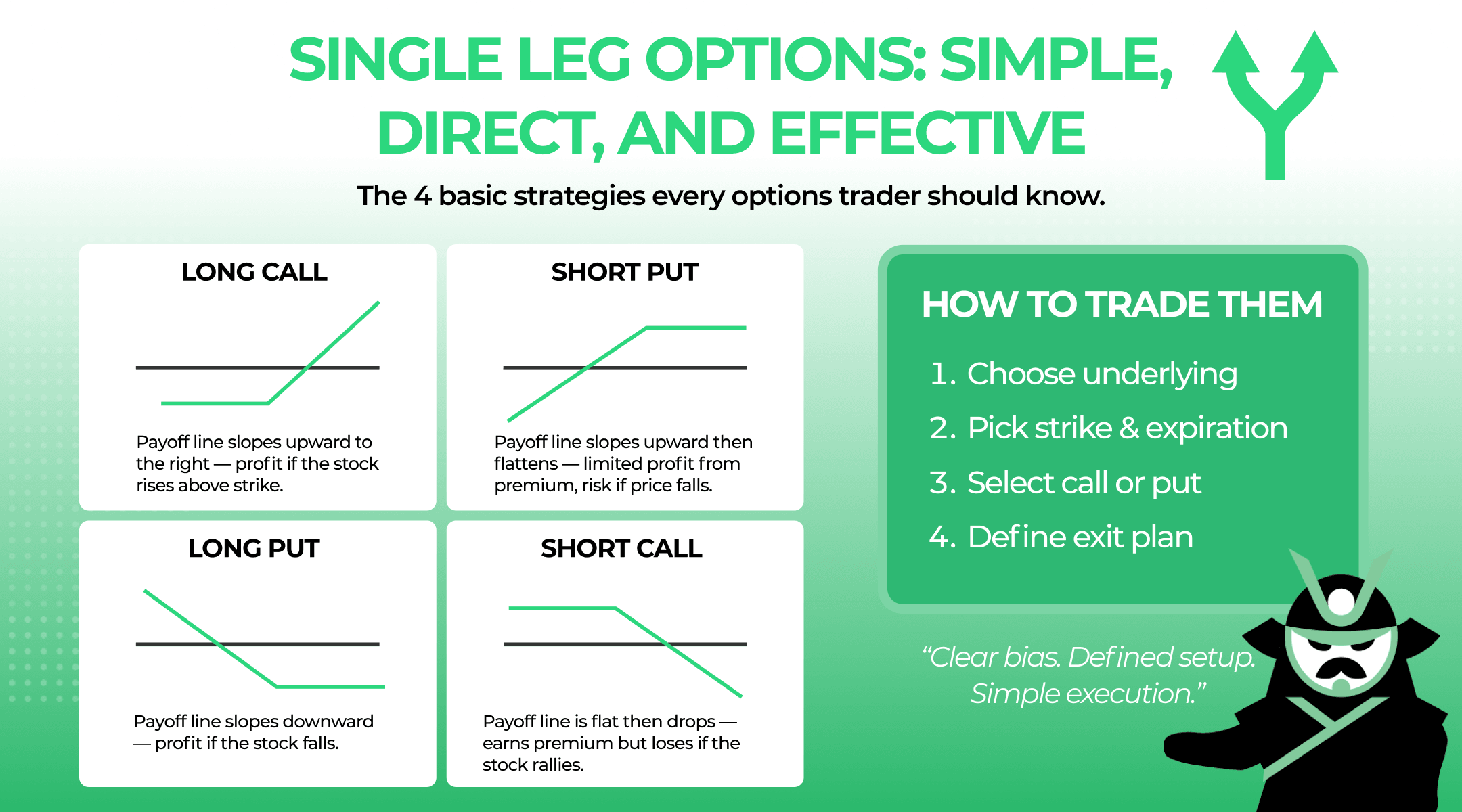

Single Leg Options Trading - The 4 Core Options Strategies to Know

The basics of single leg options explained: learn what they are, how they work, the four core strategies, and when to trade them.

