Option Samurai Blog

Learn. Trade. Profit.

Long Call Butterfly on COF

Today I opened a defined-risk, directional trade on Capital One Financial (COF) using a long call butterfly

Can You Sell Covered Calls in an IRA? What Every Retiree Should Know

Can you sell covered calls in an IRA? Find out the answer and start trading options today.

Options Strategy for a Sideways Market - How to Profit When Prices Don’t Move

Discover the best options strategies for a sideways market. Learn how to profit from low volatility phases.

Covered Calls on Dividend Stocks - Monthly Income from Quality Companies

How do you find the best dividend stocks for covered calls, and when should you sell for a covered call dividend?

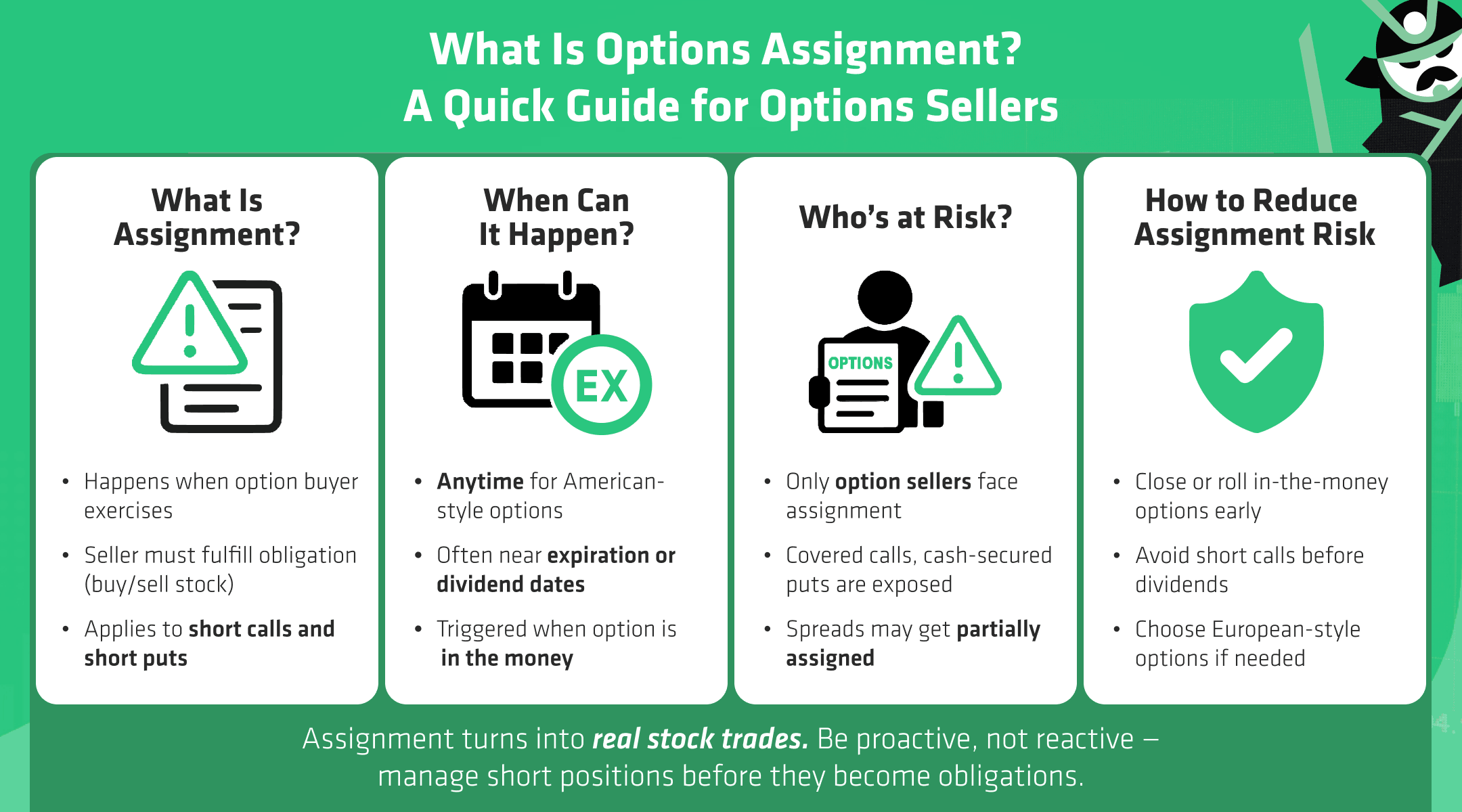

Options Assignment - When It Happens and What to Expect

Options assignment is a key concept in options trading, especially for those who sell options who may incur into the so-called assignment risk.

High Probability Options Strategies with Low Risk and Strong Edge

Discover high probability options strategies like put selling, iron condors, and ratio spreads. Low risk, high edge trades with defined probabilities.

