Category: Tutorials

What Are Synthetic Options and How Do They Work?

Synthetic options provide traders with an alternative way to manage risk and capitalize on specific market opportunities.

Simple Synthetic Long Strategies [Synthetic Long Call vs. Synthetic Long Put]

Synthetic long strategies allow investors to replicate traditional options positions using a combination of stock and options. These trades provide flexibility in managing risk and adjusting market exposure.

The Best Indicators for Option Trading

Choosing the best indicator for option trading can make a big difference in your success. Whether you're a beginner or experienced trader, identifying the best indicators for option trading helps...

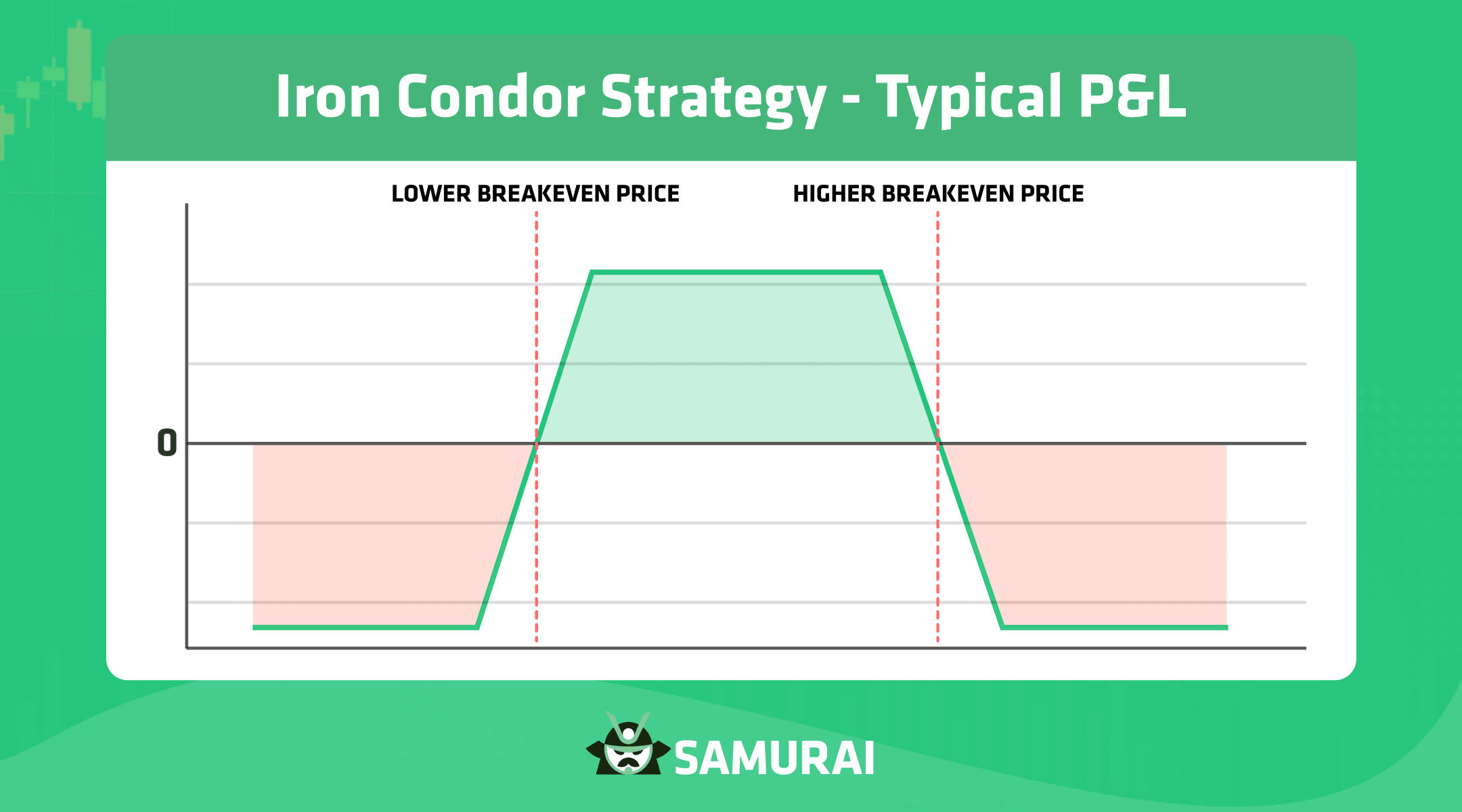

Iron Condor Strategy: Making Money in Sideways Markets [Tips and Best Practice]

You may have heard that, unlike outright stock trading, buying and selling options can make you profit from a sideways market. This is, indeed, the case with the iron condor strategy, a popular...

Long Call Butterfly Strategy Explained [Trader Insights]

The long call butterfly strategy is one of the many ways to employ options to benefit from a sideways market. Coming with capped losses (and, sometimes, even no losses on either the upside or the...

Short Put Explained [Theory, Example, and Things to Know]

Selling puts is a popular strategy among traders looking to profit from a security’s price sideways or bullish move. A short put, also known as a naked put, involves selling a put option, offering...

The Mechanics of a Short Box Spread [Risks and Rewards]

Short box spreads are a way to potentially achieve risk-free profits by capitalizing on price inefficiencies in options markets. This short box option strategy involves opening two selling a bull...

The Wheel Strategy Hack Every Dividend Investor Needs to Know [Data-Driven Strategy]

Learn the wheel strategy for Dividend Aristocrats. Combine reliable dividends with option income for stronger, more consistent returns.

Short Strangle: A Strategy for Stable Markets [Theory, Example, and Things to Know]

One of the features traders enjoy the most about options trading is likely the possibility to earn even in a sideways market. The short strangle option strategy allows this by selling a call and a...

Long Strangle - Profit from Market Movements with Options Trading [Expert Tips]

There are moments in which you know that a given stock is going to move significantly, but the direction in which this may happen is not clear. As you may not like to join a guessing game, the long...