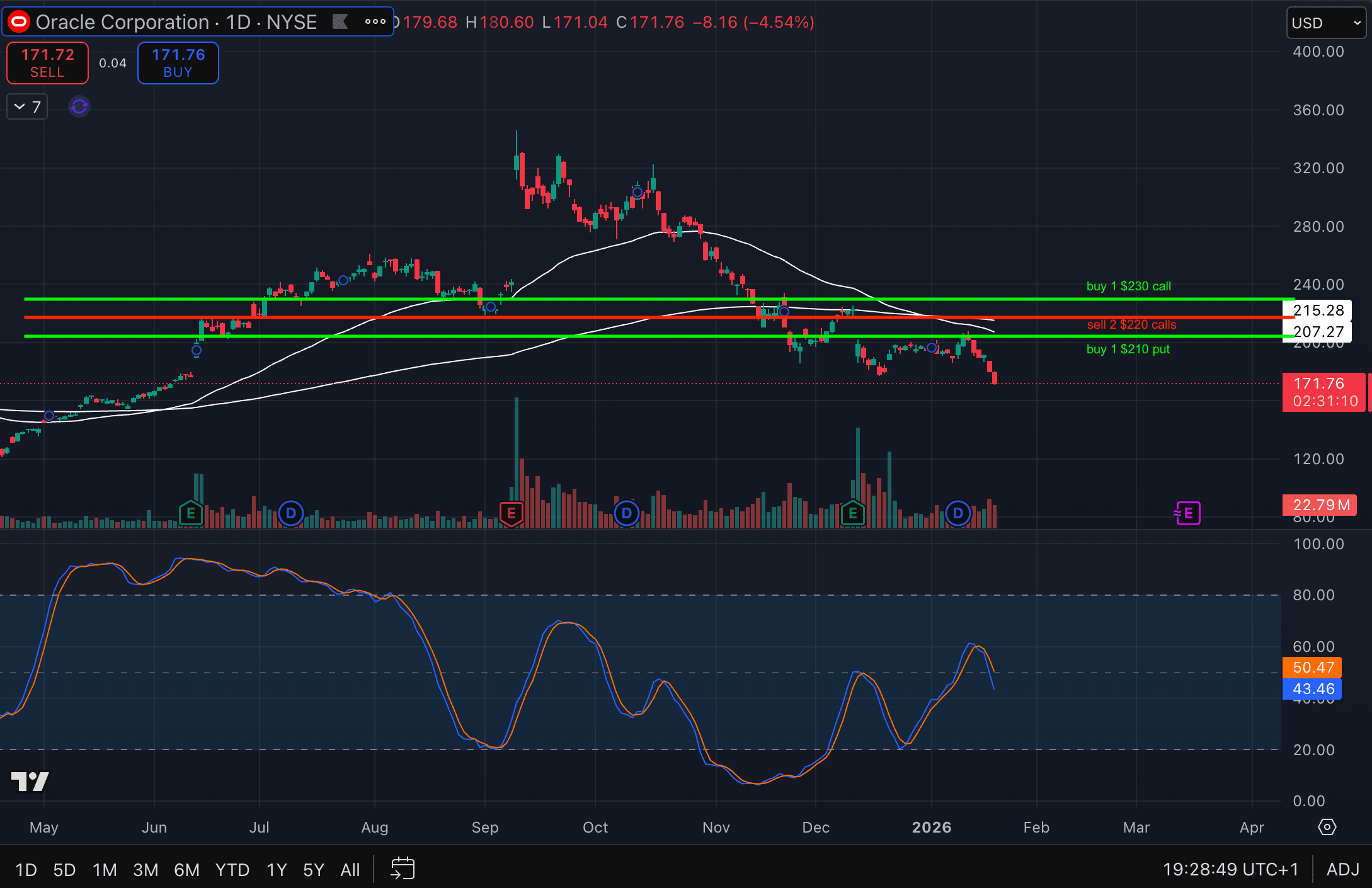

Trade Idea - Riskless Butterfly on ORCL

Today I opened a zero-loss butterfly on Oracle (ORCL). Structurally, this is a bullish butterfly with a defined outcome: it cannot lose money at expiration.