Covered Call ETFs - A Guide for Income-Focused Investors

Learn more about covered call ETFs, what they are, how they work, and the main risk and benefits involved in them.

Options Premium - What It Is and Why It Matters for Traders

This article looks at how call option premium and put option premium are priced, what moves them, and why understanding options premium can improve your decisions as a trader.

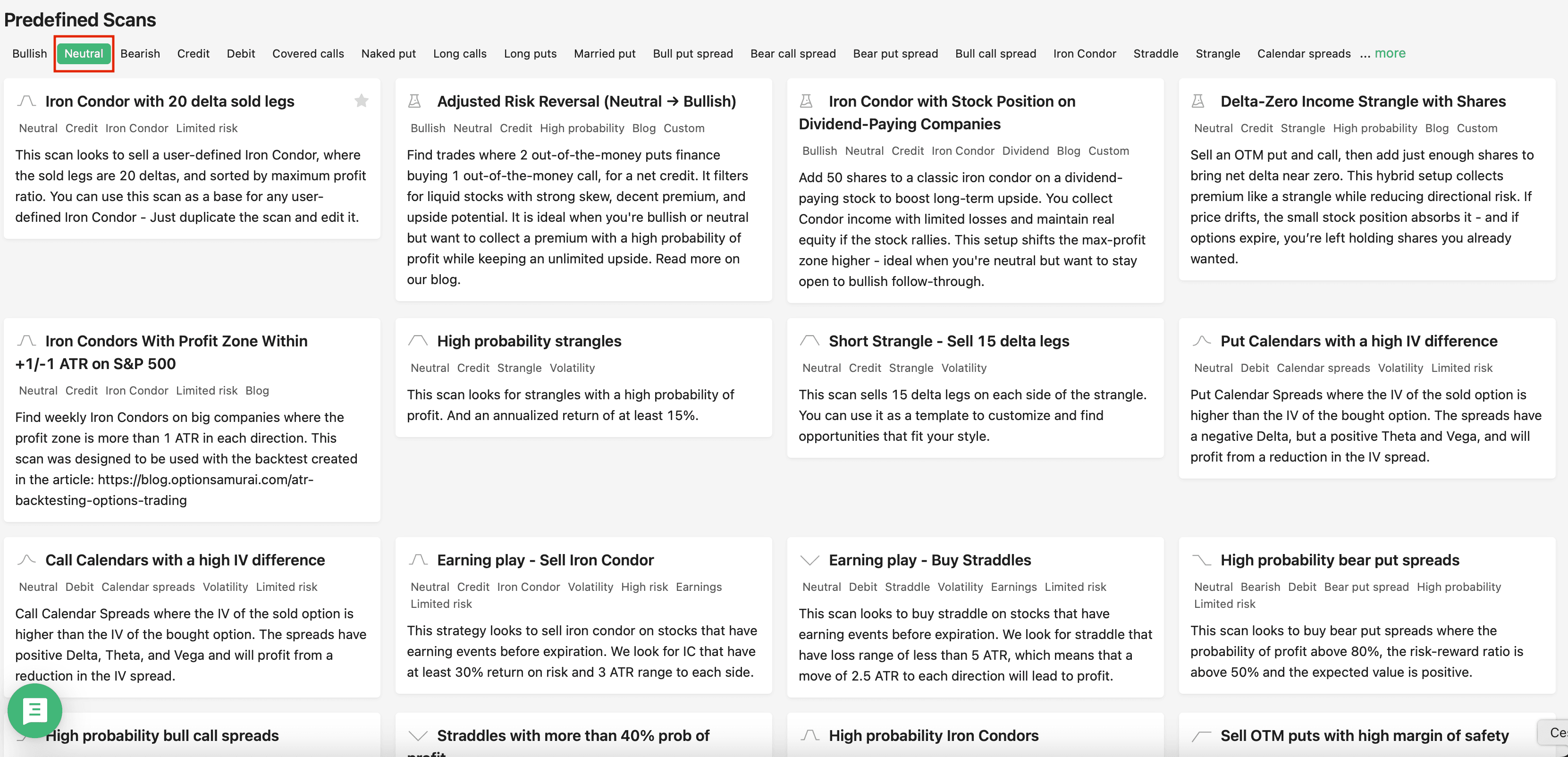

New Version for Option Samurai – Q3 2025

We’ve enhanced the Custom Option Strategy Scanner and added powerful new features: saved scan lists, predefined scans, Excel templates, and a backtest on our exclusive OI Report showing a measurable edge. Plus, site upgrades and bug fixes make Option Samurai smoother than ever.

How to Choose the Right Strike Price for Options? Understand Risk vs Reward in Seconds

Learn how to choose the right strike price for options based on your strategy, risk tolerance, and market outlook.