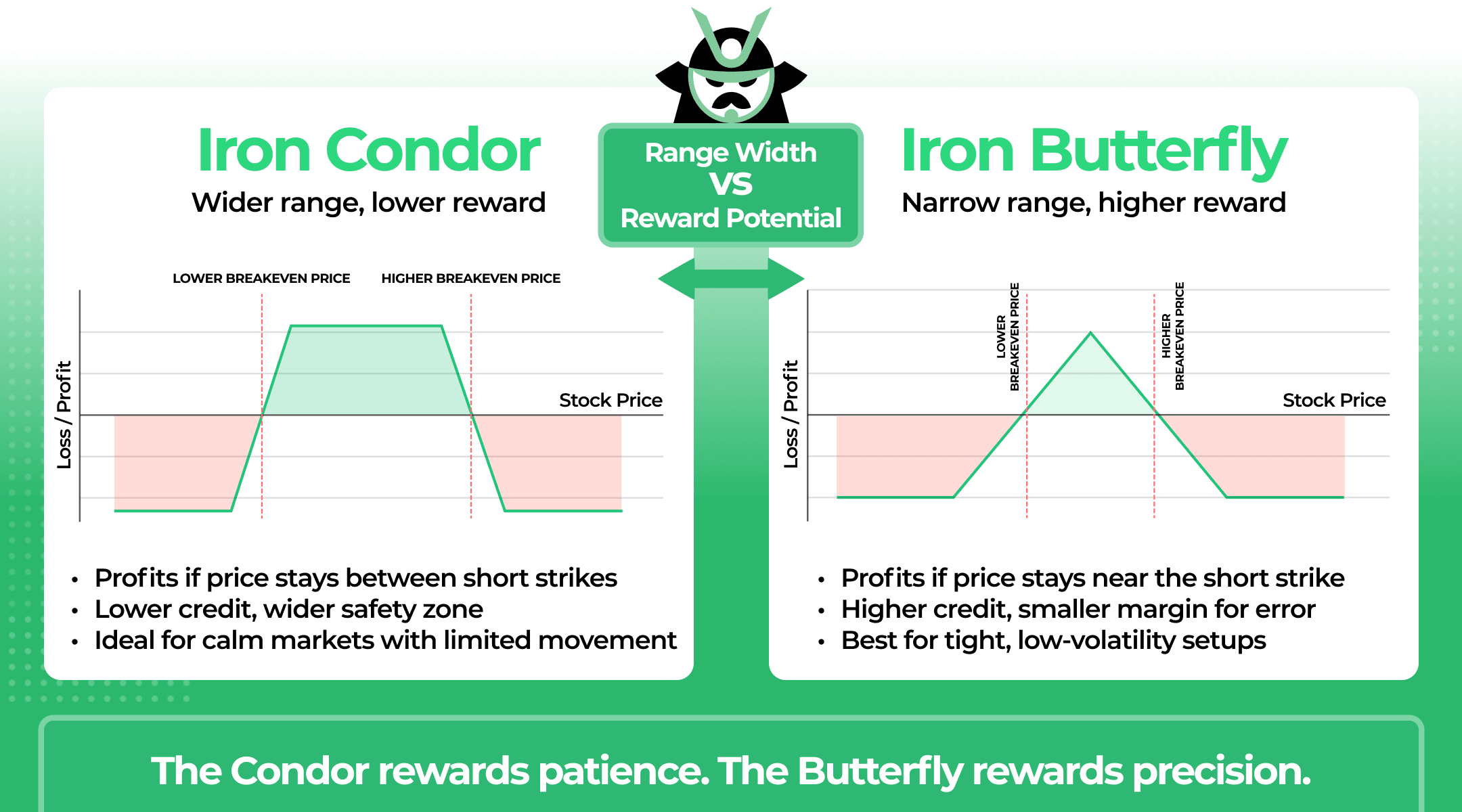

Iron Condor vs Iron Butterfly Strategies - Two Different Ways to Trade a Sideways Market

Understand the difference between the iron condor vs iron butterfly strategies. These setups are 2 popular ways to trade a sideways market.

Options Portfolio Management: How to Build and Balance Positions

Master options portfolio management with strategies, risk controls, and practical examples. Learn how to diversify, size positions, and more.

Debit Spread vs Credit Spread - How To Choose The Right Vertical For Your Market View

A clear guide to debit spread vs credit spread strategies, how they work, when to use them, and how volatility and pricing shape your choice between the two.